Return Stacked® Academic Review

Two Centuries of Trend Following

Authors

Y. Lempérière, C. Deremble, P. Seager, M. Potters, J. P. Bouchaud

https://arxiv.org/pdf/1404.3274

Exploring the Enduring Power of Trend Following Strategies

In the financial world, the strategy of trend following—buying assets that are rising and selling those that are falling—has long captivated investors. This approach forms the backbone of many Commodity Trading Advisors (CTAs) and represents a significant portion of the hedge fund industry. The academic paper “Two Centuries of Trend Following” by Lempérière et al. offers a comprehensive empirical investigation into this phenomenon by analyzing an unprecedented two centuries of market data. This extensive timeframe allows for a rigorous examination of the persistence and universality of trend following’s efficacy across diverse asset classes, including commodities, currencies, stock indices, and bonds.

Methodology and Long-Term Analysis

The authors constructed a trend following indicator using an exponential moving average of past prices, adjusted for volatility. This signal was employed to simulate a constant-risk trading strategy, generating a profit and loss (P&L) statement for statistical analysis. By focusing on monthly closing prices, they conducted long-term simulations across various assets.

Performance was assessed using metrics such as the Sharpe ratio and t-statistics, both annualized to account for the time dimension of returns. While these are gross performance metrics that don’t account for transaction costs, fees, or implementation challenges, the findings were striking. The aggregate performance of the trend following strategy since 1960 exhibited a highly significant t-statistic, indicating a robust and consistent ability to generate positive returns. This performance was remarkably stable across different decades and sectors, suggesting that trends are an intrinsic feature of financial markets.

To validate their findings beyond the available futures data dating back to 1960, the authors carefully constructed proxies for earlier periods using spot prices for currencies, stock indices, and commodities, and government rates for bonds. They navigated historical nuances to ensure the reliability of these proxies. By establishing a strong correlation between the trend following strategy applied to spot prices and futures prices during overlapping periods, they provided confidence in the validity of their extended analysis.

Key Insights from Figures

Figure 1: Persistent Performance Over Two Centuries

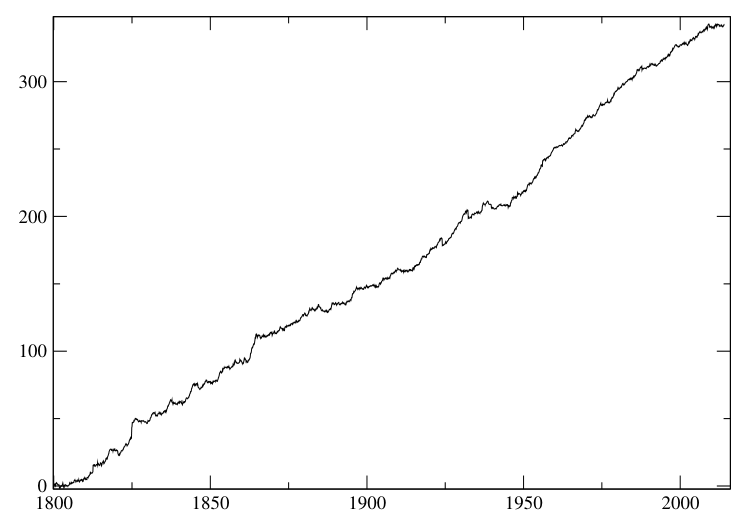

Figure 1: Aggregate performance of the trend on all sectors. t-stat=10.5, de-biased t-stat=9.8, Sharpe ratio=0.72. (Original: Figure 4)

Figure 4: Aggregate performance of the trend on all sectors. t-stat=10.5, de-biased t-stat=9.8, Sharpe ratio=0.72.

This figure encapsulates the core message of the study: the remarkable persistence of trend following returns over two centuries. The upward trajectory of the aggregate performance across all sectors from 1800 to 2010 demonstrates the strategy’s consistent ability to generate positive returns. The logarithmic scale highlights the compounding effect of consistent returns over time, emphasizing its potential for long-term investment strategies.

Figure 2: Understanding Performance Cycles

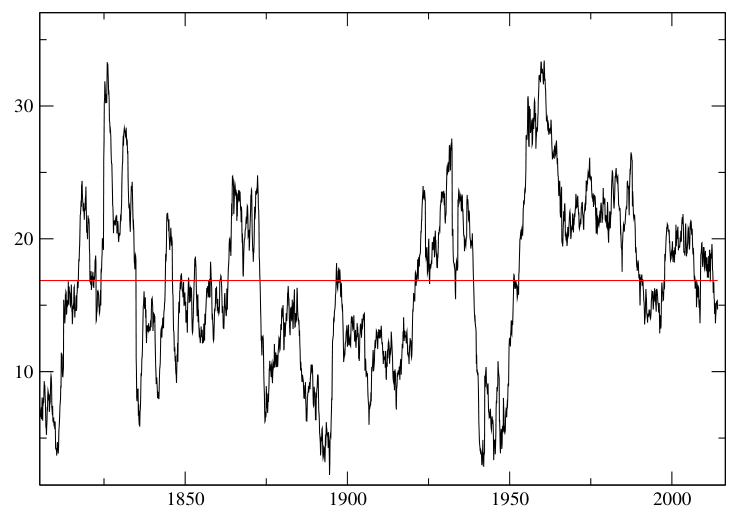

Figure 2: 10-year cumulated performance of the trend (arbitrary units). The horizontal line is the historical average. (Original: Figure 7)

Figure 7: 10-year cumulated performance of the trend (arbitrary units). The horizontal line is the historical average.

This figure addresses a common concern about trend following: periods of underperformance. By plotting the 10-year cumulative performance over two centuries, the authors demonstrate that such periods are not unusual. The strategy has experienced several phases of underperformance throughout its long history. Understanding these cycles is crucial for managing expectations and underscores the importance of a long-term perspective when employing trend following strategies.

Implications for Return Stacked Portfolios

The findings of this study have significant implications for investment strategies that incorporate trend following, such as return stacking. The demonstrated persistence and universality of trend following across diverse asset classes suggest it can be a valuable component of a diversified investment approach. By potentially generating positive returns in various market environments—including periods of economic downturn—trend following aligns with the goal of enhancing portfolio stability and resilience.

Moreover, integrating trend following with other strategies, like portable alpha, can enhance capital efficiency without taking on undue risk. This involves using leverage safely to amplify returns while maintaining a balanced risk profile. Investors interested in exploring these concepts further can refer to articles on portable alpha and managed futures trend following.

Conclusion: The Enduring Value of Trends

“Two Centuries of Trend Following” provides compelling empirical evidence supporting the existence and persistence of trend following as a robust and universal phenomenon in financial markets. The study’s meticulous methodology, extending the analysis to spot data and carefully accounting for historical context, lends significant weight to its conclusions.

The key figures discussed illuminate the long-term viability of trend following and highlight the cyclical nature of its performance. Understanding that periods of underperformance are part of the strategy’s long history emphasizes the importance of patience and a long-term investment horizon.

The exploration of behavioral factors, such as extrapolative expectations and under-reaction to news, adds depth to our understanding of why trends persist. These insights suggest that trends are not merely statistical anomalies but are deeply rooted in market psychology.

Ultimately, this research underscores the enduring power of trends in financial markets and makes a compelling case for their continued relevance in long-term investment strategies. While implementing trend following requires careful consideration of factors like leverage and instrument selection, the core principle of capitalizing on persistent market trends remains a powerful tool for investors seeking to enhance portfolio diversification and achieve long-term success.