Investing in Gold

Overview

Dive into the world of gold and learn about the precious metal’s history, characteristics, and uses in portfolio construction.

Key Topics

Gold, Investing, Return Stacking

Why Invest in Gold?

old has long been a prominent asset in the world of investment, distinguished from stocks and bonds by its lack of dividends or interest. Historically serving as a store of value, unit of exchange, and material for jewelry, gold retains its significance in modern finance as an investment serving as a store of value or as a diversifying asset in an investment portfolio.

Investors can access gold through several avenues, including physical gold (bars, coins, jewelry), gold ETFs (exchange-traded funds) that invest in physical gold, futures, or mining stocks, and direct investments in gold mining companies. While physical gold offers direct ownership, it requires secure storage and insurance. ETFs provide liquidity and ease of trade but come with counterparty risks and fees. Mining stocks can be more volatile but provide exposure to potential gains in gold mining profits.

Gold’s popularity as an investment is evident in the preferences of various forms: jewelry, gold bullion (bars or coins), gold certificates, deposit schemes, exchange-traded funds (holding either gold assets or mining companies), E-Gold, or financial derivatives with gold indices as the underlying asset.

Even after the transition from gold-backed to fiat currencies, gold remains a pillar of global reserves and personal investment portfolios. Gold’s historical performance demonstrates its utility in diversifying portfolios, especially during crises. It has acted as a reliable store of value over time and a hedge against inflation, holding its value during periods of currency devaluation. Gold has also acted as a safe haven asset as investors flock to the metal when economic stability is a concern.

The vast global gold market encompasses central banks, jewelry manufacturers, as well as individual and institutional investors. Gold prices are influenced by geopolitical events, market speculation and myriad other factors. Whether through physical means, ETFs, or mining stocks, gold investment remains a critical strategy for many seeking to mitigate risks and preserve wealth in the modern era.

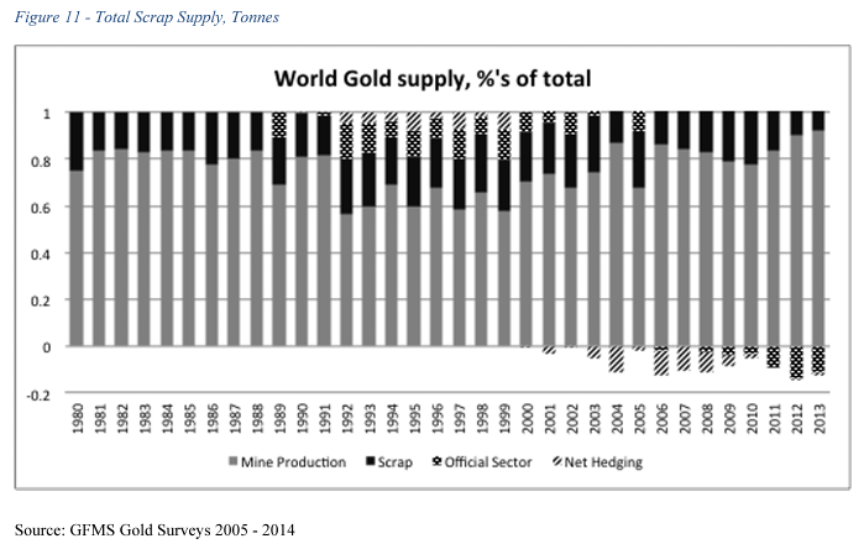

Methods for Valuing Gold

Determining the valuation of gold is a complex endeavor that is influenced by a multitude of interconnected factors. One fundamental aspect is the supply-demand dynamic. The total supply of gold is relatively inelastic, with annual production from mining and recycling introducing a steady but limited stream of new gold into the market. This inherent scarcity, coupled with historically stable and predictable increases in annual supply, is a key factor underpinning gold’s enduring value. On the demand side of the equation, jewelry consumption, central bank reserves, and investment demand are among the primary drivers (Ben McMillan 2020).

Another critical factor to consider in gold valuation is the impact of currency movements, particularly fluctuations in the value of the US dollar. As gold is primarily traded in US dollars on global markets, shifts in the dollar’s trade-weighted value can have a substantial influence on gold prices. During periods when the dollar weakens, gold becomes relatively less expensive for buyers using other currencies, potentially stimulating demand and putting upward pressure on prices. Conversely, a stronger dollar can have a dampening effect, making gold comparatively more expensive globally and possibly leading to reduced demand and softening prices (O’Connor et al. 2015).

Gold vs. Other Precious Metals and Commodities

When evaluating gold in comparison to other precious metals and commodities, it is important to recognize both the similarities and the distinctive characteristics that set gold apart. One key differentiating factor is gold’s relatively limited industrial usage compared to metals such as silver, platinum, and palladium, which have significant industrial applications. This more confined role serves to further enhance gold’s standing as an investment asset, with its value proposition primarily anchored in its enduring appeal as a store of value and its perceived utility as a hedge against inflation and economic uncertainty.

History of Gold as an Investment

Gold has been revered for millennia, serving as a symbol of wealth, power, and divinity. The earliest known use of gold can be traced back to 4000 B.C, where gold flakes were found in Paleolithic caves. Ancient civilizations, particularly the Egyptians, utilized gold extensively in their mythology, construction, and economic systems. They established the first recorded value of gold, positioning it as part of their currency system, with one piece of gold equal to two and a half parts of silver. The Pyramid of Giza, capped with gold, stands as a testament to the metal’s significance in ancient society (New York Gold Co. 2017). The kingdom of Lydia, an ancient civilization centered in western Turkey, is recognized as the first to use gold coins as currency, a practice that was also adopted by the Greeks, who regarded gold as a marker of wealth and social status.

The international gold standard, officially established in the 1870s, marked a pivotal period in financial history. Under this system, the value of currency was directly linked to a fixed quantity of gold. Britain emerged as an early adopter, implementing a de facto gold standard by the early 18th century and formally legalizing it in 1816. The gold standard thrived until World War I, with a brief revival in the late 1920s. While it provided a period of economic stability for many countries, the system’s vulnerabilities were exposed during economic downturns, such as the depression beginning in 1873 and subsequent financial crises in the 1880s and 1900s (Richard N. Cooper 1982; Selgin 2012).

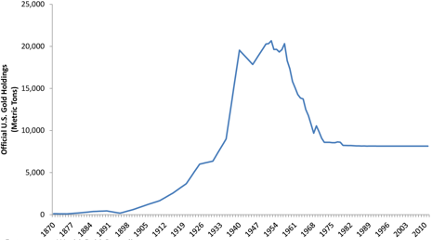

Official U.S. Gold Holdings (Metric Tons)

Source: Erb and Harvey (2013)

Following World War II, the Bretton Woods system sought to re-establish economic stability by pegging international currencies to the U.S. dollar, which was then convertible to gold at a fixed rate of $35 per ounce. This system combined the benefits of the gold standard with the flexibility needed to manage post-war economies. However, by the 1960s, inflationary pressures and increasing dollar liabilities made maintaining the gold price unsustainable. In 1971, President Nixon closed the gold window, ending the direct convertibility of dollars to gold. This decisive move marked the collapse of the Bretton Woods system, transitioning the world to a fiat currency regime and leading to significant fluctuations in gold prices.

Several major historical events have had a profound impact on gold prices. The 1970s oil crisis, combined with the end of the gold standard, led to unprecedented inflation and a surge in gold prices, peaking in 1980 before entering a prolonged bear market that lasted until the early 2000s. The 2008 financial crisis once again highlighted gold’s role as a safe haven asset, as economic instability drove investors towards tangible assets, pushing gold prices to historic highs (Arayssi 2012).

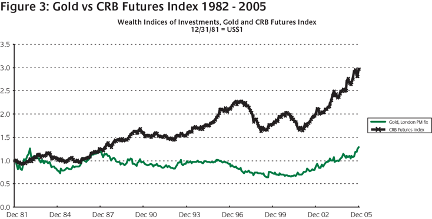

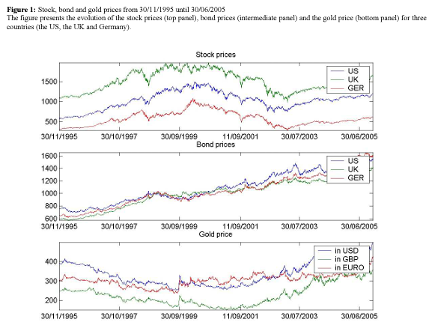

Source: Michaud et al. (2011)

Over time, gold investment vehicles have evolved significantly. Historically, gold coins and bars were the primary forms of investment. The introduction of gold exchange-traded funds (ETFs) in the early 2000s revolutionized gold investing by providing liquidity and ease of access while eliminating the need for physical storage. ETFs that hold physical gold bullion have become popular choices, allowing investors to buy and sell shares that represent gold ownership. This innovation has opened up gold investing to a broader market demographic, providing more flexibility and reducing barriers to entry. While gold ETFs are typically utilized so as to remove the necessity of holding and storing the physical bullion, gold funds do exist that allow an investor the option of taking physical delivery of gold.

Theoretical Foundations of Gold as an Investment

Gold has long been perceived as a robust hedge against inflation and currency devaluation. Historical studies have noted that gold preserves its value over extended periods, even amidst significant economic upheavals. Research by Baur and Lucey (2009) indicates that gold acts as a hedge against stocks on average and a safe haven during extreme market conditions, highlighting its stabilizing effect during macroeconomic turbulence. Erb and Harvey (2013) critically examined arguments supporting gold investment, particularly the notion of gold as a safe haven, and while not all arguments hold, they concluded gold still serves as an ultra-long inflation hedge.

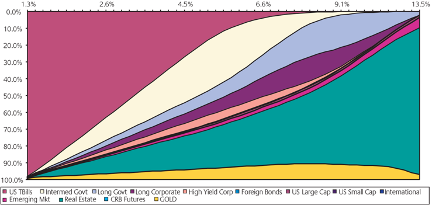

Gold’s potential for portfolio diversification has been extensively analyzed. Jaffe (1989) emphasized that direct gold investments are more effective in reducing portfolio risk compared to gold stocks. Hillier, Draper, and Faff (2006)confirmed gold’s significance relative to other precious metals, reinforcing its inclusion in diversified portfolios. Michaud et al. (2011) provided evidence supporting small but significant gold allocations, ranging from 1-2% in low-risk portfolios to 2-4% in balanced portfolios, underscoring gold’s role in stabilizing returns during adverse market conditions.

Strategic Asset Allocation Composition Map: 1986 - 2005

Source: Michaud et al. (2011)

The relationship between gold prices and macroeconomic variables has been subject to extensive scrutiny. Studies show mixed findings about the influence of interest rates on gold prices. For instance, Baur (2011) identified a positive impact of lower short-term interest rates on gold prices but noted a negative impact from longer-term interest rates, additionally noting that gold is impacted by weaker currencies, but not necessarily serving as a hedge against higher consumer prices. Despite some discrepancies, a common conclusion is that gold tends to serve as a hedge during periods of high inflation and economic instability, providing some degree of protection against volatile market conditions (Richard O. Michaud 2011).

Benchmarks and Valuation

Gold’s unique nature as a globally recognized and widely traded commodity has led to the establishment of several key benchmarks that serve as critical reference points for its pricing and valuation. Three of the most prominent benchmarks in the gold market are the London Bullion Market Association precious Metals Index (the London Gold Fix), the S&P GSCI Gold Index, and the XAU currency index (representing the current exchange rates between gold and the US Dollar).

The London Gold Fix has historically been a fundamental standard used to establish the price of gold. Traditionally, this fix was determined through a twice-daily telephone auction process involving major market-making banks. In recent years, this process has evolved to become fully transparent and electronic. The AM and PM fixings allow the global market to adjust to varying trading hours across different time zones and serve as a crucial benchmark price for a wide array of gold-related financial products.

The S&P GSCI Gold Index is a publicly available and investable index, maintained by S&P Global, tracking the COMEX Gold future. In contrast to the London Fix, this index prices during NYMEX trading hours, providing intra-day insights into gold price movements.

Establishing reliable and universally applicable benchmarks for gold investments presents a number of inherent challenges. These stem in part from the sheer diversity of factors that can influence gold prices, ranging from macroeconomic trends and geopolitical events to market-specific dynamics and investor sentiment. While widely followed benchmarks like the London Gold Fix and COMEX futures provide valuable reference points, the often volatile and sentiment-driven nature of gold markets can complicate efforts to make definitive performance comparisons over shorter timeframes.

Further compounding the complexities of gold investment benchmarking is the wide variety of vehicles through which exposure can be obtained, from physical bullion and coins to gold mining stocks, ETFs, and derivatives. Each of these options carries its own unique risk-return characteristics and operational considerations, making standardized comparisons more difficult. For example, gold coins typically hold a premium to a published spot gold price, due to factors such as manufacturing costs, storage costs, and collection/rarity demand. The liquidity of bullion also poses an impediment to its value, as the seller needs to find a buyer, and transport the metal to finalize the sale.

Additional Literature, Theoretical Evidence, and Implications for Portfolios

- In Gold and Gold Stocks as Investments for Institutional Portfolios by Jaffe (1989), the author reviews the diversification potential of gold and gold stocks within a traditional portfolio, finding that the independent returns of such assets have the possibility to increase the average returns of a portfolio.

- In Do Precious Metals Shine? An Investment Perspective by Hillier et al. (2006) the authors review the empirical evidence surrounding precious metals’ (gold, platinum, and silver) hedging characteristics.

- In Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds, and Gold by Baur and Lucey (2010), the authors analyze the prospect of gold being a protective asset during market turmoil in several different geographic markets. The analysis uncovers that gold is, on average, a hedge against extreme market conditions, though, highlights the time-sensitive nature of owning the asset in an investment portfolio during extreme environments.

Source: Baur and Lucey (2010)

- In Asymmetric Volatility in the Gold Market by Baur (2011), Baur finds that positive economic shocks increase gold’s volatility more than negative economic shocks. This result has the potential to be additive to a traditional investment portfolio.

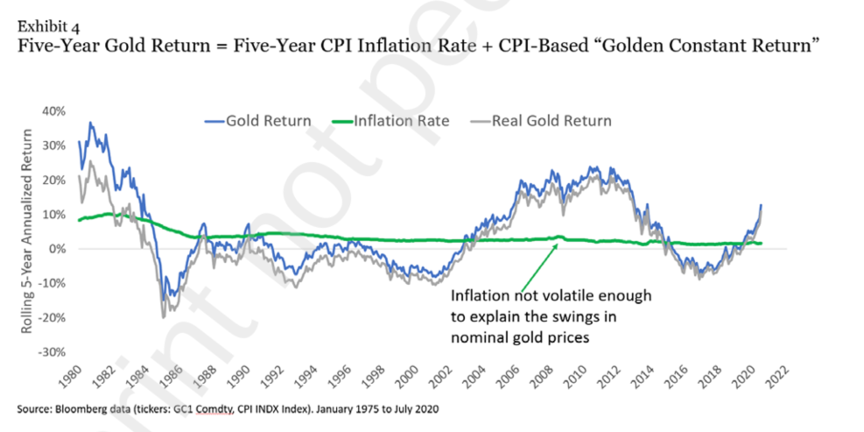

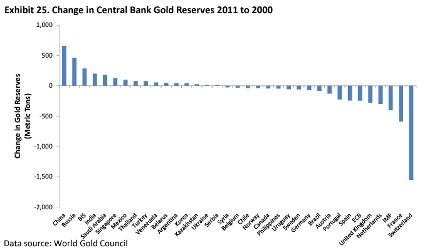

- In The Golden Dilemma by Erb and Harvey (2013) address several of the inherent arguments for gold as an investment such as its inflation hedging ability, currency hedging ability, and several others. The authors find that gold holds the possibility to maintain purchasing power over the long-term, though, find that a significant portion of the empirical evidence supporting gold’s inflation hedging capabilities is skewed by 1979, when gold increased by over 100%. The authors also explore the change in demand and supply dynamics across central banks, geographies, and investment funds.

Source: Erb and Harvey (2013)

- In The Financial Economics of Gold – A Survey by O’Connor et al. (2015), the authors provide a comprehensive review on gold, the gold market, and gold as an investment.

Source: O’Connor et al. (2015)

- In Is Gold a Safe Haven in all Currencies? by Baur (2021), Baur reviews gold’s safe haven properties across 68 international markets and currencies. Importantly, Baur finds that gold acts as a safe haven in the majority of these markets, finding that the local currency’s strength/weakness can influence the precious metal’s effectiveness as a safe haven asset.

- In Gold, the Golden Constant, COVID-19, ‘Massive Passives’ and Déjà Vu by Erb et al. (2021), the authors review the empirical evidence behind gold as an inflation hedge, and the timing of gold investment given the current real price of gold.

Source: Erb et al. (2021)

- In Gold and the S&P500: An Analysis of the Return and Volatility Relationship by Kuck (2021), Kuck reviews both the conditional returns and volatility of gold when conditioned on US equity markets, finding that while gold’s returns are not strictly dependent on equities, the conditional increased volatility of gold during equity shocks may be detrimental to a portfolio, overall.

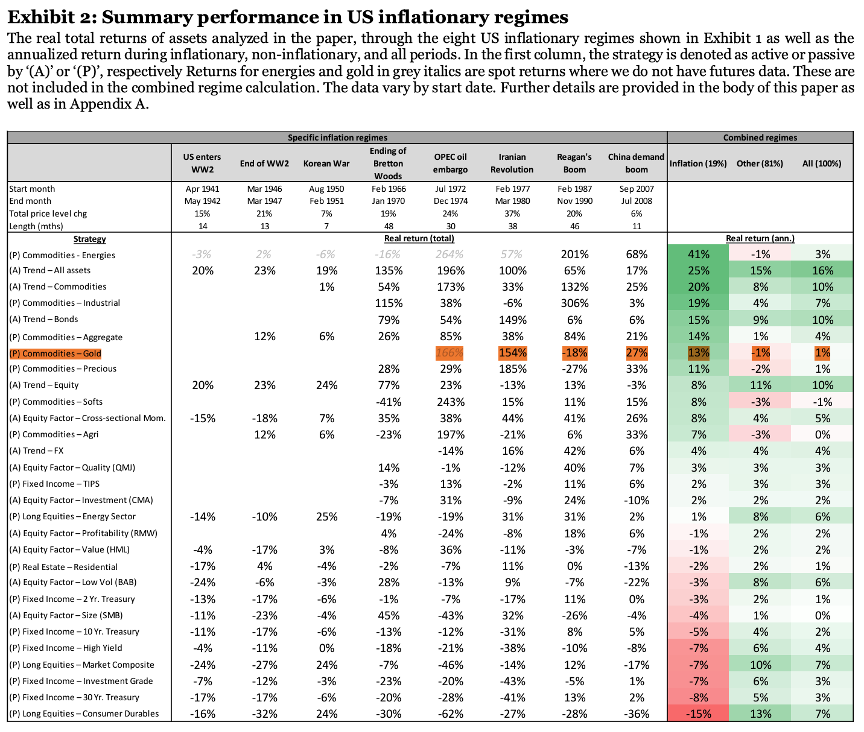

- In The Best Strategies for Inflationary Times by Neville et al. (2021) the authors survey a wide variety of investment strategies, asset classes, and individual assets to assess each individual response to inflationary regimes.

Source: Neville et al. (2021)

- In How to Use Gold as a Safe Haven by Baur and Dimpfl (2023) review the use of gold as a safe haven investment in both strategic and tactical context, finding that its use as a strategic investment is preferential due to the requirement of optimal timing in a tactical asset allocation framework.

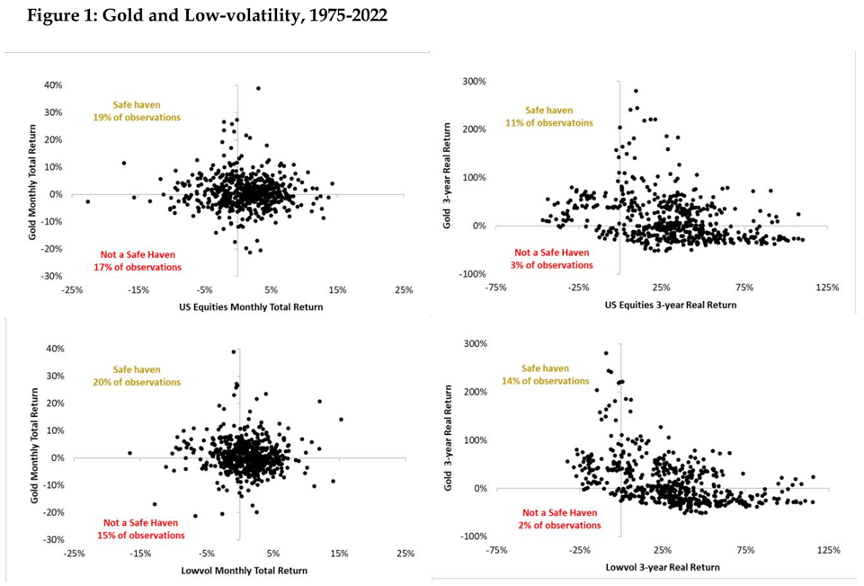

- In The Golden Rule of Investing by Van Vliet and Lohre (2023) explore the place of gold in an equity-based portfolio with the purpose of reducing drawdown characteristics. The authors find that a modest allocation to gold in such a portfolio reduces drawdowns, at the expense of returns. The authors then analyze gold in the context of a low-volatility equity portfolio, finding a favorable pairing between the factor and commodity.

Source: Van Vliet and Loire (2023)

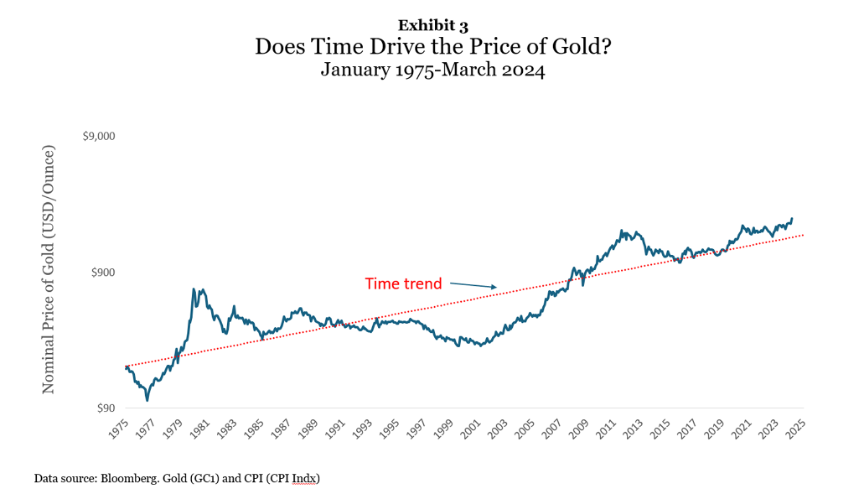

- In Is There Still a Golden Dilemma? By Erb and Harvey (2024), review the current environment of gold, considering the offering of gold from retail stores and central bank attitudes, and analyze the efficacy of gold given macroeconomic backdrops.

Source: Erb and Harvey (2024)

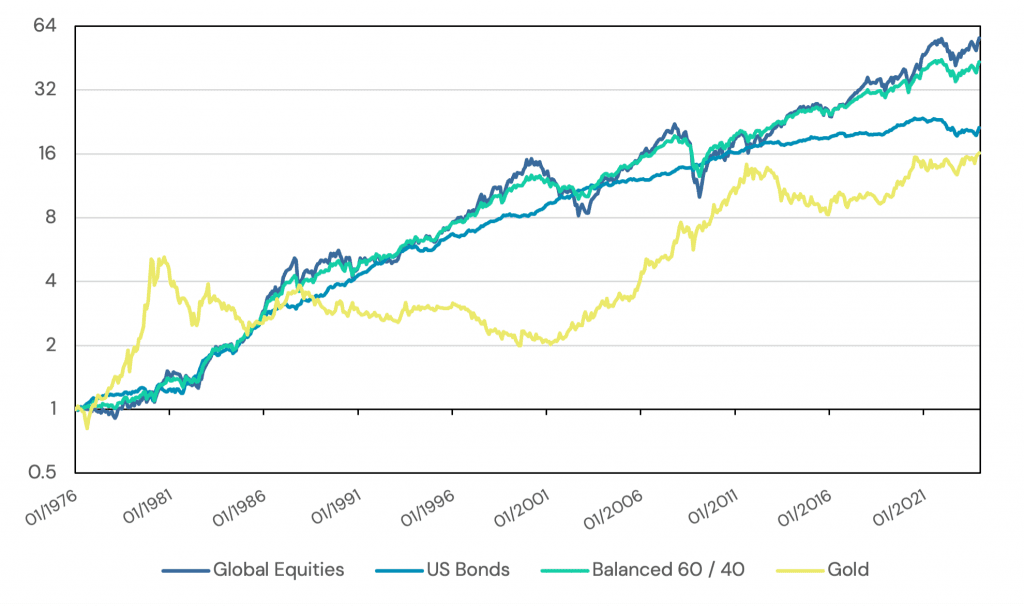

Performance History

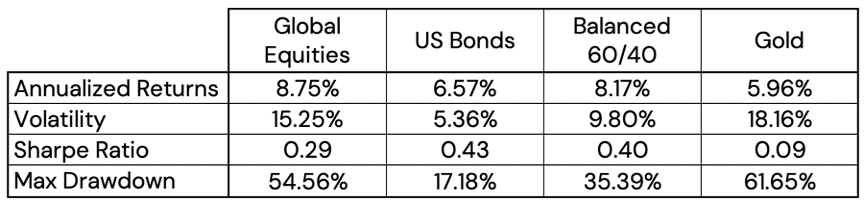

In this section we show the historical performance of gold using the spot gold price, in relation to global equities, US Bonds, and a balanced 60/40 portfolio.

Historical Performance and Statistics

Source: Bloomberg, FRED, Philadelphia Fed. Performance is backtested and hypothetical. Performance data begins in 1976 and ends in 2023 due to data availability. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. See Appendix A for index definitions.

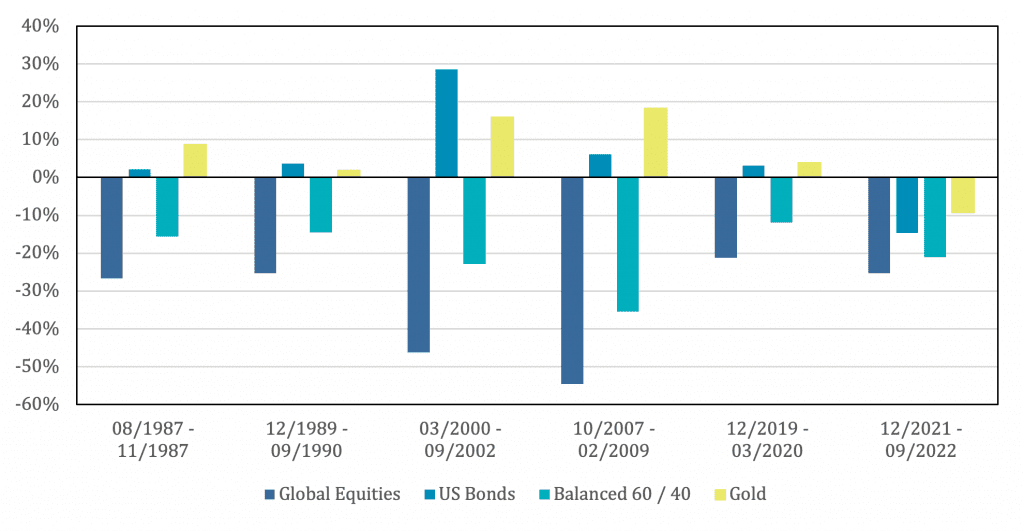

Performance During Equity Drawdowns (Greater than 20%)

Source: Bloomberg, FRED, Philadelphia Fed. Performance is backtested and hypothetical. Performance data begins in 1976 and ends in 2023 due to data availability. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. See Appendix A for index definitions.

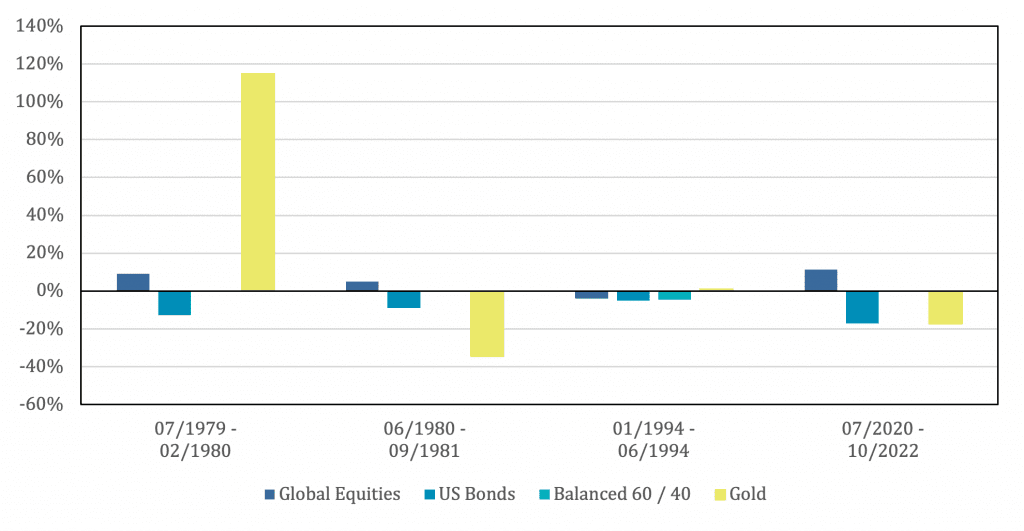

Performance During Fixed Income Drawdowns (Greater than 5%)

Source: Bloomberg, FRED, Philadelphia Fed. Performance is backtested and hypothetical. Performance data begins in 1976 and ends in 2023 due to data availability. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. See Appendix A for index definitions.

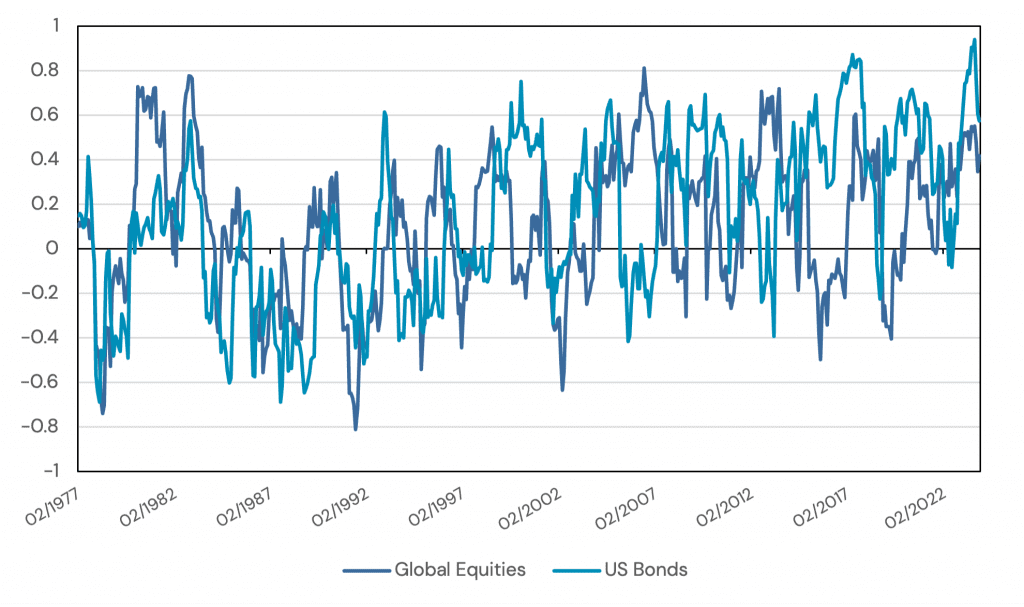

Rolling 12-Month Correlation to Stocks and Bonds

Source: Bloomberg, FRED, Philadelphia Fed. Performance is backtested and hypothetical. Performance data begins in 1976 and ends in 2023 due to data availability. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. See Appendix A for index definitions.

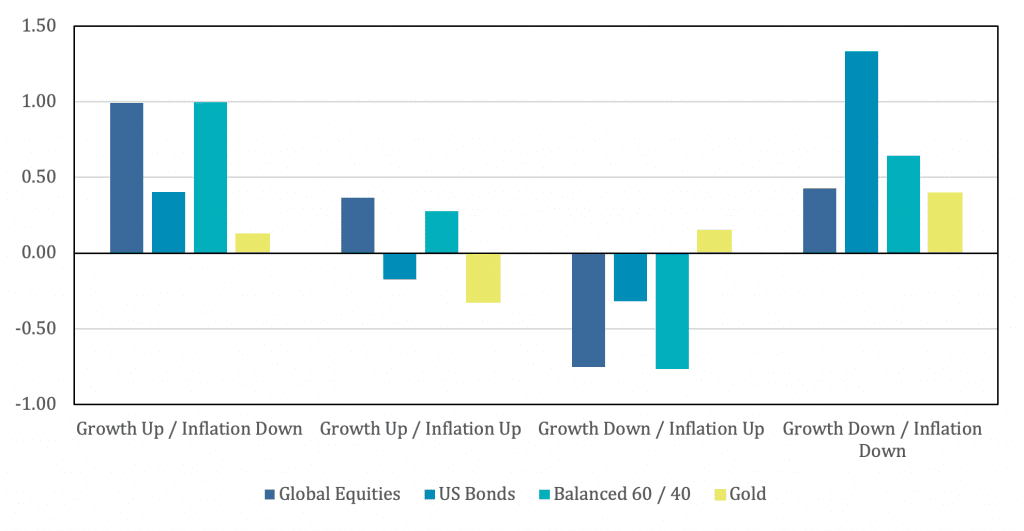

Sharpe Ratios During Macroeconomic Regimes

Source: Bloomberg, FRED, Philadelphia Fed. Performance is backtested and hypothetical. Performance data begins in 1976 and ends in 2023 due to data availability. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all distributions. Past performance is not indicative of future results. See Appendix A for index definitions.

Potential Applications to Return Stacking

Gold has long been recognized for its unique properties and potential benefits when incorporated into investment portfolios. From serving as a diversifier to hedging against inflation and currency risk, gold can play a strategic role for a variety of investors. In this section, we explore some of the key applications of gold in portfolios.

Below we show some examples of how one might contemplate use cases for gold in an investment portfolio.

If you’d like to explore any of these scenarios, please visit the Return Stacked Tools site to find tools to test and visualize these ideas in an intuitive framework.

Enhancing Portfolio Diversification

One of the primary benefits of including gold in a portfolio is its ability to provide additional diversification to a traditional portfolio. As a potential diversifier, gold hold a low average correlation to stocks and bonds and has empirically shown to reduce portfolio drawdowns during market downturns, on average.

As noted in the Performance History section, gold also has historically exhibited a positive Sharpe ratio in a “Growth Down / Inflation Up” economic regime, when stocks and bonds tend to underperform. This outcome, however, as noted by Erb and Harvey (2013) may be greatly skewed by one year, 1979, when gold dramatically appreciated in value.

Hedging Against Inflation and Currency Risk

Gold is often seen as a hedge against inflation risk, due to its nature as a real asset. Erb and Harvey (2013) reviewed this potential use case, finding that over the ultra-long-term, gold can indeed act as an inflation hedge, however, shorter-term fluctuations in price levels had little-to-no-impact on gold price. That said, in the long-term, gold can be effective method of maintaining purchasing power.

Baur (2021) reviewed the potential for gold to act as a safe-haven asset in over 68 equity markets, finding empirical evidence that gold was beneficial in 60 of those markets. Additionally, Baur extended his analysis by reviewing the local exchange rate dynamics can impact gold’s potential as a safe haven. His analysis found that falling currencies can enhance the safe have effect, extending its potential outside of the United States, exclusively.

Appendix A: Index Definitions

Global Equities – The MSCI ACWI Total Return Index (Bloomberg ticker: MXWD Index). Performance is gross of all costs (including, but not limited to, advisor feed, manager fees, taxes, and transaction costs). Source: Bloomberg.

US Bonds – The Bloomberg US Aggregate Total Return Value Unhedged USD Index (Bloomberg ticker: LBUSTRUU Index). Performance is gross of all costs (including, but not limited to, advisor feed, manager fees, taxes, and transaction costs). Source Bloomberg.

Gold – The spot gold rate represented by the gold-to-US Dollar exchange rate (Bloomberg ticker: XAUUSD:CUR).

Balanced 60/40 – A monthly rebalanced portfolio consisting of a 60% allocation the MSCI ACWI Total Return Index and a 40% allocation to the Bloomberg US Aggregate Total Return Value Unhedged USD Index. Performance is gross of all costs (including, but not limited to, advisor feed, manager fees, taxes, and transaction costs). Source Bloomberg.

Appendix B: Regime Definitions

Based upon the work in Exploring Macroeconomic Sensitivities: How Investments Respond to Different Economic Environments by Ilmanen, Maloney, and Ross.

Growth and Inflation are each defined as a composite of two series, which are first normalized to z-scores by subtracting the historical mean and dividing by the historical volatility.

“Up” and “Down” regimes are defined as those times when measures are above or below their full sample median.

Growth:

- Chicago Fed National Activity Index

- Realized Industrial Production minus prior year Industrial Production forecast from the Survey of Professional Forecasters.

Inflation:

- Year-over-year CPI change

- Realized year-over-year CPI minus prior year NGDP forecast from the Survey of Professional Forecasters.