Margin Management in Return Stacking

Overview

Return stacking is an investment approach that seeks to enhance diversification by layering non-correlated strategies, such as managed futures, on top of traditional exposures. While this strategy aims to improve risk-adjusted returns, it involves futures contracts that require margin management to mitigate risks like margin calls during volatile markets. Portfolio managers can address margin challenges through various methods, including maintaining liquidity buffers, reducing exposure, or pledging collateral, though ETFs and mutual funds simplify this process by managing risks at the fund level for investors. Regulatory protections and central clearing mechanisms further reduce counterparty risks, ensuring return-stacked strategies remain viable within a controlled risk framework.

Key Topics

Collateral Management, Margin Management, Margin Call

Introduction

Return stacking has become an increasingly popular approach for investors seeking to enhance portfolio diversification without reducing core equity exposure. By layering non-correlated strategies, such as managed futures, on top of a traditional equity portfolio, investors aim to improve risk-adjusted returns.

However, leveraging futures contracts introduces the risk of margin calls. Understanding how margin requirements work, the conditions that could lead to a margin call, and the available mitigation strategies is crucial for any investor implementing a return stacking approach.

The Mechanics of a Stacked Portfolio

Consider an example Return Stacked® strategy consisting of:

- 75% U.S. Equities (directly held)

- 25% Cash Collateral (to support futures positions)

- 25% S&P 500 E-Mini Futures (to synthetically achieve 100% total equity exposure)

- 100% Managed Futures Exposure (trading approximately 30 futures contracts across equity indices, bonds, currencies, and commodities).

Understanding Margin Requirements

Futures contracts require margin—a good-faith deposit to ensure solvency in the event of adverse price movements. Futures margin is typically split into two categories:

- Initial Margin: The amount required to open a position.

- Maintenance Margin: The minimum level that must be maintained to avoid a margin call.

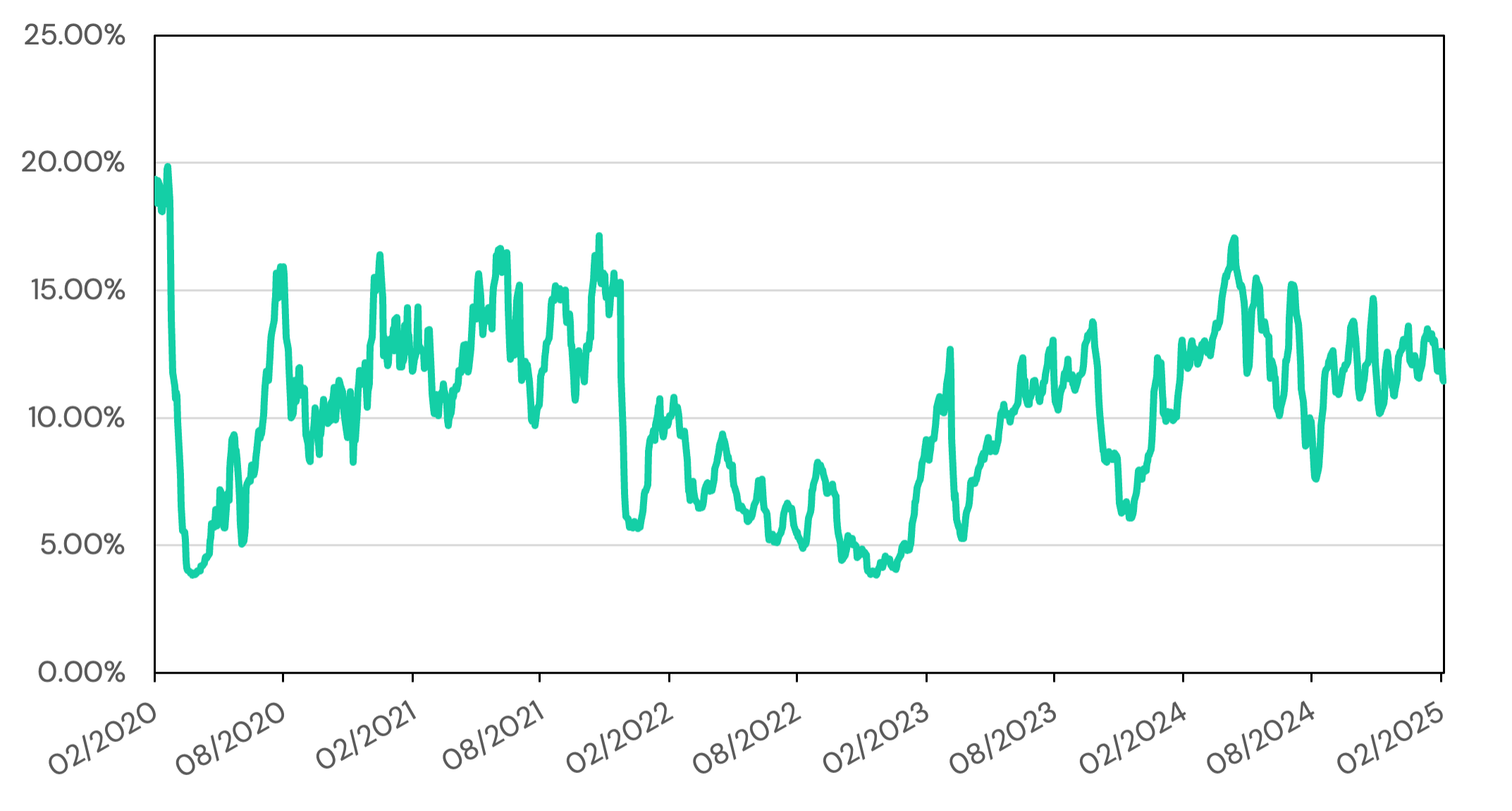

An S&P 500 E-mini contract typically requires an initial margin of 6-8% of the notional exposure with a maintenance margin of 5-7%. Interest rate and currency futures usually have lower initial margins (0.5-5%), while the more volatile contracts found in some commodities markets can reach 8-15%+. As a result, managed futures programs trading across multiple asset classes generally require an average margin of 10-15% of total notional exposure.

It is important to note that margin requirements are time-varying and usually increase during periods of market stress. This dynamic can further amplify liquidity needs during volatile market conditions.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Impact of Diversification on Margin Volatility

While diversification does not eliminate the risk of extreme, correlated losses that could lead to margin calls, a well-diversified managed futures program may experience lower peak margin demands compared to a more concentrated leveraged strategy. For example, during an equity market selloff, bonds or certain commodities may rally, offsetting losses and mitigating margin stress.

Given our portfolio’s structure, the estimated margin required to maintain these positions would be:

- S&P 500 E-mini: 1.5% of total portfolio value (6% initial margin x 25% of the portfolio’s notional value)

- Managed Futures: 12% of total portfolio value (12% initial margin x 100% notional exposure)

Total estimated margin requirement: ~13.5% of total portfolio value

Figure 1: Estimated Initial Margin over Time for a Hypothetical 100% Equity / 100% Managed Futures Portfolio

Source: ReSolve Asset Management.

Since our portfolio includes 25% cash collateral, there is a built-in cushion. However, if markets move sharply against the stacked positions, margin calls could still occur.

When Margin Calls Happen

A margin call occurs when the account’s margin balance falls below the required maintenance margin level, prompting the broker to demand additional funds or liquidation of positions to meet the requirement. This ensures that the investor has sufficient collateral to cover potential losses.

Key scenarios where this might happen:

- Large and Sudden Drawdowns in Managed Futures: If multiple managed futures positions experience correlated losses, required margin could spike. A 15-20% drawdown in managed futures might deplete available cash collateral and trigger a call.

- Simultaneous Losses in both Equities and Managed Futures: If equities decline sharply while managed futures also face losses (e.g., a rapid shift in market regimes affecting trend-following models), the portfolio could experience margin stress.

- Limit-Up / Limit-Down Market Moves: Futures markets impose daily price limits to curb extreme volatility. If multiple positions hit limit-down (or limit-up for shorts), the portfolio manager may be unable to close positions, increasing potential margin exposure. While the probability of all managed futures positions being simultaneously locked is low (due to their diversified nature), it remains a tail-risk scenario.

How to Handle a Margin Call

For investors allocating to an ETF or mutual fund implementing return stacking, margin calls and liquidity management are handled entirely within the fund structure. The fund manager is responsible for responding to a broker’s margin call using strategies such as:

| Strategy | Description |

| Wire Excess Cash to the Futures Account | If excess liquidity is available elsewhere, simply wiring additional funds can restore margin balances without disrupting portfolio structure. |

| Reduce Futures Exposure | Selling down managed futures contracts or reducing E-mini exposure can lower margin requirements, but this may impact the overall strategy’s integrity. |

| Sell Equities to Raise Cash | Selling part of the 75% equity allocation to free up cash for margin obligations is an option. This introduces unintended equity exposure shifts, but may be necessary in extreme cases. Additionally, if the managed futures portfolio has a significant drawdown and margin is depleted, equities would likely need to be sold down to raise cash for rebalancing back to the intended 100/100 allocation. |

| Pledge Equities as Collateral | Some prime brokers allow stocks to be pledged as collateral instead of cash. This avoids forced selling but could introduce additional risks and financing costs. |

Because all of these adjustments happen within the ETF or mutual fund, individual investors do not need to actively manage margin calls or make allocation decisions in response to them. This structure significantly reduces operational complexity for investors, while ensuring that portfolio risk is managed by professional fund managers.

The Likelihood of a Systemic Margin Event

One of the strengths of managed futures is their diversified exposure across asset classes. The probability of every futures position experiencing simultaneous, extreme losses is low, making a full-scale margin crisis less likely.

Stress Testing and Scenario Planning

To mitigate risks, managers of ETFs and mutual funds implementing return stacking should:

- Stress-test portfolios against historical and hypothetical drawdowns.

- Maintain an emergency liquidity buffer beyond minimum margin needs.

- Ensure flexible funding sources for potential margin obligations.

Counterparty Risk in Margin Events

In addition to market volatility, counterparty risk plays a role in systemic margin stress. If a broker or clearinghouse faces liquidity issues or defaults, margin requirements may suddenly increase, and access to funds may become restricted. However, to help manage this risk for investors, exchange-traded futures are centrally cleared, meaning that the exchange itself acts as the counterparty to both sides of a trade. This central clearing mechanism significantly reduces counterparty risk, as the exchange guarantees the fulfillment of the contract even if one of the trading participants defaults. This structure enhances market stability and ensures the integrity of futures contracts, making them less susceptible to counterparty-related disruptions.

Return Stacking Within a Mutual Fund or ETF

From a legal perspective, structures like the Investment Company Act of 1940 in the U.S. provide protections ensuring that investor liability is limited to their shares in the fund. This structure shields investors from the risk of margin calls affecting their personal assets, as any required liquidity management happens within the fund and is handled by the fund manager.

Additionally, funds operating under the ’40 Act have strict regulations regarding leverage and liquidity management, reducing the probability of extreme margin stress events. The SEC Rule 18f-4, which governs the use of derivatives within mutual funds and ETFs, imposes limits on leverage and requires funds to maintain risk management programs. This regulation helps mitigate the potential for excessive margin exposure within these vehicles, ensuring that Return-Stacked® strategies operate within a controlled risk framework while avoiding the operational complexity and personal liability associated with managing futures contracts directly.

Conclusion

By proactively managing these risks, fund advisors can help clients confidently harness the benefits of return stacking while minimizing the dangers of excessive leverage.