The Return Stacking How-To Guide

Overview

The implementation of return stacking allows investors to solve some potentially pressing problems faced in portfolio construction. In this article, we explore four case studies that showcase some of the most utilized methods to introduce return stacking to a portfolio.

Key Topics

Return Stacking, Portable Alpha, Capital Efficiency, Diversified Alternatives

Introduction

While we hear from many advisors that are excited about the concept of return stacking, one of the first questions we are asked is: “how should we put this into practice?”

In this article, we will provide a few of our favorite examples on how to use return stacking in an investment portfolio. We have also written a return stacking checklist if you’d like to read about some of the considerations we make when reviewing portfolios and recommending options.

The Building Blocks

To keep the guide relatively easy to follow, we will use a few generic asset classes and generic return stacking strategies. The asset classes we will use are equities, fixed income, alternatives, and cash.

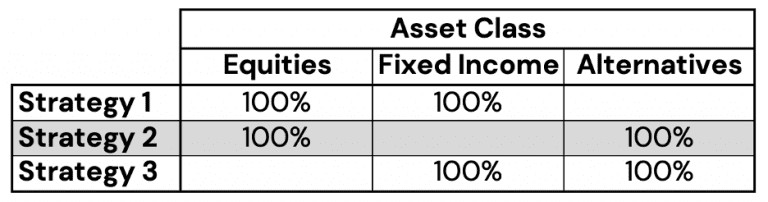

Figure 1: Generic Return Stacked Strategies

Source: Newfound Research. For illustrative purposes only.

Case Study 1: Adding Cash to a Portfolio

In our first, and potentially most straightforward case, we would simply like to free up cash in a portfolio without incurring cash drag. Investors may want to do this for a variety of reasons, including managing withdrawals, fees, and capital calls. Often, we even hear about advisors who are required to keep a certain amount of cash allocated by their compliance departments.

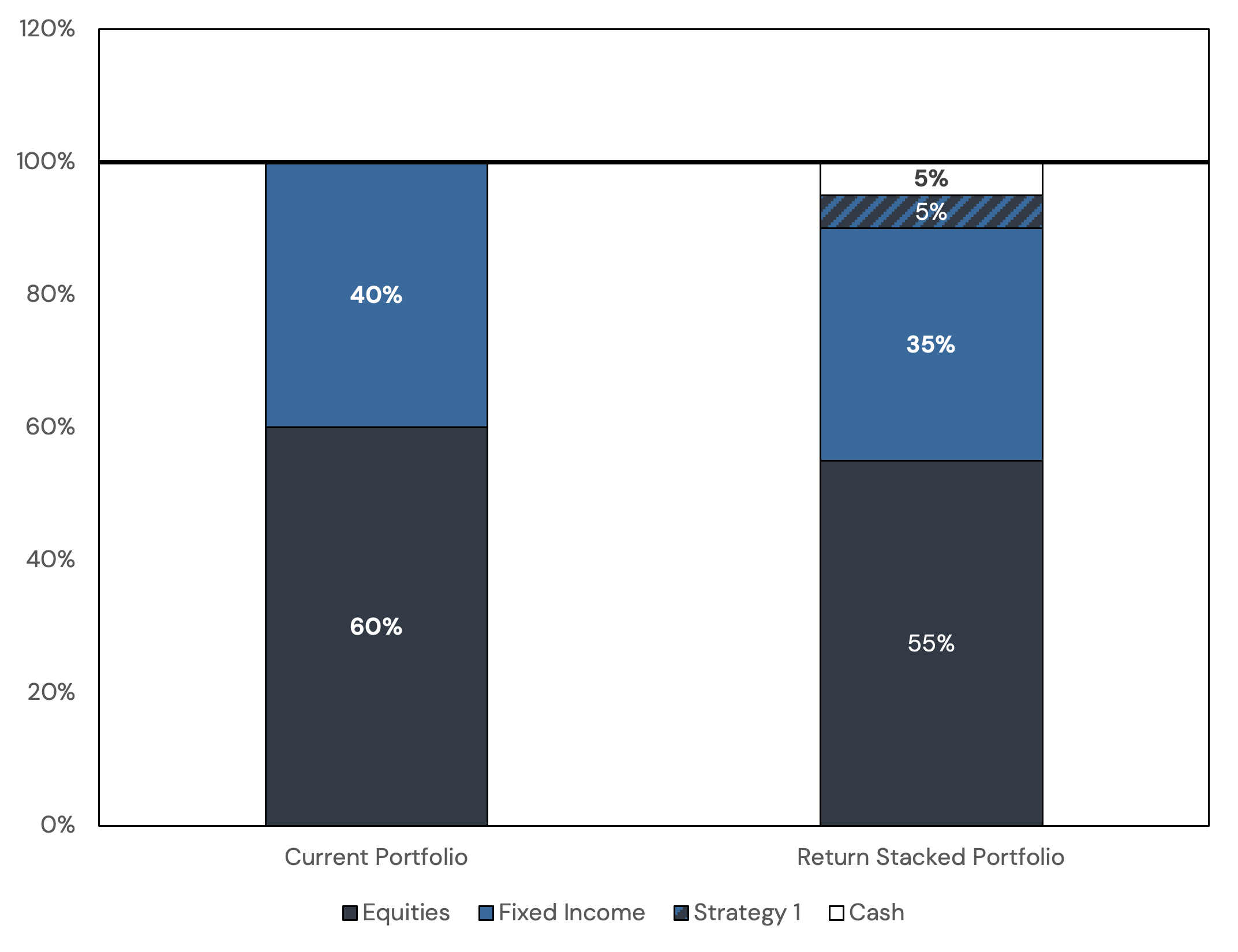

If we begin with a 60/40 equities/fixed income portfolio with the desire to add 5% to the portfolio, it makes sense to look to Strategy 1 (100% Equities / 100% Fixed Income) as an addition to our lineup. To accomplish this, we would sell 5% of our equities and 5% of our bonds to add a 5% exposure to Strategy 1.

Since the 5% allocation to Strategy 1 provides us with 5% exposure to both stocks and bonds, our previous allocation is preserved, and we now have 5% free to leave in cash.

Source: Newfound Research. For illustrative purposes only.

Figure 3: Freeing Up Cash in a Portfolio – Notional Allocation

Source: Newfound Research. For illustrative purposes only.

While stacking an “extra” 5% cash may seem appealing from a return perspective, we should note that Figure 3 is slightly misleading. Although we have freed up 5% cash while maintaining our pre-existing 60/40 exposure, the extra 5% cash return would be in excess of the prevailing borrowing rate.

Since the interest rate earned on cash and the embedded cost of leverage are similar, this means that the return profile of the Current Portfolio and the Return Stacked Portfolio should be nearly identical. By utilizing capital-efficient instruments — similar to techniques employed in portable alpha strategies — we maintain our portfolio’s exposure while freeing up cash. In other words, a capital efficient strategy, like Strategy 1, can allow investors to hold more cash without necessarily incurring the penalty of cash drag on their portfolio.

If you would like to learn more about this idea, we have written a deeper dive on this topic, available here.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

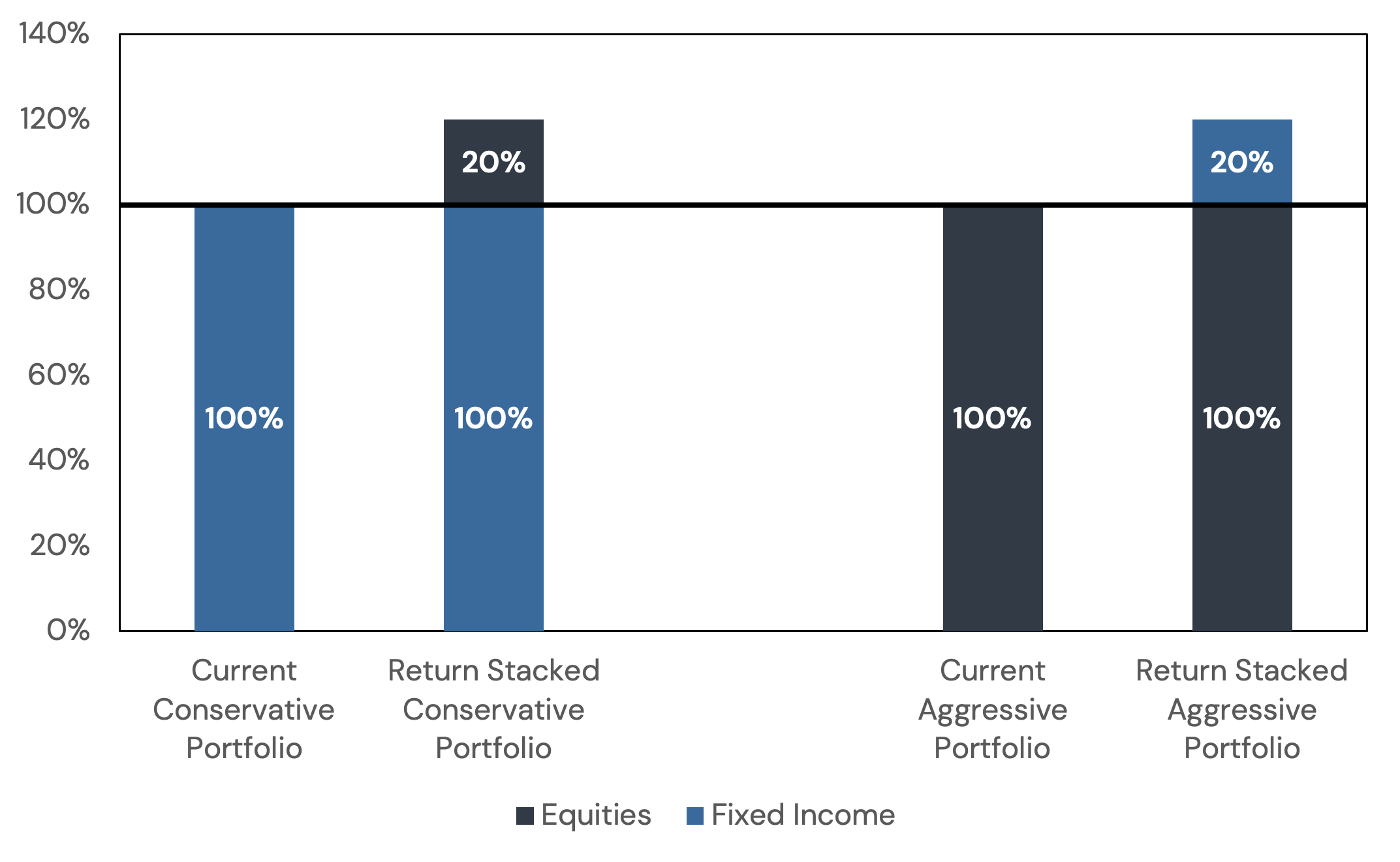

Case Study 2: Adding Stock/Bond Exposure to a Conservative or Aggressive Portfolio

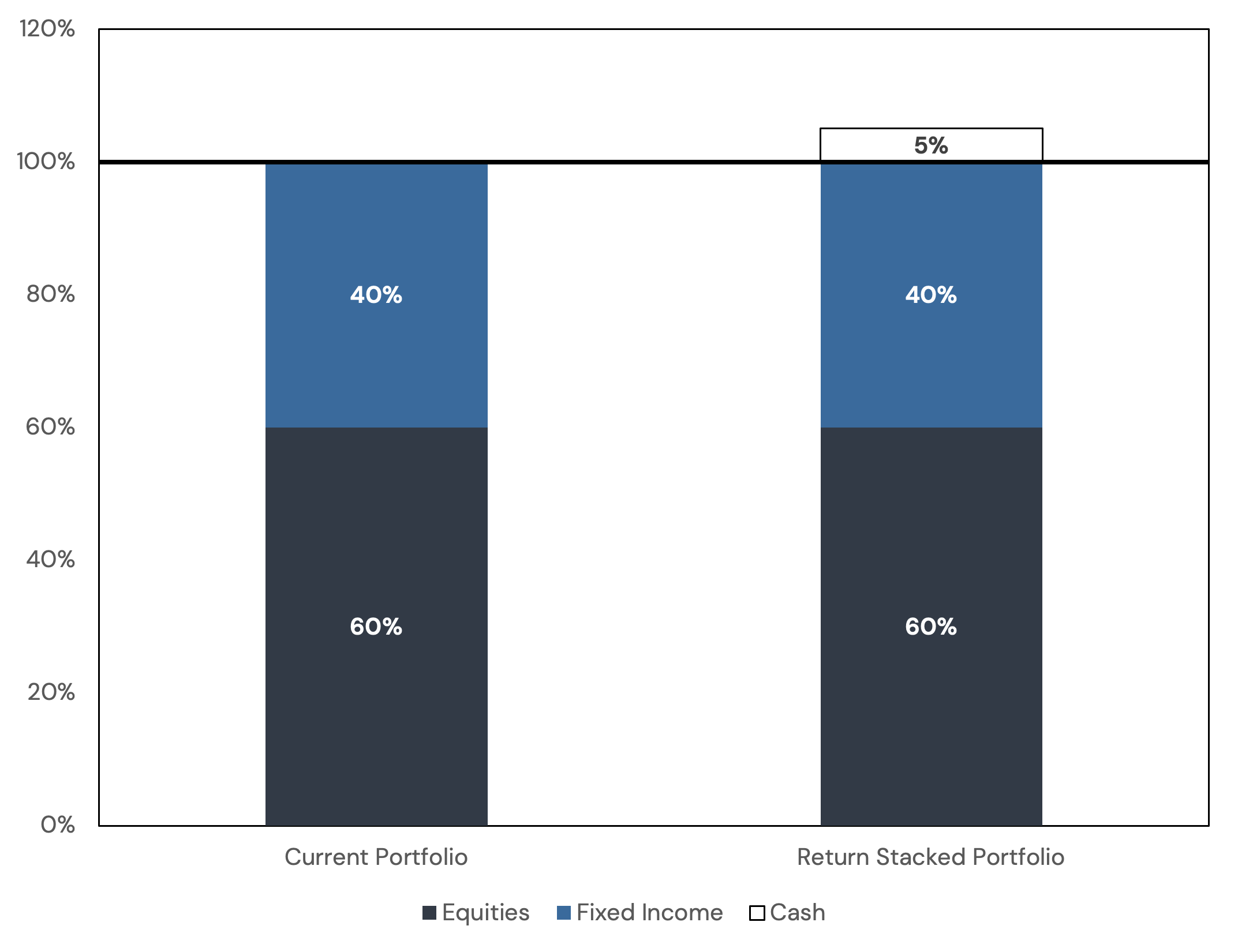

In many cases, investors may exist on the extremes of being a conservative or aggressive investor, with the extremely conservative investor being entirely invested in fixed income, and the extremely aggressive investor being entirely invested in equities.

Both investors, however, are missing out on the potential diversification benefits between equities and fixed income.

It may be, then, that either of these two investors want to keep their existing asset allocations but include the other asset class on top to improve the diversification of their portfolios.

The conservative investor is subject to the large risk that their portfolio may not be able to keep up with inflation. By stacking equity exposure on top, the portfolio can gain access to a growth asset without compromising the nominal safety of fixed income.

The aggressive investor, on the other hand, is entirely exposed to equity market risk (we refer the reader to “Why Not 100% Equities” by Cliff Asness at AQR for an in-depth article covering this use-case). By stacking fixed income on top of the equity portfolio, the investor has now gained access to a potentially diversifying asset and introduced an additional source of return to their portfolio.

If we say that each investor wants to add 20% of the left-out asset class, then each investor would sell 20% of their existing portfolio and replace the exposure with Strategy 1 (100% Equities / 100% Fixed Income).

More specifically:

-

The conservative investor would sell 20% of their bonds to buy 20% of Strategy 1.

-

The aggressive investor would sell 20% of their stocks to buy 20% of Strategy 1.

Figure 4: Adding Stock and Bond Diversification to a Portfolio – Portfolio Allocation

Source: Newfound Research. For illustrative purposes only.

Figure 5: Adding Stock and Bond Diversification to a Portfolio – Notional Allocation

Source: Newfound Research. For illustrative purposes only.

Case Study 3: Including Alternative Assets

In this section, we show two sub-case studies with two different methods of including alternative or diversifying assets.

In many cases, an investor may want to add diversifying assets +but is reluctant to sell down existing core exposures to do so. By implementing return stacking techniques, we can include diversifying assets without sacrificing our existing exposures.

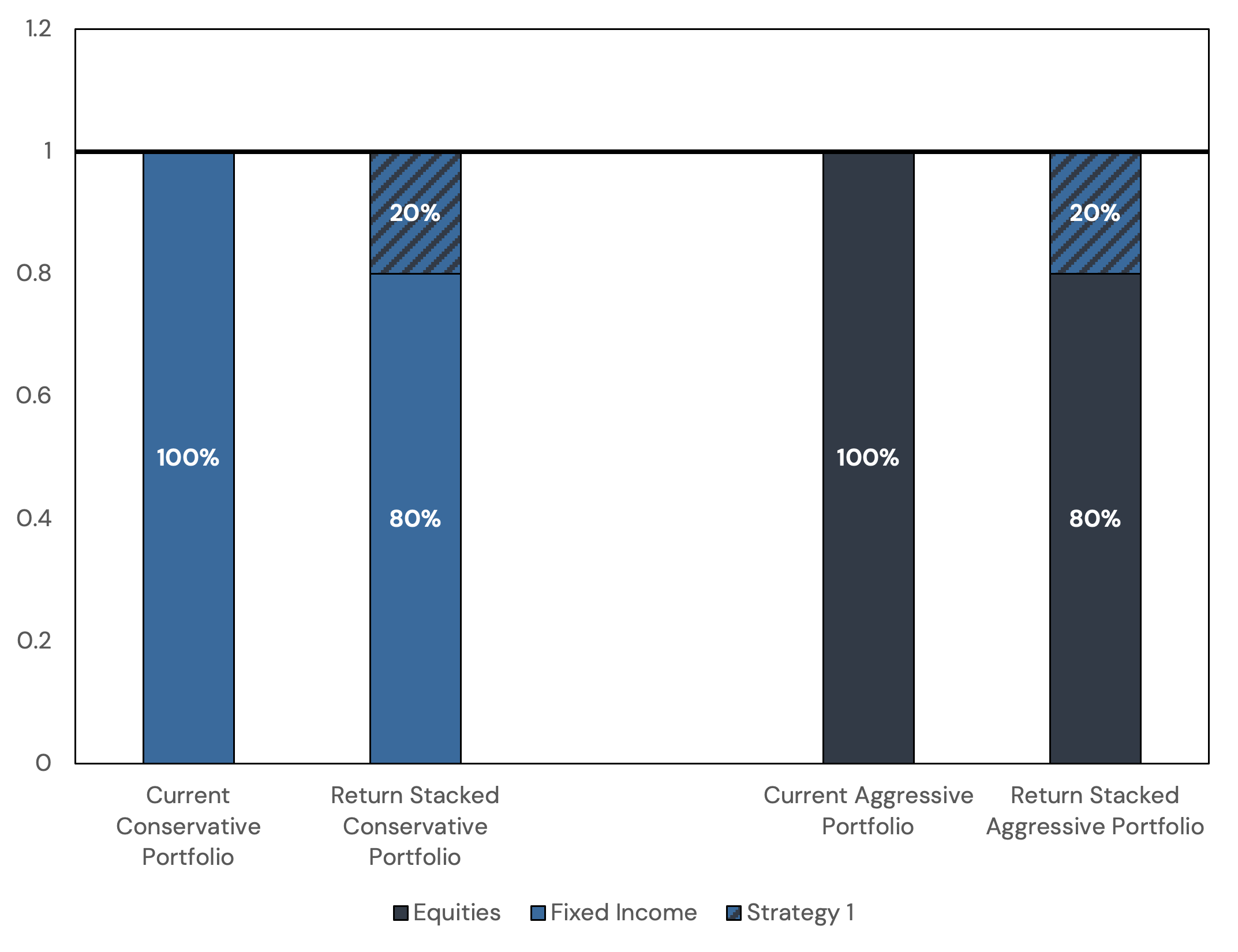

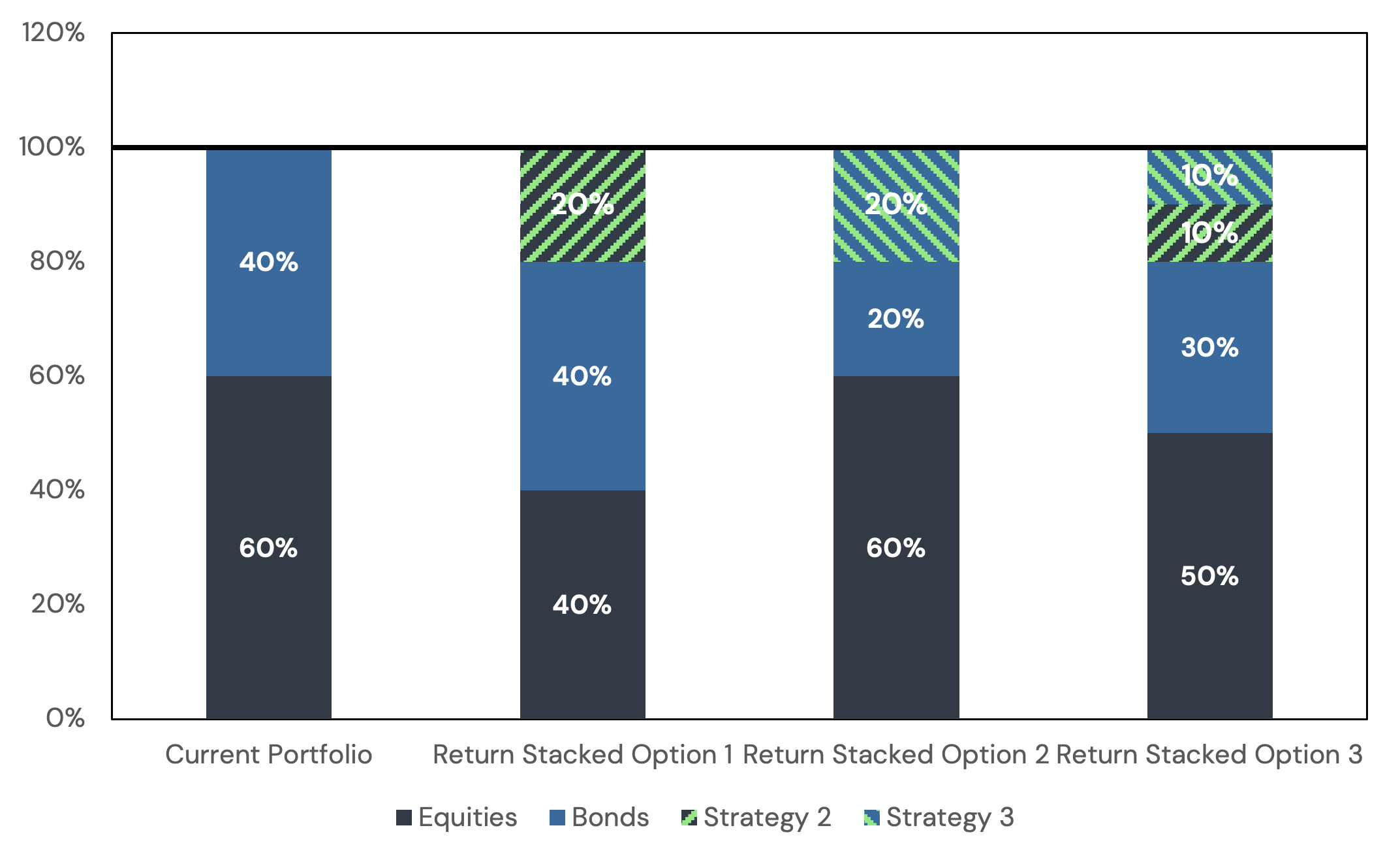

Case Study 3A: Adding a Capital Efficient Fund with Alternatives Exposure

One straightforward way to include certain alternatives is to utilize strategies that pre-package capital-efficient alternatives on top of core stock or bond exposures, such as Strategy 2 (100% Equities / 100% Alternatives), Strategy 3 (100% Fixed Income / 100% Alternatives), or a combination thereof. These strategies employ the concept of portable alpha by overlaying alternative investments onto beta exposures, enhancing portfolio efficiency.

If a portfolio begins with a 60/40 equity/bond exposure and wants to add an additional 20% to alternatives, there are three options to accomplish this:

- Sell 20% stocks to purchase 20% of Strategy 2 (100% Equities / 100% Alternatives).

- Sell 20% bonds to purchase 20% of Strategy 3 (100% Fixed Income / 100% Alternatives).

- Sell 10% of stocks and 10% of bonds to purchase 10% in Strategy 2 and 10% in Strategy 3.

As we can see from Figure 7, in all cases the resulting asset allocations are all the same; however, the underlying strategies held in the portfolio differ, as shown in Figure 6.

Figure 6: Adding Alternative Exposure Through Pre-Packaged Return Stack – Portfolio Allocation

Source: Newfound Research. For illustrative purposes only.

Figure 7: Adding Alternative Exposure Through Pre-Packaged Return Stack – Notional Allocation

Source: Newfound Research. For illustrative purposes only.

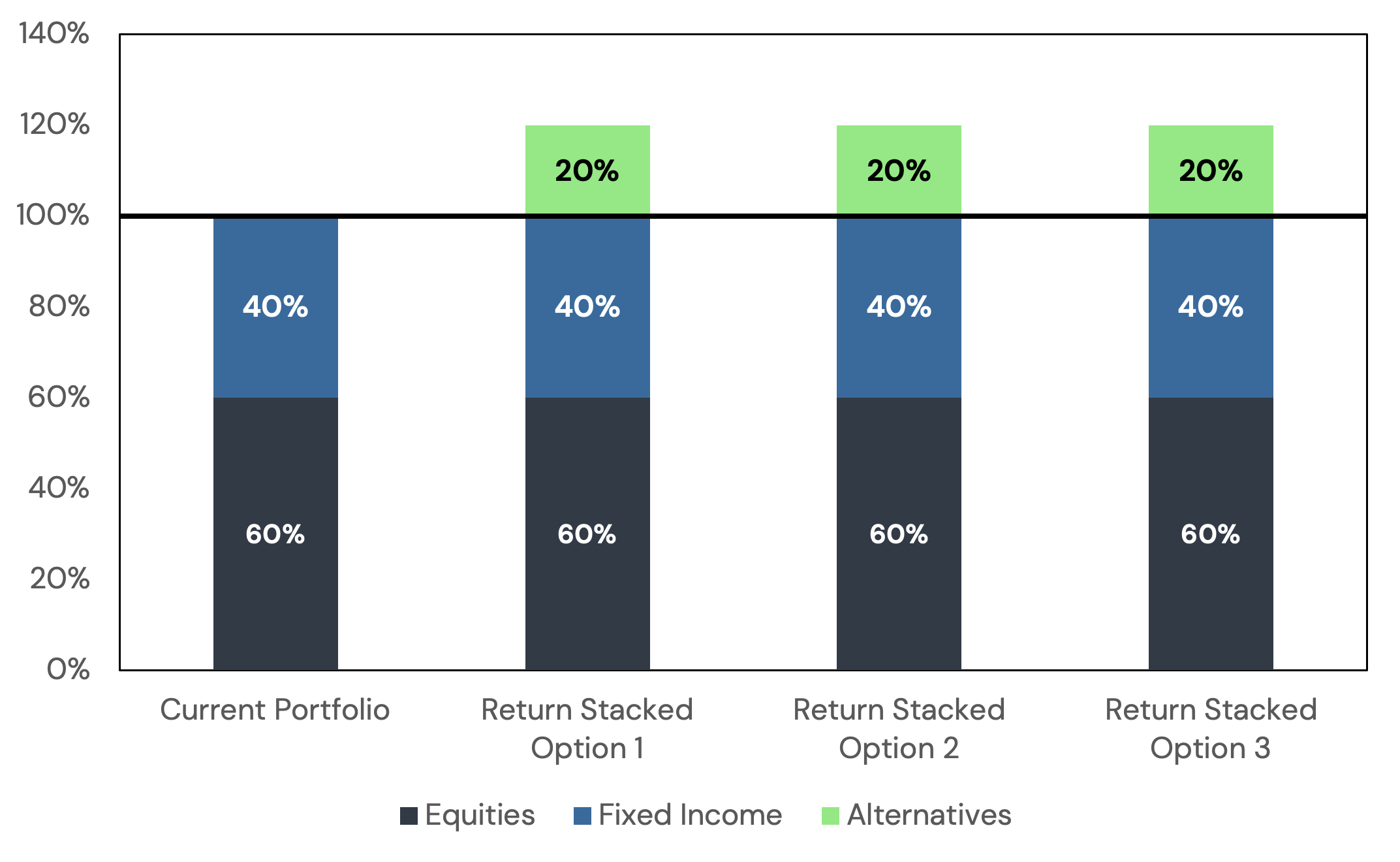

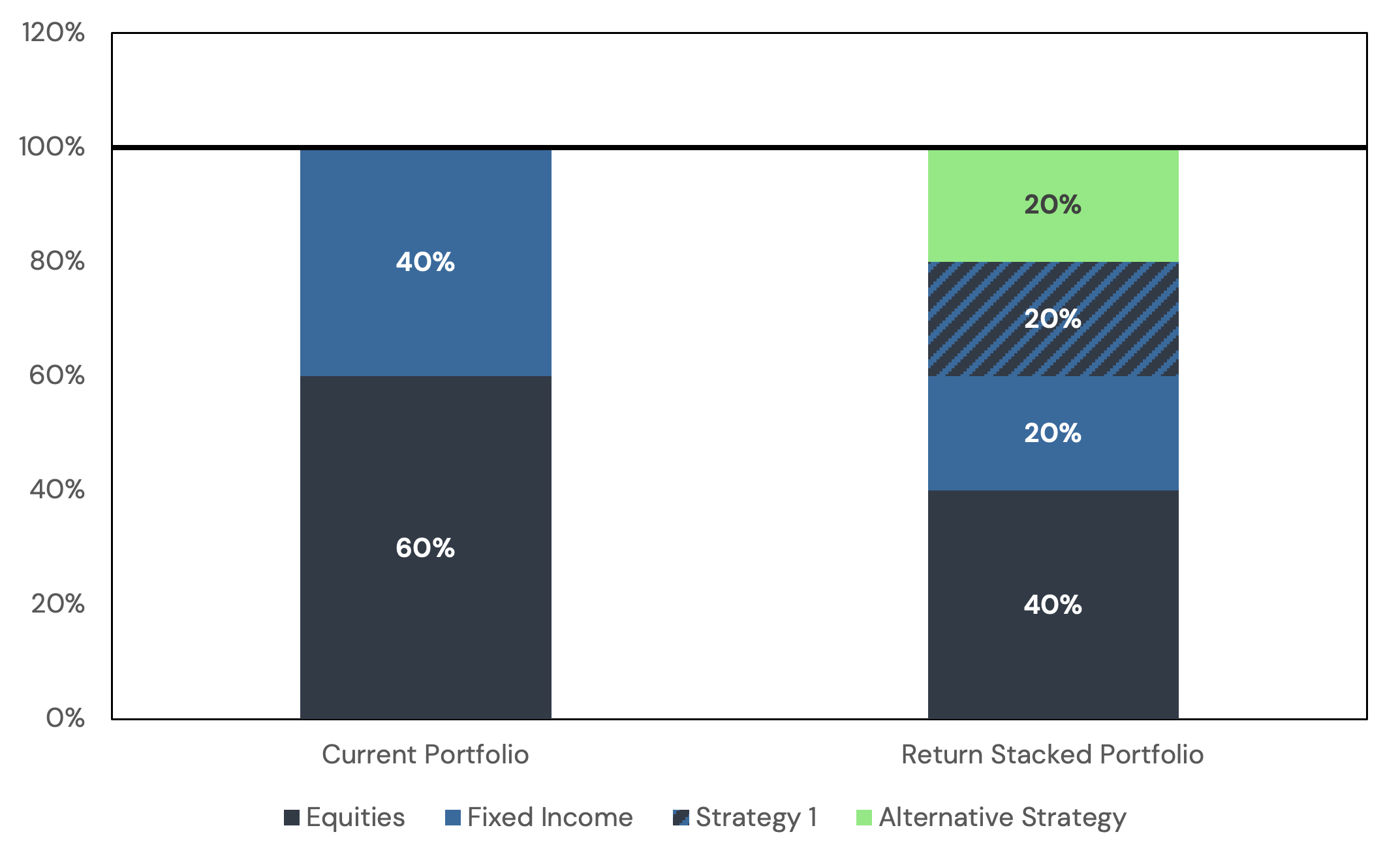

Case Study 3B: Freeing-Up Space for Alternative (or Diversifying) Assets

In this case study, we use the term “alternatives” loosely. This freed-up space could be allocated to almost any additional asset class that you could think of, such as alternative funds or real assets. This is very much a “choose your own adventure” style of return stacking. Similar to portable alpha strategies, the investor could choose any combination of funds, asset classes, or styles to allocate to with the freed-up capital (though, we would still recommend that these additions diversify the existing portfolio).

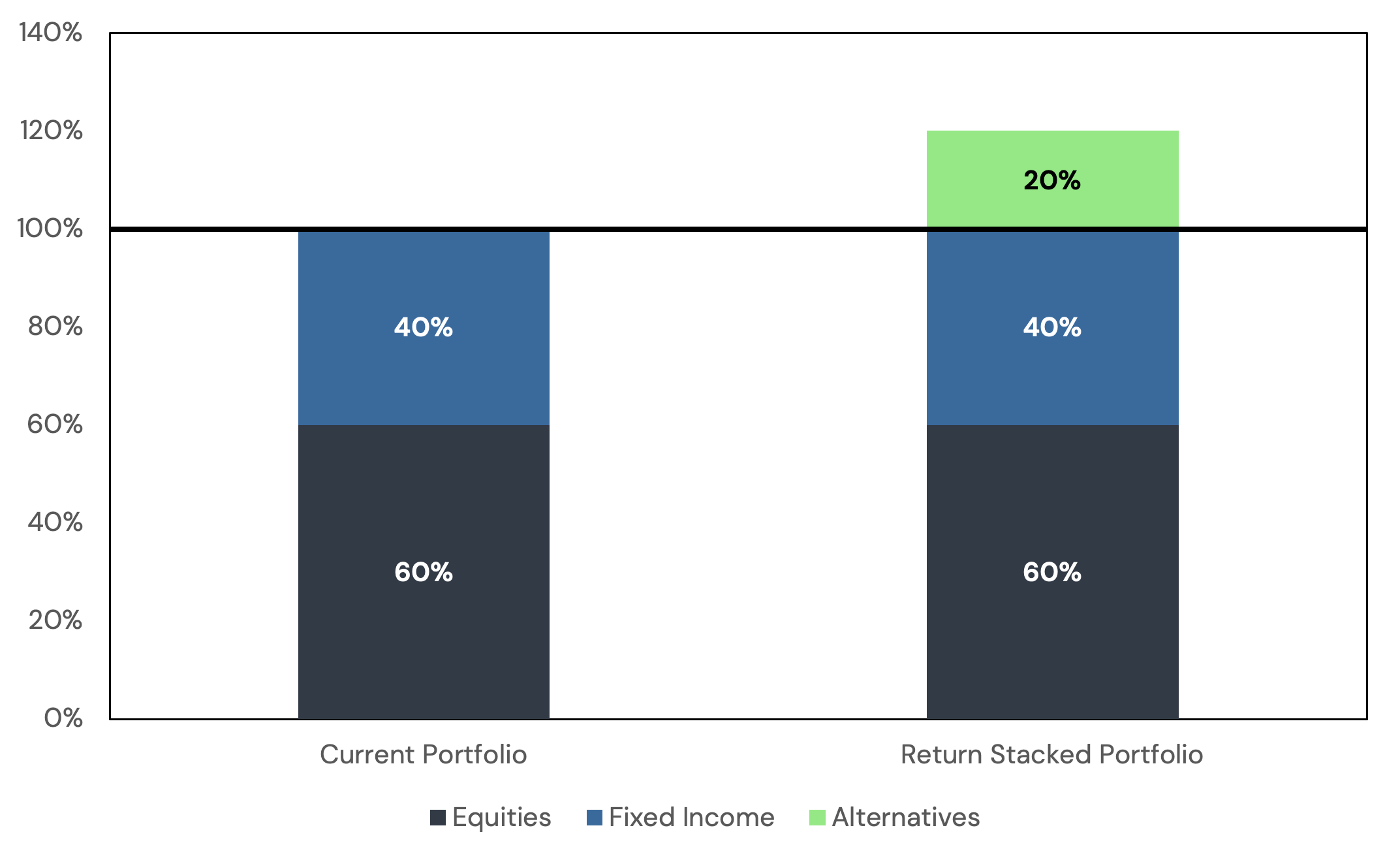

To accomplish this, using a 60/40 portfolio as a starting point with the desire to add 20% alternatives exposure, we could once again utilize Strategy 1. By selling 20% equities and 20% bonds to buy 20% of Strategy 1 (100% Equities / 100% Fixed Income), the portfolio now has 20% of available capital to allocate to alternatives, or whatever asset class the investor may desire.

Figure 8: Choose Your Own Adventure – Portfolio Allocation

Source: Newfound Research. For illustrative purposes only.

Figure 9: Choose Your Own Adventure – Notional Allocation

Source: Newfound Research. For illustrative purposes only.

Conclusion

Return stacking is a very powerful concept that has many potential applications in portfolio design. In this post, we have demonstrated that return stacking may resolve three potential challenges for advisors. In each case, the current asset allocation remains intact and does not materially affect the composition of the funds held within the portfolio. In essence, the return stacking strategies we’ve explored not only preserve existing asset allocations but also embody the core principles of portable alpha, enhancing portfolio efficiency and diversification.

While there are certainly many additional cases where return stacking can be a solution, the case studies highlighted in this article reflect the most common concerns that we hear from advisors, with the most straightforward implementations.