Delta’s Pension Miracle: A Portable Alpha Case Study

Overview

This case study demonstrates how Delta Air Lines transformed its underfunded pension into a fully funded asset using Portable Alpha, providing actionable insights into leveraging innovative investment strategies, governance, and liquidity management to achieve long-term financial success.

Key Topics

Portable Alpha, Liquidity Management, Manager Selection, Evolving Investment Strategies, Governance and Stakeholder Buy-in, Return Stacking

Introduction

Delta Air Lines achieved a remarkable financial turnaround, bringing its pension fund from a precarious 38% funded status in 2011 to over 100% today. Chief Investment Officer Jon Glidden played a pivotal role in this achievement, implementing a strategic investment approach that provides valuable lessons for all investors.

His success story centers on the adoption of Portable Alpha, a strategy that, with Delta’s commitment, transformed the airline’s pension from a significant liability into a powerful asset.

This was the first time I was ever really introduced to portable alpha. I was like, ‘Wait a minute . . . . They’re cheating, but they’re winning.‘

Jon Glidden

Background: The Delta Pension Challenge

Prior to 2011, Delta’s pension plan was severely underfunded. This presented a major challenge for the company, raising concerns about its long-term financial health. The high spending rate required to meet obligations exacerbated the problem. These realities restricted the investment team’s ability to allocate significantly to illiquid private market investments, a common strategy for pensions.

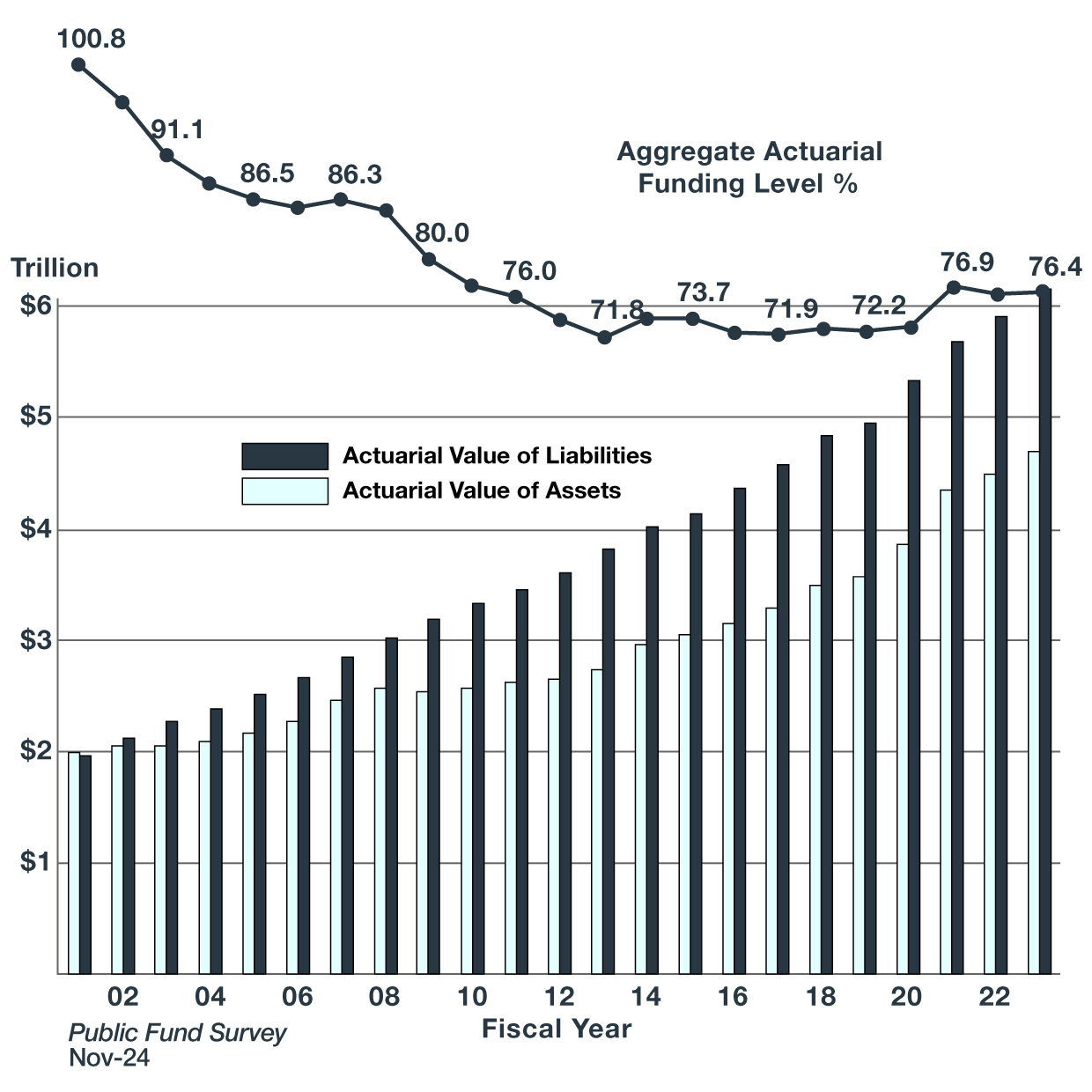

Figure 1: Public Pension Fund Survey on Funding Status

Source: NASRA Public Fund Survey, https://www.nasra.org/publicfundsurvey, November 2024.

Recognizing the urgency of the situation, Glidden developed a bold solution. He proposed a more balanced approach to managing market risk (beta), complemented by an aggressive pursuit of alpha. To clearly convey this non-traditional path, he transparently presented his plan, addressing what he called the often-misunderstood concepts of leverage, derivatives, and high-fee managers.

Portable Alpha: Delta's Engine for Growth

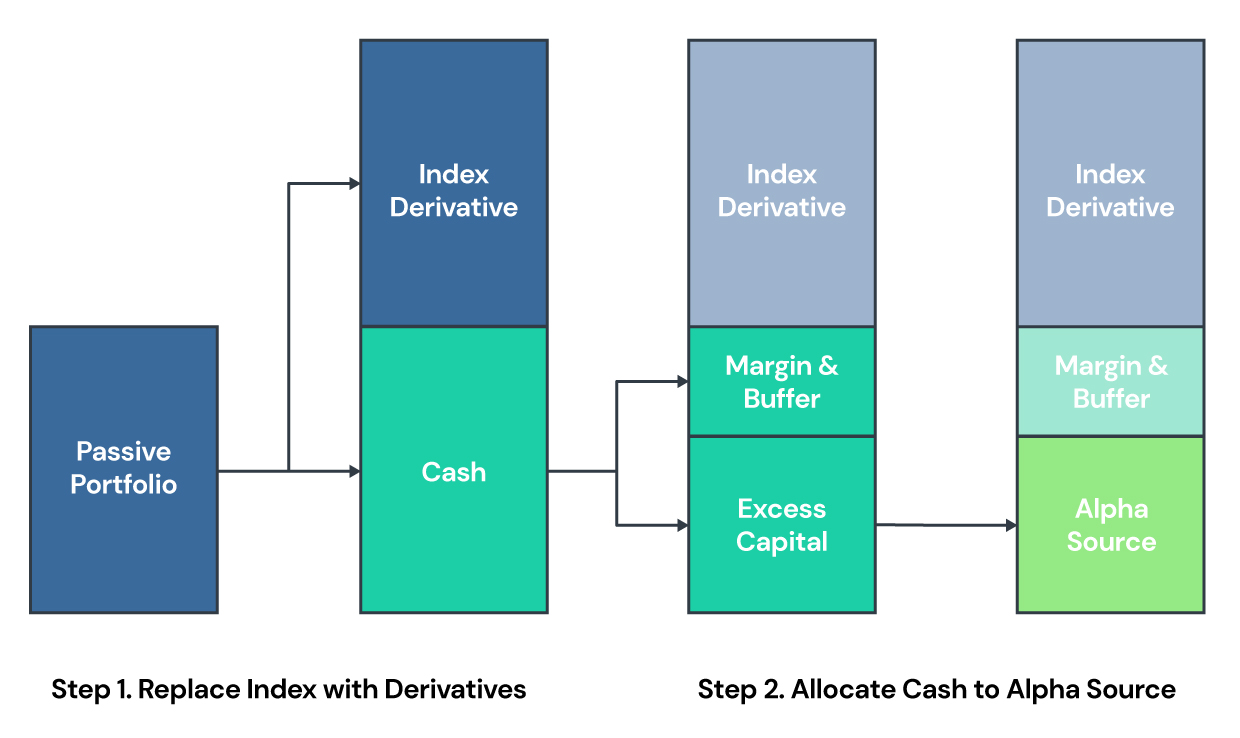

Portable alpha, also known as “return stacking,” is a strategy that separates the pursuit of alpha from managing beta, or market risk. This allows investors to establish their desired market exposure through low-cost, liquid instruments like index futures and swaps. These instruments consume very little capital, liberating the investment committee from the constraints of traditional portfolio construction. Investors can then pursue excess returns through a diversified portfolio of active managers, with low correlation to market indexes. Glidden saw portable alpha as the perfect tool for Delta’s needs. It allowed the fund to preserve strategic market exposures while stacking uncorrelated active strategies, and their commensurate excess returns, on top.

Figure 2: How Portable Alpha Works

For illustrative purposes only.

Glidden’s philosophy was motivated by what he calls the “Four Forces”: strategic investments in private market assets; using market-neutral hedge funds to generate consistent alpha above borrowing costs; efficient portfolio construction utilizing the Capital Market Line for enhanced returns; and active governance to ensure consistent implementation and stakeholder buy-in.

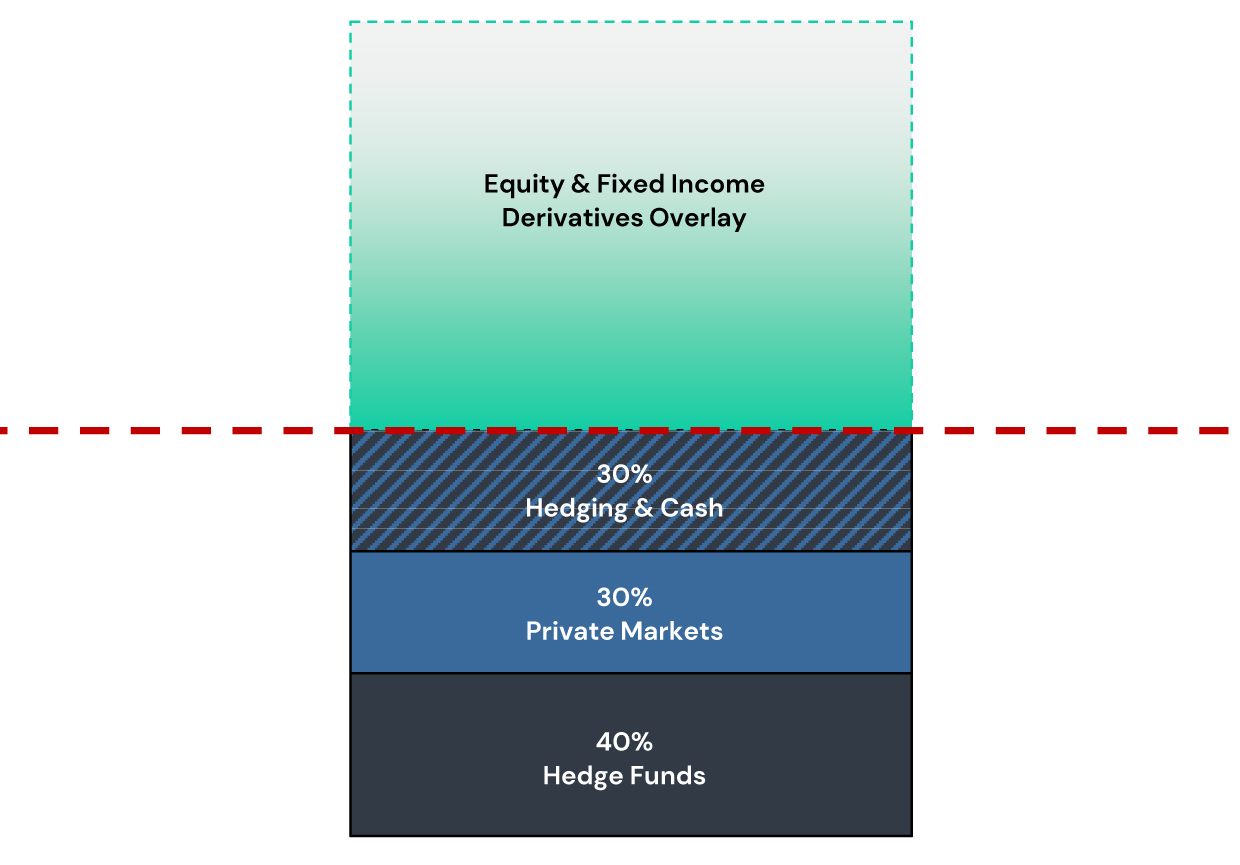

Delta’s portable alpha implementation involved a specific allocation framework. Thirty percent was targeted for private markets, 40% for market-neutral oriented hedge funds, with remaining capital earmarked for a hedging sleeve and cash collateral. This diversified portfolio was further amplified by an equity and fixed income overlay implemented through derivatives that varied over time depending on the needs of the pension. The plan’s core objective was consistent: generating consistent alpha in excess of market exposures. This objective was primarily driven by its private market and hedge fund allocations, targeting around two percentage points annually.

Figure 3: Hypothetical Breakdown of the Delta Pension Portable Alpha Portfolio

For illustrative purposes only. Proportions used are not meant to be indicative of any precise portfolio allocations at any time.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Manager Selection and Implementation Challenges

Putting this strategy into practice wasn’t easy. Hedge fund selection involved a rigorous, quantitatively driven process. Glidden sought managers demonstrating consistent residual return, a high information ratio, strong team dynamics, and a clearly defined investment approach. Within private markets, diversification across strategies and investment types was paramount. The portfolio included a mix of private equity, credit, and real assets, further diversified through primaries, secondaries, and co-investments.

Managing this sophisticated portfolio with a small team required careful delegation and strategic partnerships. External experts augmented Delta’s internal capabilities by conducting due diligence and providing ongoing monitoring, especially within the extensive and often opaque world of private markets. Gaining buy-in from the governance structure was another key challenge. Glidden achieved this through open communication, defining success metrics from the outset, and establishing clear risk parameters.

A “green, yellow, red zone” framework was implemented for cash collateralization and other key metrics, providing transparent benchmarks for risk assessment. Regular communication with the investment committee, both in one-on-one meetings and through comprehensive reporting, kept them informed and involved, building trust and maintaining alignment.

Navigating Volatility: War Stories and Lessons Learned

Glidden’s wealth of experience with portable alpha has been tested during periods of significant market volatility. Reflecting on the 2008 financial crisis, he notes the common mistakes of early portable alpha adopters: an over-reliance on strategies with inherent downside risk and inadequate cash buffers. The 2020 COVID crisis presented its own unique challenges. Delta faced $3 billion in margin calls as markets plummeted, severely stressing its liquidity.

While the hedging program generated $1 billion in gains, Glidden was forced to consider a sizable hedge fund redemption, a move that went against a fundamental principle of portable alpha. This experience reinforced the vital importance of comprehensive liquidity management. Delta established multiple layers of defense, including readily available lines of credit and avoiding investments in potentially illiquid “enhanced cash” products.

After the initial shock of COVID, Delta recalibrated the portfolio. The core portable alpha strategy remained intact, but the derivative overlay was adjusted toward a more bond-centric approach and the hedge portfolio was further refined. The 2022 downturn, marked by simultaneous declines in both stock and bond markets, presented a novel set of challenges. Reduced private market distributions further constrained liquidity.

The biggest rules of Portable Alpha—Don’t let market movements screw with your intended beta portfolio. Don’t let market movements screw with your alpha engines.

Jon Glidden

The 2020 COVID crisis and the subsequent market downturn in 2022 provided invaluable lessons in liquidity and cash management, reinforcing the critical need for readily available resources in times of stress. As markets plummeted in 2020, Delta faced significant margin calls, prompting Glidden to consider various options for bolstering liquidity. While reluctant to redeem from his hedge fund portfolio—a move counter to the principles of Portable Alpha—he ultimately submitted redemption notices, only to rescind them as markets rebounded. This experience underscored the importance of having multiple lines of defense beyond relying solely on liquid alpha sources. One key step Glidden took was establishing a readily accessible line of credit, providing a crucial backstop in the event of future market deterioration.

Further emphasizing the importance of cash management, Glidden structured a tiered approach, prioritizing the “cleanest” and most liquid instruments. This hierarchy begins with government money market funds, followed by prime money market funds, and finally, an enhanced cash strategy (explicitly excluding commercial paper due to illiquidity considerations). Through these experiences, Glidden solidified two cardinal rules of Portable Alpha: protect the intended beta target from market fluctuations and safeguard the alpha engines by avoiding forced redemptions that could disrupt long-term performance.

The Return Stacking landscape is ever evolving, go deeper by connecting with a team member.

Evolution and Future Outlook

Having achieved full funding, Delta’s pension strategy has evolved to reflect its current financial position. The portfolio has transitioned towards a more conservative, bond-centric allocation, reflecting its enviable funded status and the attractive yields available in the fixed income market.

Glidden and his team are actively researching new alpha sources. They are exploring strategies like active currency management, liquid alternatives, and manager swaps. Additionally, they are seeking ways to create synergies between pension investments and Delta’s corporate initiatives, including sustainability, DEI, and innovation.

Instead of pursuing a full Pension Risk Transfer, Glidden believes Delta can create more value by strategically managing the assets on its balance sheet. His goal is to generate consistent, long-term outperformance of liabilities, allowing excess funding to potentially offset other corporate obligations or to enhance employee benefits.

Key Takeaways and Conclusion

I love alpha. I love beating benchmarks. It’s what gets me out of bed in the morning.

Jon Glidden

Jon Glidden’s success at Delta offers a compelling case study for the potential of Portable Alpha. His journey emphasizes the importance of strong governance and early success in building stakeholder confidence. Meticulous liquidity management is crucial, as is a diversified portfolio of alpha sources.

Investors considering implementing a Portable Alpha strategy can learn from Glidden’s experiences. By incorporating these essential elements, they can position themselves for success while mitigating downside risks. Glidden’s story is not just about achieving impressive returns; it highlights the power of collaboration, adaptability, and a commitment to continuous improvement in navigating the complexities of long-term investing.

Delta’s success highlights the transformative potential of portable alpha. Our next piece will explore how recent innovations such as return stacking are democratizing this technique, making it accessible to a wider range of investors.

Sources

- https://podcast.returnstacked.com/episodes/YF45ahI0vsV

- https://www.capitalallocators.com/podcast/delta-airlines-pension-fund-turnaround/

- https://www.marketsgroup.org/news/Jonathan-Glidden-Delta-interview

- https://www.institutionalinvestor.com/article/2bstmh8ejny137ipgny0w/culture/how-jon-glidden-resurrected-a-forsaken-strategy-and-revived-a-dying-pension

- https://www.nasra.org/publicfundsurvey