Diversification 2.0 Understanding Return Stacking and the Evolution of Portfolio Construction

Overview

Key Topics

Return Stacking, Portfolio Construction, Alpha Generation, Capital Efficiency, Alternative Investments, Risk Management, Modern Investment Vehicles

Table of Contents

The Modern Alpha Challenge

The Mechanics of Return Stacking

Modern Sources of Return Stacks

Solving the Diversification Funding Problem

Implementation Guidelines for Modern Portfolios

Risk Management: Lessons from 2008

Building More Efficient Portfolios Through Return Stacking

Key Takeaways

Introduction

The investment management industry is grappling with significant challenges. High stock valuations, a flat bond yield curve, and ongoing struggles to generate excess returns through traditional stock selection are exposing the limitations of conventional portfolio construction. The classic 60/40 portfolio, a staple of balanced investing for decades, may no longer suffice in today’s complex markets.

Since the 1980s, institutional investors have been adopting advanced strategies to redefine how portfolios achieve diversification and enhanced returns. These approaches, known as Portable Alpha or Return Stacked® Portfolios, were once exclusive to institutional portfolios. However, recent innovations in investment vehicles have made these powerful concepts accessible to a wider range of investors.

The Origins of Return Stacking: PIMCO's Innovation

The story of Return Stacking begins in the 1980s when PIMCO faced a fundamental challenge in fixed income portfolio management. At that time, approximately 44% of the Bloomberg US Aggregate Bond Index consisted of Treasury securities—effectively fungible instruments offering minimal opportunity for security selection alpha. This created a significant drag on potential outperformance, as nearly half of actively managed fixed income portfolios were invested in securities where generating excess returns through security selection was virtually impossible.

PIMCO’s innovative solution laid the groundwork for modern return stacking approaches. Instead of holding Treasury bonds directly, they utilized derivatives to maintain the desired Treasury exposure while freeing up capital to invest in strategies where they believed they had an edge. This approach, known as the BondsPLUS program, demonstrated how thoughtful portfolio engineering could unlock new sources of return without sacrificing core exposures.

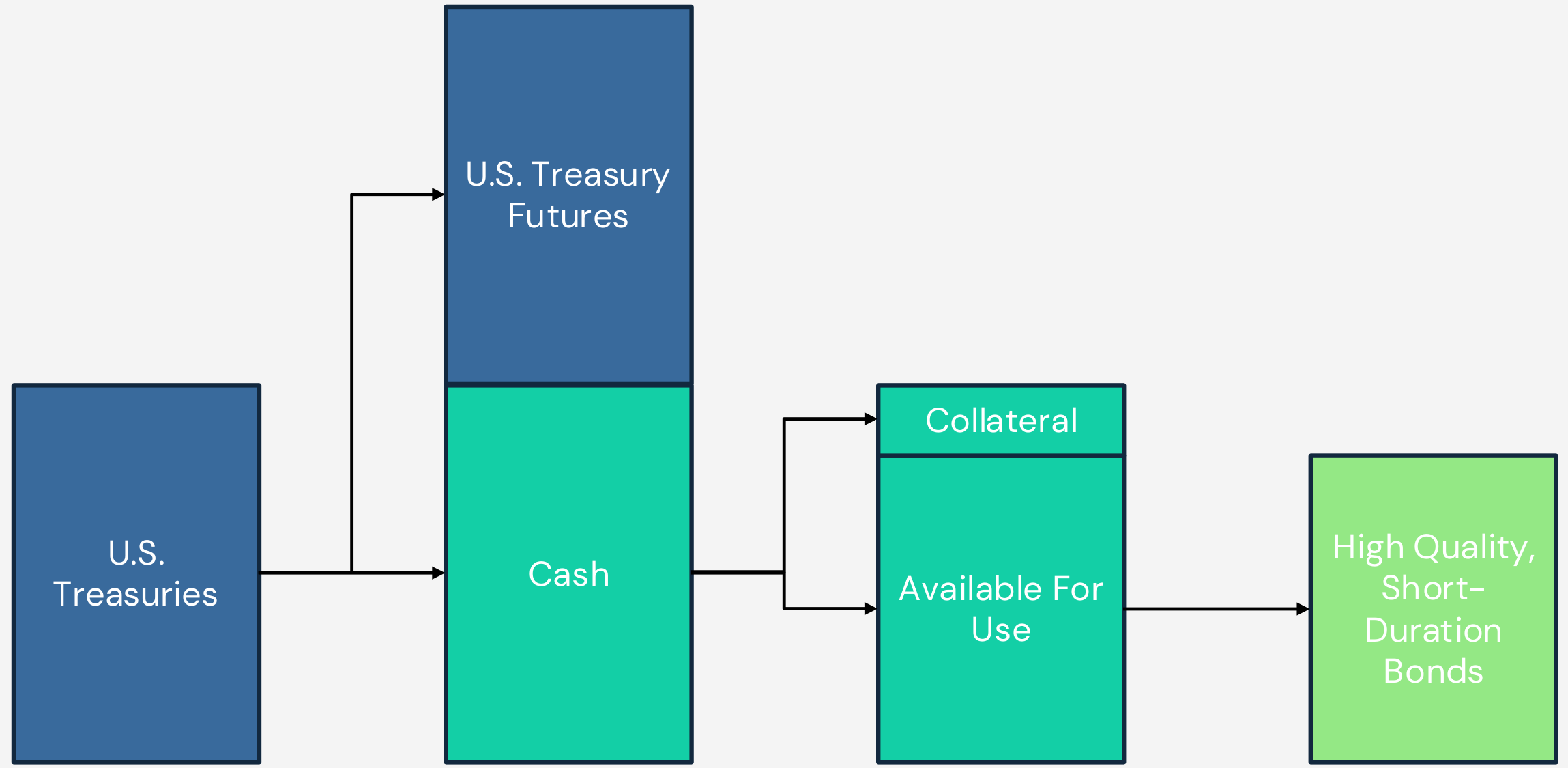

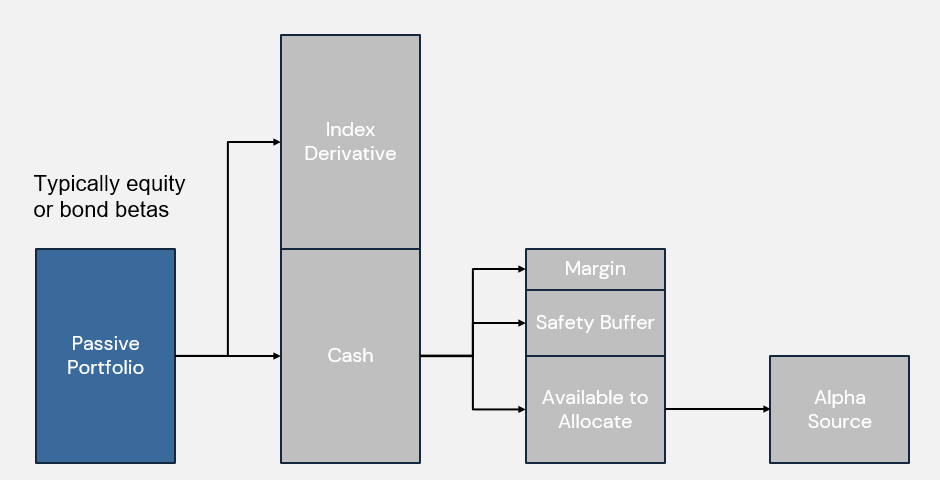

Figure 1. PIMCO’s BondsPLUS Program Structure Revolutionized Fixed Income Management

Source: PIMCO. The diagram illustrates the BondsPLUS program’s revolutionary two-step approach: 1) Replace Bonds with Derivatives and 2) Allocate Cash to “Alpha Source”.

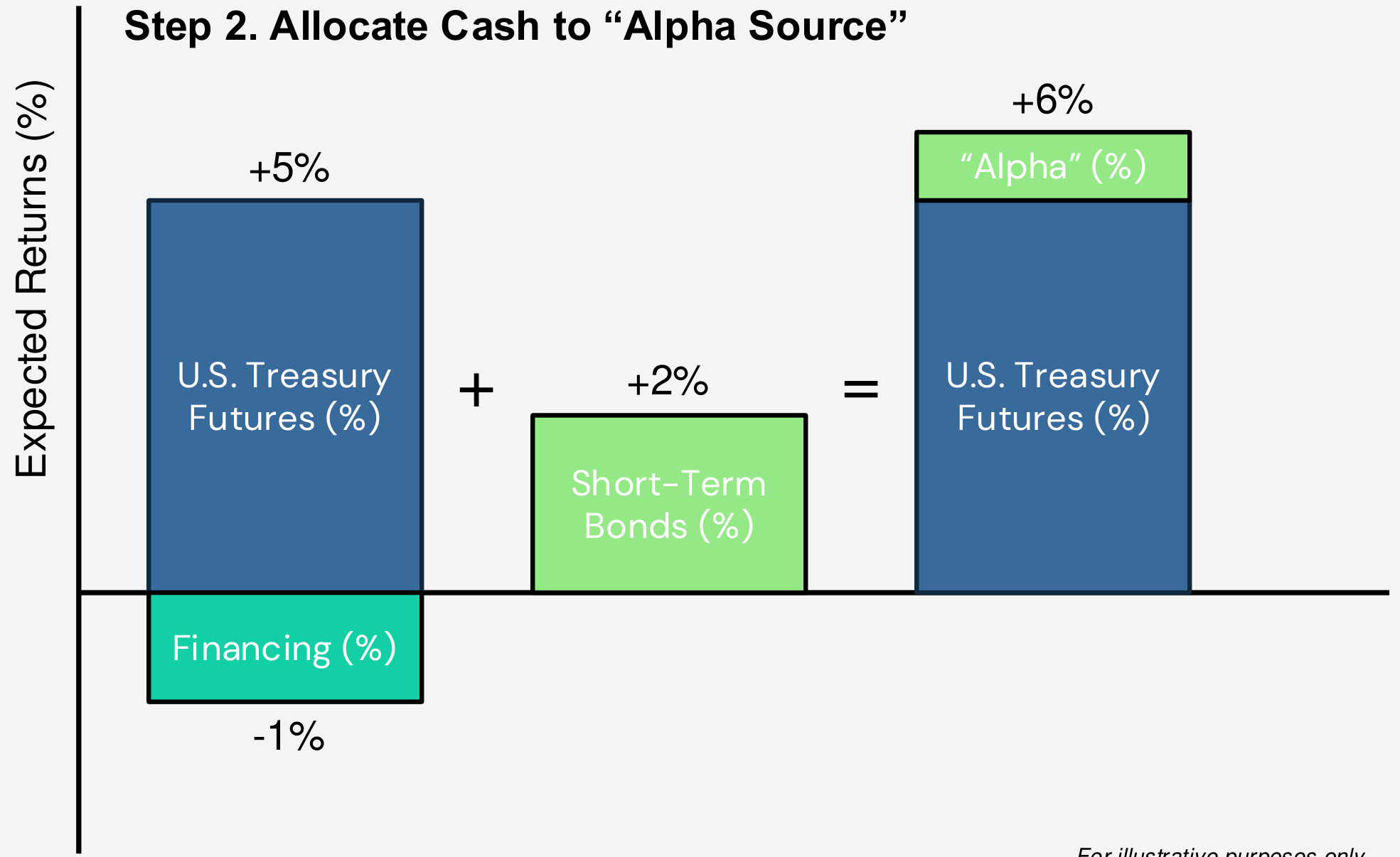

The mechanics of the BondsPLUS program were elegantly simple. By replacing physical Treasury holdings with Treasury futures contracts, PIMCO could maintain the desired interest rate exposure while posting only a fraction of the capital as margin. The freed-up capital was then invested in carefully selected short-duration bonds, aiming to generate returns above the implied financing cost embedded in the futures contracts.

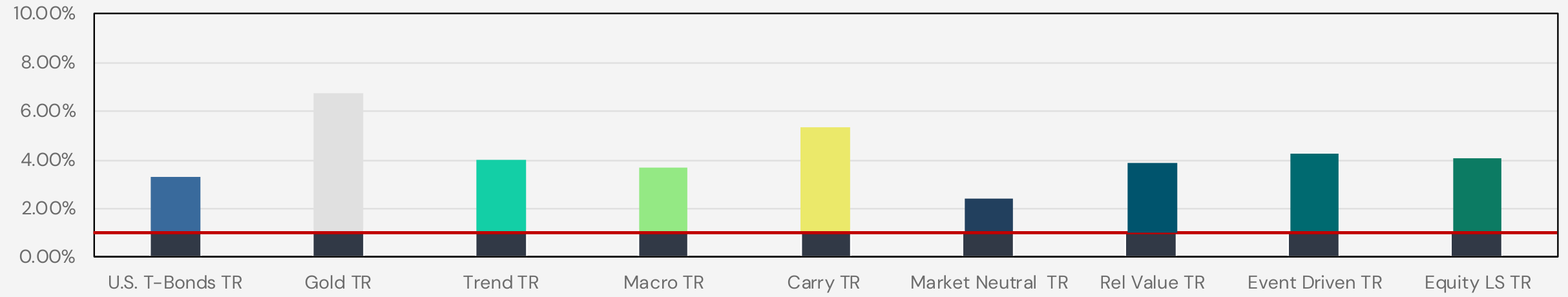

Figure 2. Expected Returns of PIMCO’s BondsPLUS Demonstrate the Power of Capital Efficiency

For illustrative purposes only. Shows how combining Treasury futures exposure with actively managed short-duration bonds can potentially generate excess returns.

The success of the BondsPLUS program led PIMCO to expand the concept to equity markets in 1986 with the launch of S&P 500 futures contracts. The StocksPLUS program applied the same principles: use futures to maintain equity exposure while deploying freed-up capital to potentially generate additional returns. This marked the beginning of what would become known as Portable Alpha—the ability to “transport” excess returns from one asset class or strategy onto another market exposure.

Diversification 2.0: Mastering the Art of Portable Alpha

Portable alpha (or as we like to call it: Return Stacking) has become increasingly popular in the financial media (including recent notes from industry giants like BlackRock, Russell Investments, and AQR) but many advisors are left asking: What does portable alpha mean? How might it benefit clients? How can I implement it?

The Modern Alpha Challenge

The fundamental challenge facing investors today extends beyond PIMCO’s original fixed income dilemma. Analysis reveals a stark misalignment between capital allocation and alpha generation potential across global markets.

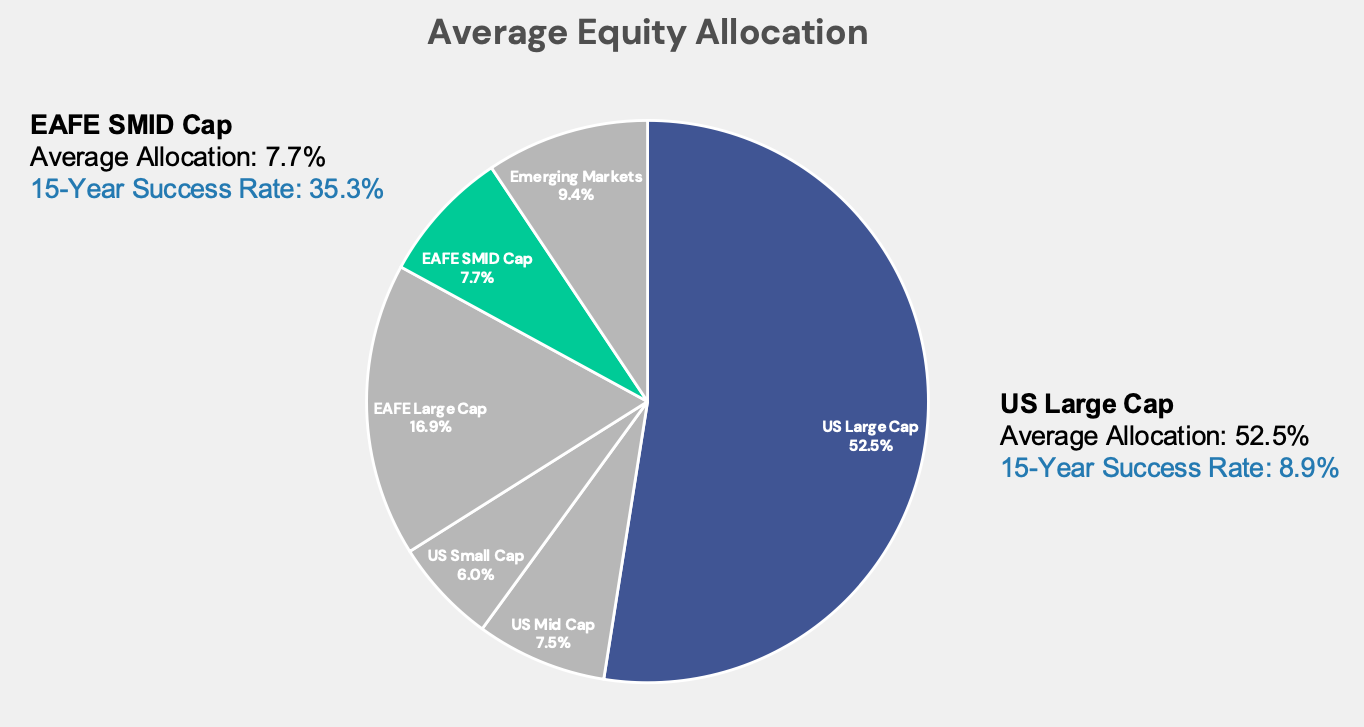

Figure 3. Average Equity Allocation Reveals Misalignment Between Capital and Opportunity

Source: MSCI and Morningstar. Calculations by Newfound Research. Typical % Equity Allocation is the relative market capitalization based upon representative MSCI Index capitalizations. 15-Year Success Rate is the percentage of active funds in the category that outperform a composite of passive benchmarks.

U.S. large-cap stocks represent over 52.5% of global equity market capitalization, yet less than 9% of active managers in this space have outperformed their benchmark over the past fifteen years. Meanwhile, international developed small and mid – cap stocks – representing just 7.7% of global market cap – have seen active manager success rates exceeding 35%. This creates what Corey Hoffstein describes as “a paradoxical situation where the majority of your capital is allocated precisely where it’s hardest to find alpha.”

The Mechanics of Return Stacking

Understanding Return Stacking requires grasping both its theoretical foundations and practical implementation. At its core, the approach uses capital -efficient instruments like futures contracts to maintain desired market exposures while freeing up capital for additional investments.

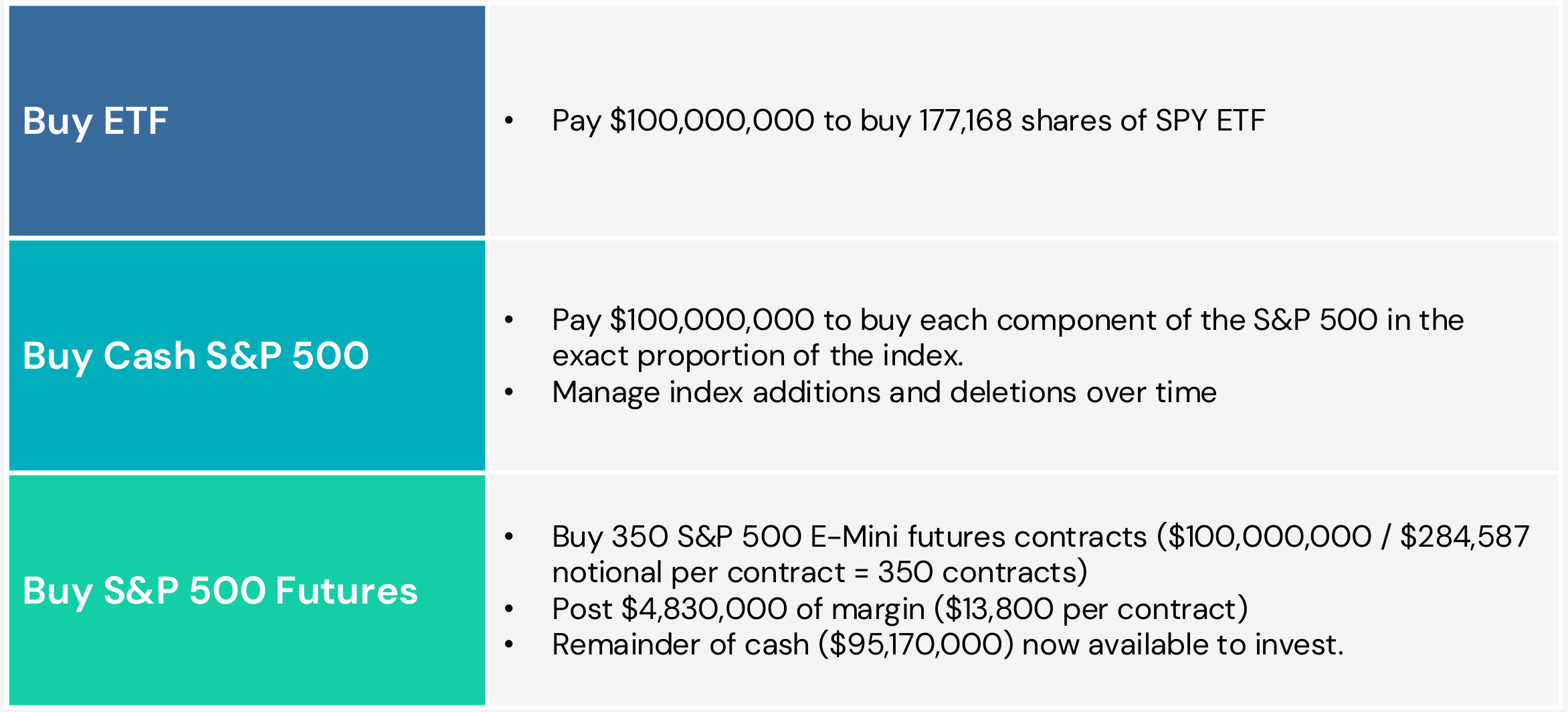

Consider an institutional investor seeking $100 million of S&P 500 exposure. Traditional implementation would require purchasing approximately 177,168 shares of an S&P 500 ETF, consuming the full $100 million. Alternatively, using S&P 500 E-Mini futures, the same exposure can be achieved through 350 contracts while only posting $4.83 million in margin.

Figure 4. Methods for Obtaining S&P 500 Exposure Demonstrate Capital Efficiency Benefits

Source: Bloomberg. Calculations assume current market prices and standard margin requirements. Actual capital requirements may vary based on broker requirements and market conditions.

The choice of which exposures to achieve through derivatives versus direct investment represents a critical decision point in return stacking implementation. Modern approaches typically organize this decision framework around three key components: index derivatives, cash allocation, and alpha sources.

Figure 5. Beta Exposure Choices Framework for Return Stacked® Portfolios

Source: Return Stacked® Portfolio Solutions. Diagram illustrates the systematic approach to implementing Return Stacked® exposures through various instruments.

The choice of which exposures to achieve through derivatives versus direct investment represents a critical decision point in return stacking implementation. Modern approaches typically organize this decision framework around three key components: index derivatives, cash allocation, and alpha sources.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Modern Sources of Return Stacks

The evolution of return stacking has expanded potential alpha sources far beyond PIMCO’s original fixed income strategies. Today’s practitioners can access a diverse range of return streams, each offering unique diversification and return potential.

Figure 6. Alternative Strategies Total Returns Demonstrate Diverse Alpha Sources

Source: Tiingo and HFR Indices, Societe Generale Financial Data, Bloomberg. Calculations by ReStore Asset Management SECZ. Performance is net of underlying fund fees but gross of any advisor fees, transaction costs, or taxes. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. Performance measured from January of 2004 to March of 2024.

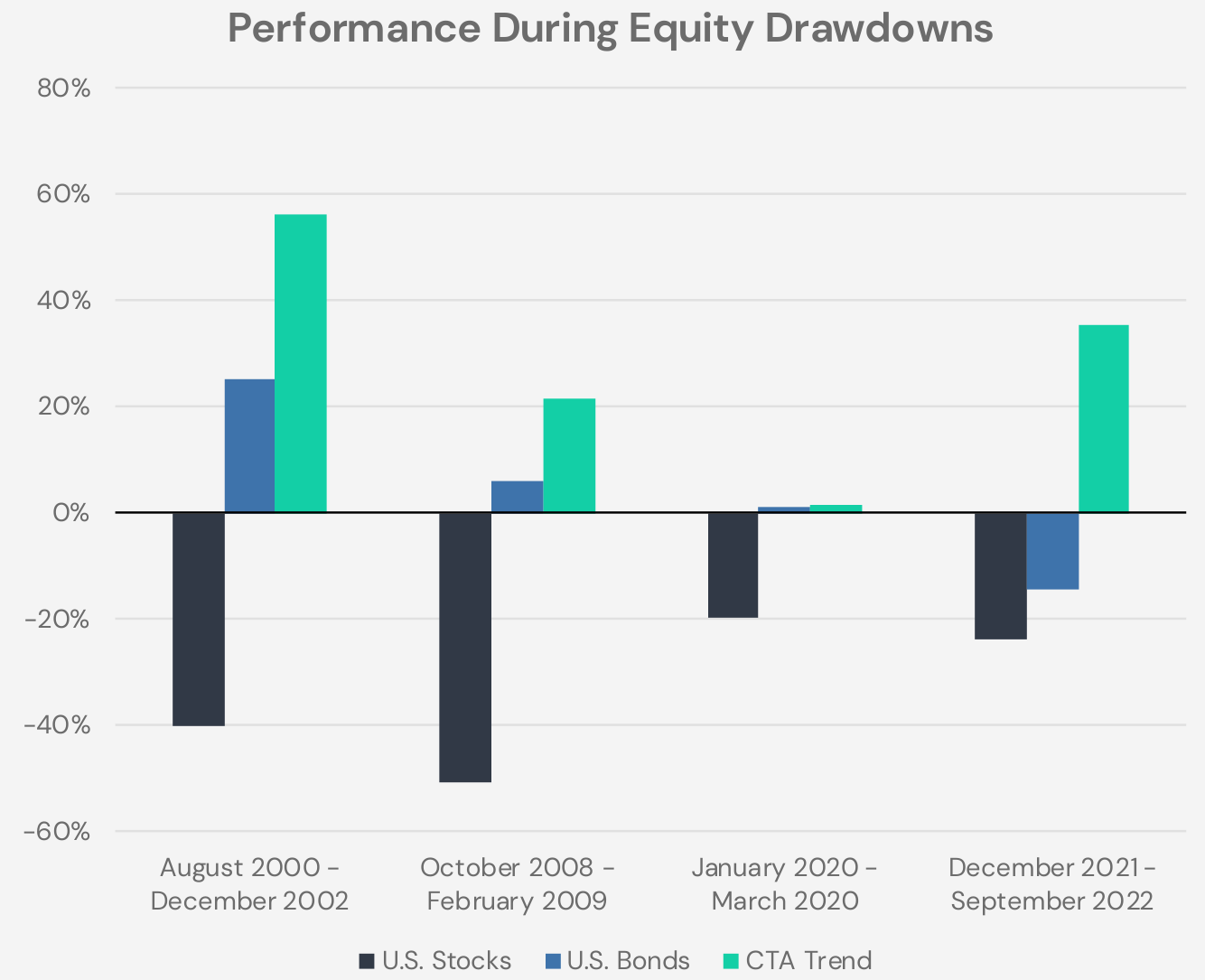

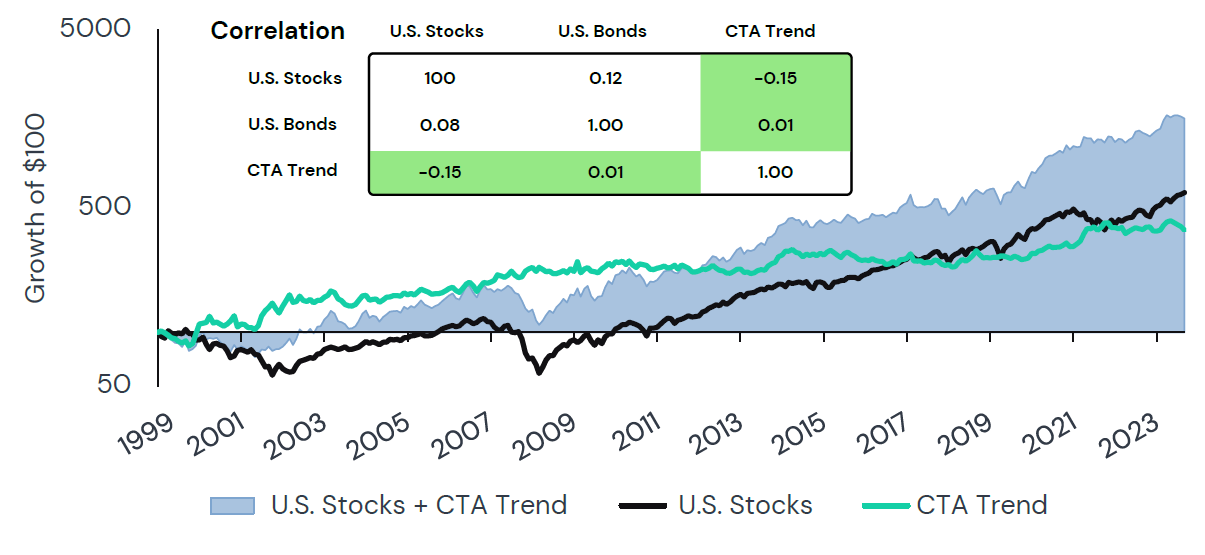

Managed futures represent a particularly compelling example of a potential “stack.” These strategies can trade long and short positions across equity indices, bonds, currencies, and commodities, typically following trend signals. Historical analysis demonstrates their ability to generate positive returns during equity bear markets while maintaining low correlation to traditional portfolios.

Figure 7. Performance of Managed Futures During Major Equity Market Drawdowns

Source: Bloomberg. U.S. Stocks is the S&P 500 Index. U.S. Bonds is the Bloomberg US Aggregate Bond Index. CTA Trend is the Société Générale Trend Index. Returns are gross of taxes and assume reinvestment of all distributions. Past performance is not indicative of future results.

Solving the Diversification Funding Problem

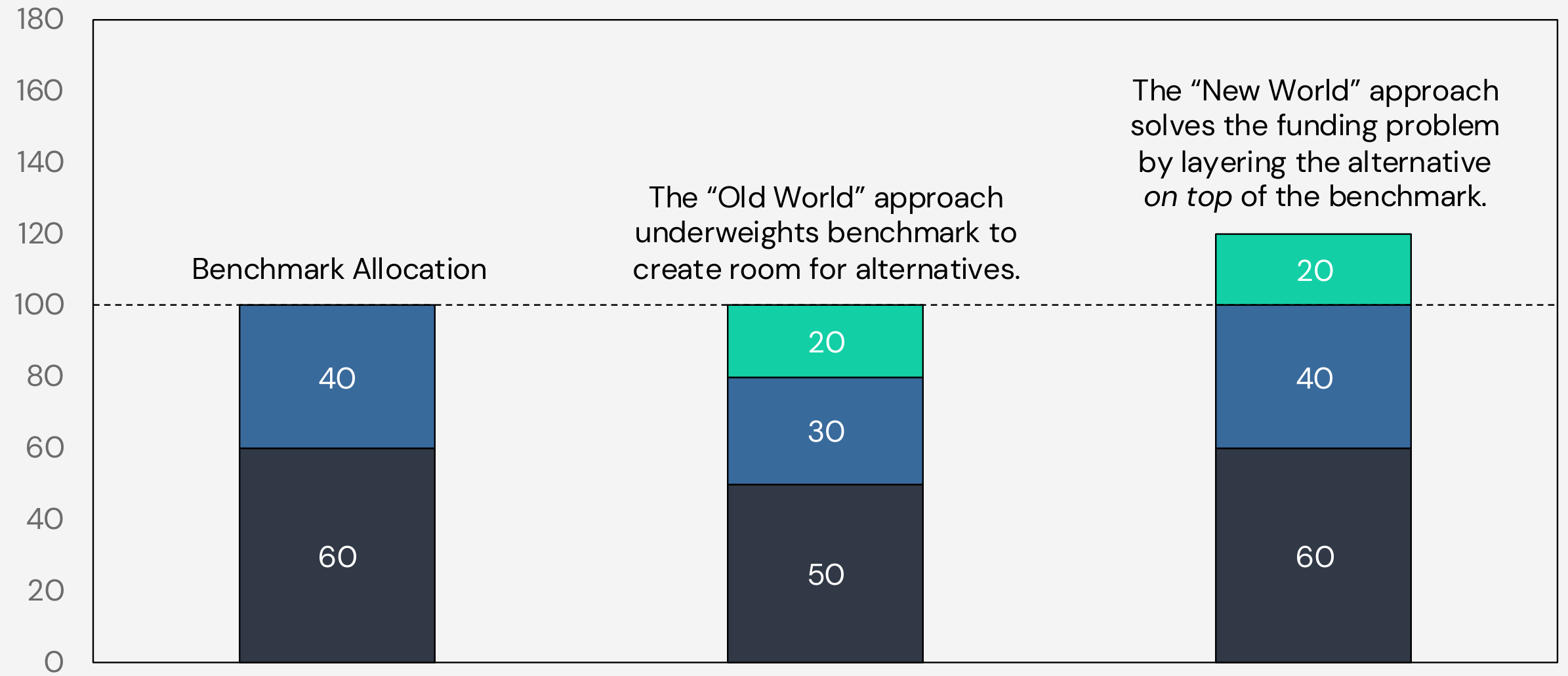

Traditional diversification approaches have historically required investors to sell existing positions to accommodate alternatives – “diversification through subtraction” This creates both performance and behavioral hurdles, as alternatives must not only generate positive returns but outperform what was sold to add value.

Figure 8. The Alternative Strategy “Funding” Problem: Addition Through Subtraction

For illustrative purposes only. Shows traditional portfolio allocation shifts required to add alternative investments.

Return stacking seeks to resolve this funding problem by allowing investors to maintain desired core exposures while adding diversifying strategies on top. This approach can significantly reduce behavioral friction, as evidenced by examining the much smoother return stacked combination in Figure 10. versus simply holding a CTA Trend strategy on its own.

Figure 10. Relative Performance Shows Benefits of a Return Stacking Approach

Source: Bloomberg. U.S. Stocks is the S&P 500 Index (“SPX”). U.S. Bonds is the Bloomberg US Aggregate Bond Index (“LBUSTRUU”). Returns for U.S. Stocks and U.S. Bonds are gross of all fees. CTA Trend is the Société Générale Trend Index (“NEIXCTAT”), an index designed to track the largest trend following commodity trading advisors (“CTAs”) in the managed futures space net of underlying fees. U.S. Stocks + CTA Trend is 100% U.S. Stocks / 100% CTA Trend / -100% Bloomberg Short Treasury US Total Return Index (“LD12TRUUU”). You cannot invest in an index. Please see glossary at the end of this presentation for index definitions. Returns are gross of taxes. Returns assume the reinvestment of all distributions. Past performance is not indicative of future results. Period is 12/31/1999 through 8/31/2024. The starting date is chosen based upon the earliest date data is available for the underlying indexes.

Risk Management: Lessons from 2008

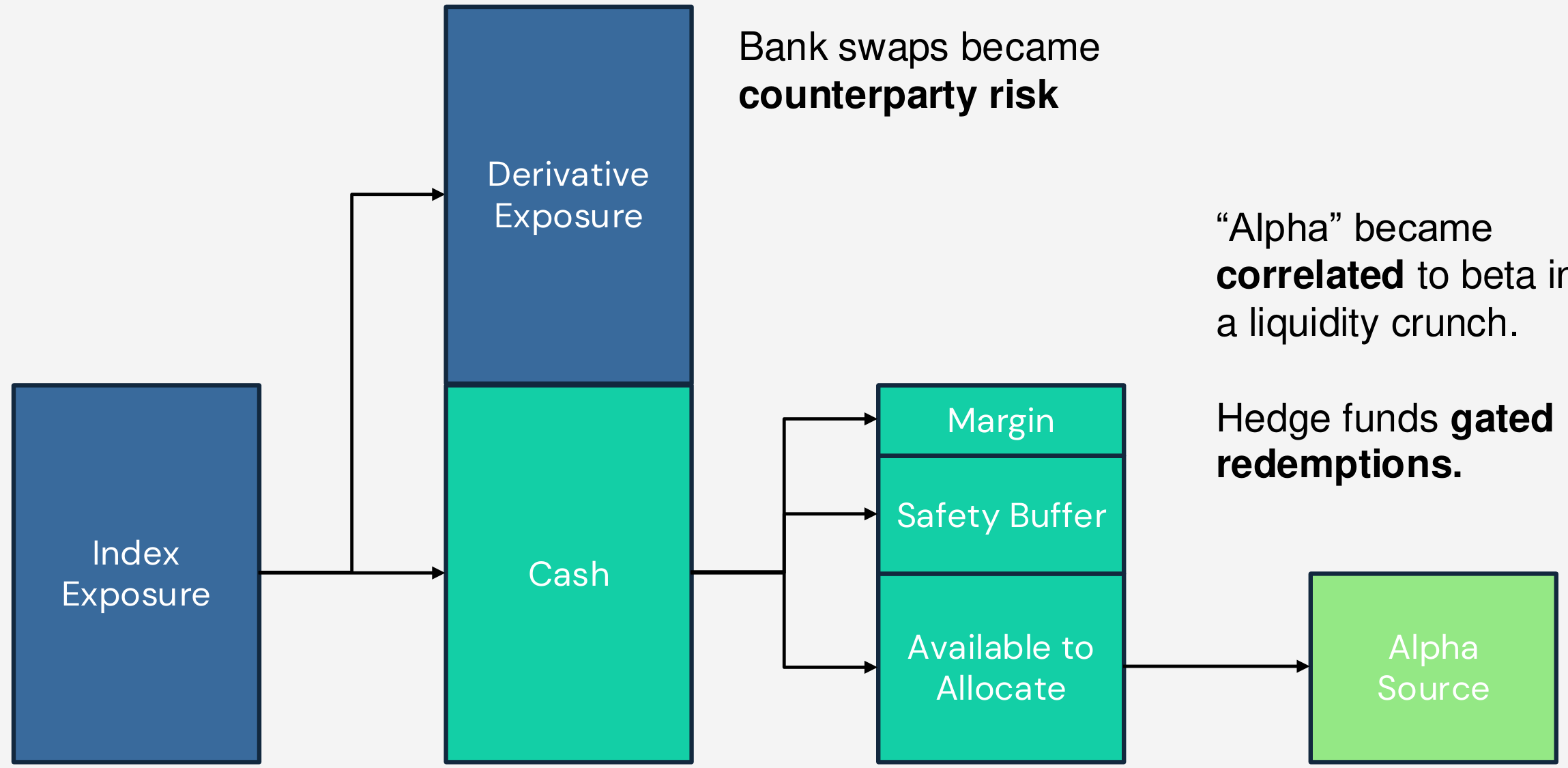

The 2008 financial crisis provided crucial lessons about risk management in Return Stacked® portfolios. By 2008, approximately 25% of institutions were using some form of Portable Alpha strategy. However, the crisis exposed several critical vulnerabilities in implementation approaches.

The first lesson concerned margin management. If markets plummet 50% and you only maintain a 20% margin buffer, you’ll deplete your capital and face forced position closures. This led many institutions to refine their approach to margin buffers, particularly when stacking on top of more volatile assets like equities.

The second lesson involved counterparty risk. Institutions using total return swaps with banks like Lehman Brothers found themselves in precarious positions when their counterparties faced existential crises.

Some key aspects of today’s Portable Alpha facelift include much tighter risk management processes, more sophisticated derivative management, a preference for highly liquid exchange-traded derivatives, and more robust counterparty risk management frameworks.

Implementation Guidelines for Modern Portfolios

Modern implementations of Return Stacking typically follow systematic guidelines based on tracking error considerations. For example, if a stack has 10% expected volatility and zero correlation to the benchmark, each 10% diversifying stack added creates 1% tracking error. This means that in any given year, a 1% tracking error translates to expected deviations of ±2% from your benchmark.

In our experience, optimal implementation (again assuming a stack with 10% volatility and 0 correlation) typically involves:

- A minimum stack size of 10% to achieve meaningful impact

- A maximum tolerable stack size of 20–30% for most client portfolios

- Distribution across multiple return sources to reduce line-item risk

- Regular rebalancing to maintain target exposures

The introduction of pre-packaged Return Stacked® solutions has made implementation more accessible than ever. These vehicles handle the operational complexity of derivatives trading and margin management, allowing investors to focus on strategic allocation decisions.

Building More Efficient Portfolios Through Return Stacking

Recent market conditions, with high equity valuations, volatile interest rates, and unpredictable inflation, make the case for return stacking particularly compelling. However, implementation requires careful consideration of portfolio mathematics and risk management.

The introduction of pre-packaged Return Stacked® solutions has democratized access to these strategies. Investors can now choose between two primary implementation approaches:

- Pre-stacked Solutions: Providing simultaneous exposure to multiple diversifying return streams through a single vehicle.

- Capital Efficient Portfolio Construction: Using derivatives and cash management to create custom stacked exposures.

Key Takeaways

Return Stacking represents a fundamental evolution in portfolio construction methodology, offering solutions to long-standing challenges in traditional approaches to diversification and alpha generation. The strategy:

- Allows investors to pursue alpha in alternatives without disrupting core beta exposure.

- Provides access to diversifying strategies while maintaining traditional benchmarks.

- Helps mitigate behavioral biases associated with alternative investments.

- Offers practical implementation options through modern investment vehicles.

As investment vehicles continue to evolve and accessibility improves, return stacking strategies are becoming increasingly viable for a broader range of investors. The approach offers particular promise for those seeking to enhance returns and improve diversification while maintaining familiar portfolio frameworks.