Return Stacking: Turning “Lazy Collateral” Into Opportunity

Overview

Many alternative strategies, like managed futures and long/short equity, only use a small portion of their capital to gain exposure through derivatives. The rest? It often sits idly in cash. This article dives into how advisors can unlock the hidden potential of that “lazy” capital by layering in traditional equity or bond exposures – without altering the behavior of the core strategy. Along the way, it tackles key implementation questions, dispels leverage myths, and explores why this smarter use of capital may help solve the persistent behavioral challenge of holding alternatives.

Key Topics

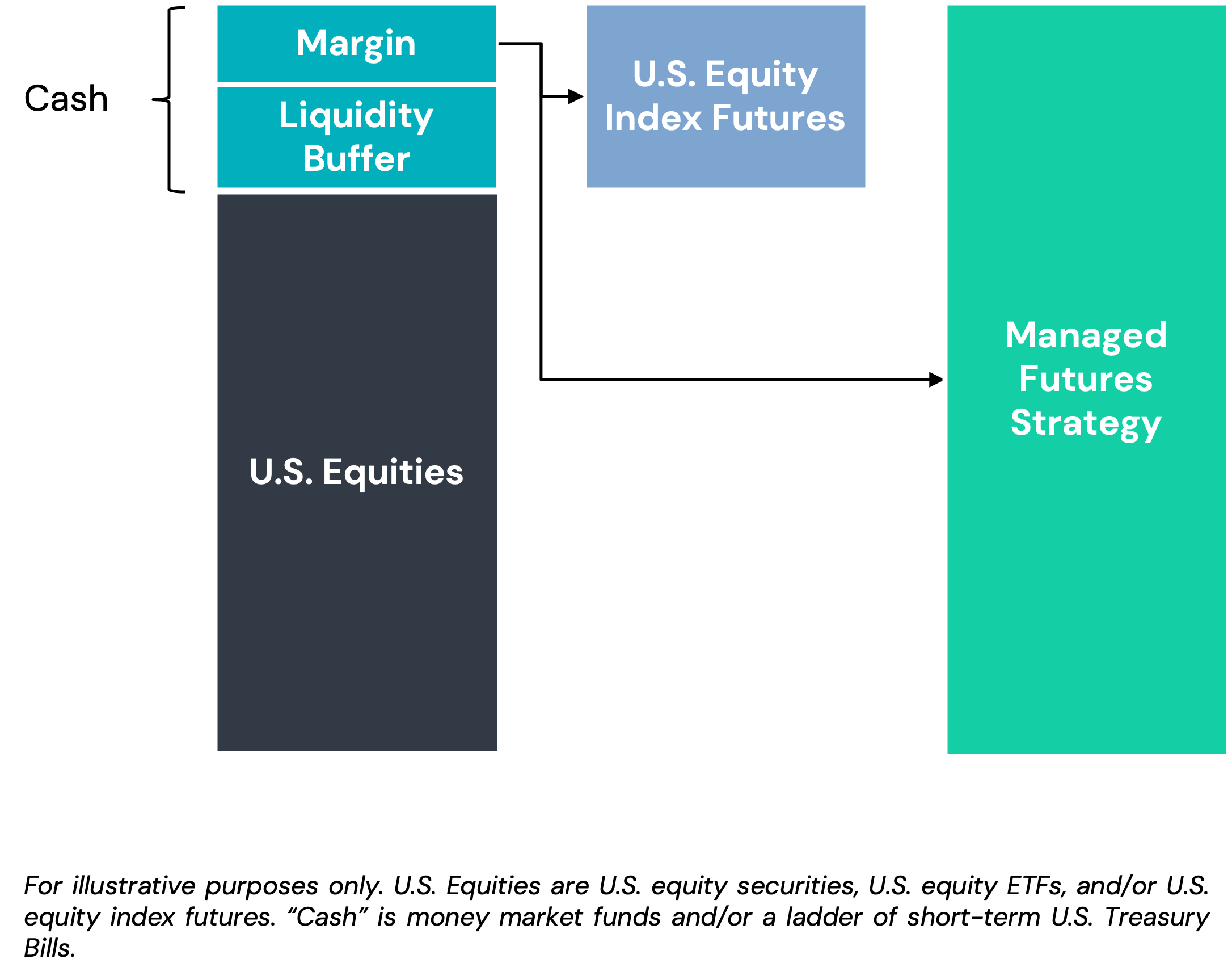

Return stacking can sound complicated, but the core idea is surprisingly simple: many alternative strategies—especially those implemented with futures or long/short equity exposures—don’t require all of their capital to be fully deployed at all times. Instead, they hold a substantial portion of the portfolio in cash or cash-equivalent collateral, using only a fraction to support derivative positions or short books. That underutilized – dare we say “lazy” – capital represents an opportunity.

Return stacking strategies aim to make better use of that capital. Rather than letting it sit idle in T-bills or money market instruments, the collateral can be replaced with traditional beta exposures—like equities or bonds—without materially changing the behavior of the alternative strategy. It’s a practical evolution in portfolio construction that seeks to deliver more efficient use of investor capital, and it’s especially relevant for advisors looking to combine uncorrelated return streams within a single line item.

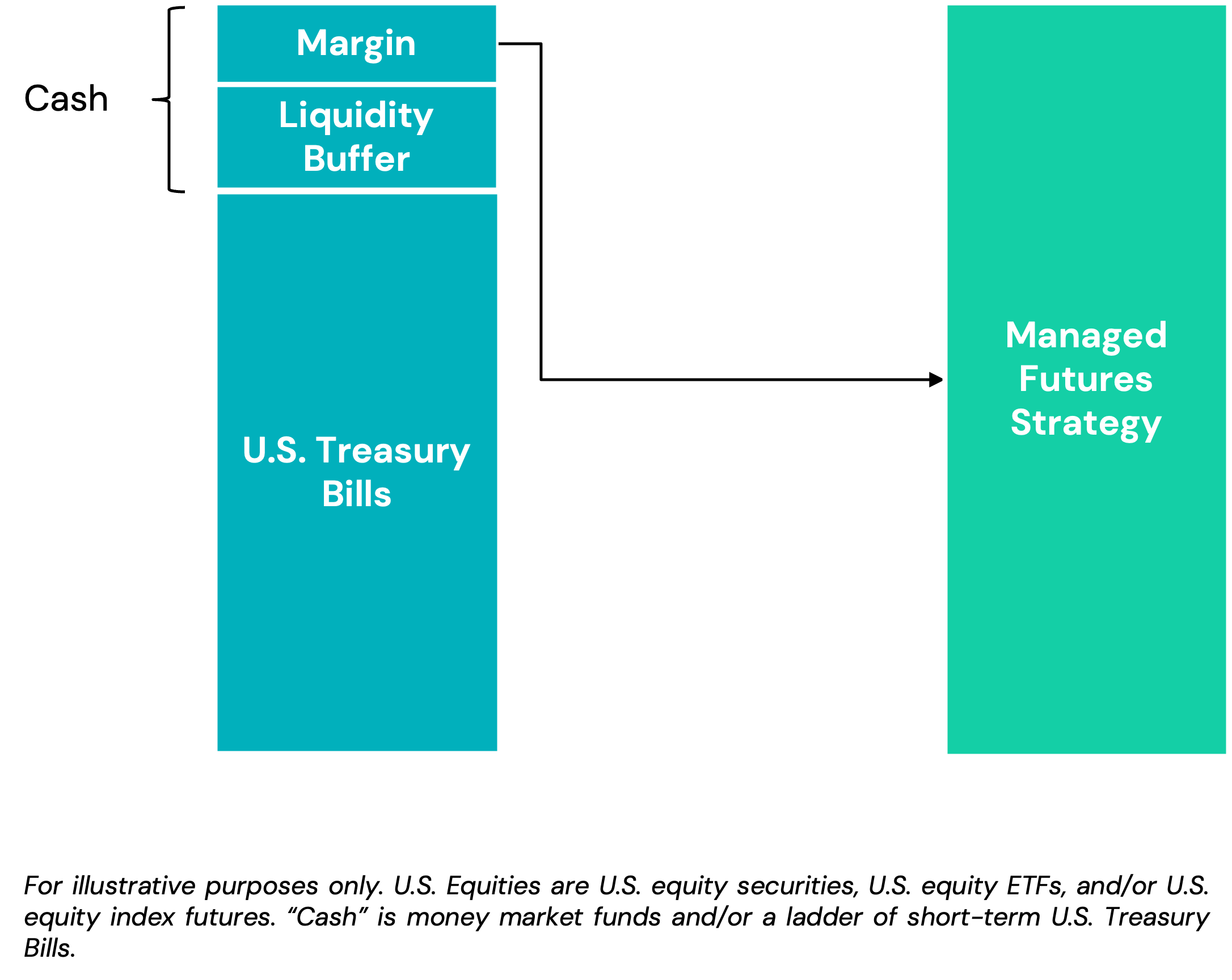

Understanding the Structure with an Example: Managed Futures Are Already Efficiently Levered

Many diversification strategies require reducing core equity allocations to make room for diversifying assets. This trade-off can lead to lower long-term return potential. Return stacking addresses this challenge by maintaining full equity exposure while incorporating managed futures, which have historically delivered uncorrelated returns and strong performance in market downturns.

A return-stacked portfolio may offer:

- A more favorable skew profile – Seeking to reduce left-tail risk while maintaining upside potential. Historically, managed futures has performed well during equity downturns, which can reduce the impact of a bear market at the portfolio level.

- Diversification without sacrificing core exposure – Retaining full equity exposure while adding managed futures as an overlay. This enables investors to stick to the investment plan and maintain diversification in their portfolio.

- Potential improvement in risk-adjusted returns – Providing an alternative return stream that has historically provided an attractive return profile, potentially increasing total portfolio returns and reducing portfolio volatility.

Understanding Portfolio Skewness

But here’s the key: the notional exposure achieved through futures doesn’t require full capital commitment. For example, a $100 position in a U.S. Treasury, S&P 500, or Oil futures contract may only require $5 to $10 in margin.

The remaining capital—often 85% or more—remains in cash or short-term government securities, acting as collateral. It’s simply there to meet margin requirements, facilitate redemptions, and keep the structure liquid and conservative.

This creates a natural question: is there a more effective and efficient use of this excess collateral?

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

What Happens When You Replace That Cash with Equities?

This can be accomplished while maintaining the diversification benefits inherent to the managed futures strategy.

Just as collateral can be replaced with equity exposure, the same approach can be applied with fixed income. Many advisors working with income-oriented or risk-sensitive clients may prefer to preserve core bond allocations while still gaining exposure to alternative return streams.

In a return stacked implementation, a core bond sleeve – whether composed of investment-grade corporates, Treasuries, or a diversified bond index – can serve as the base exposure. The managed futures strategy can then be overlaid on top using the same capital-efficient mechanics.

This structure may help mitigate some of the risks inherent to traditional fixed income portfolios, particularly during inflationary shocks or rising rate environments where bond prices come under pressure. The managed futures component, which is historically uncorrelated to bonds, can offer potential diversification and downside mitigation.

In short, return stacking is not exclusively a growth strategy. It can be tailored to serve a variety of risk profiles, including conservative or income-seeking clients.

In both cases, the cash-equivalent collateral is not what’s driving the intended alpha. It’s a placeholder—there for operational and structural reasons, not because of its return potential. That makes it a compelling candidate for stacking in additional exposures, provided the underlying strategies remain liquid and margin requirements are manageable.

Return stacking is a broader portfolio construction tool that can be applied wherever cash is embedded in an alternative strategy and not fully utilized. Advisors who understand the implementation mechanics can unlock opportunities to build more diversified portfolios without requiring additional client capital or sacrificing core allocations.

Advisors know how difficult it can be to get clients to stick with diversifiers. When managed futures or long/short strategies are held as standalone positions, they’re easy to second-guess—especially during periods of underperformance or when equities are doing well. Clients often ask, “Why do we own this?” and the temptation to reduce or eliminate the allocation grows stronger.

That’s the behavioral tax: clients abandon diversifiers too early, and the timing mismatch erodes long-term benefits.

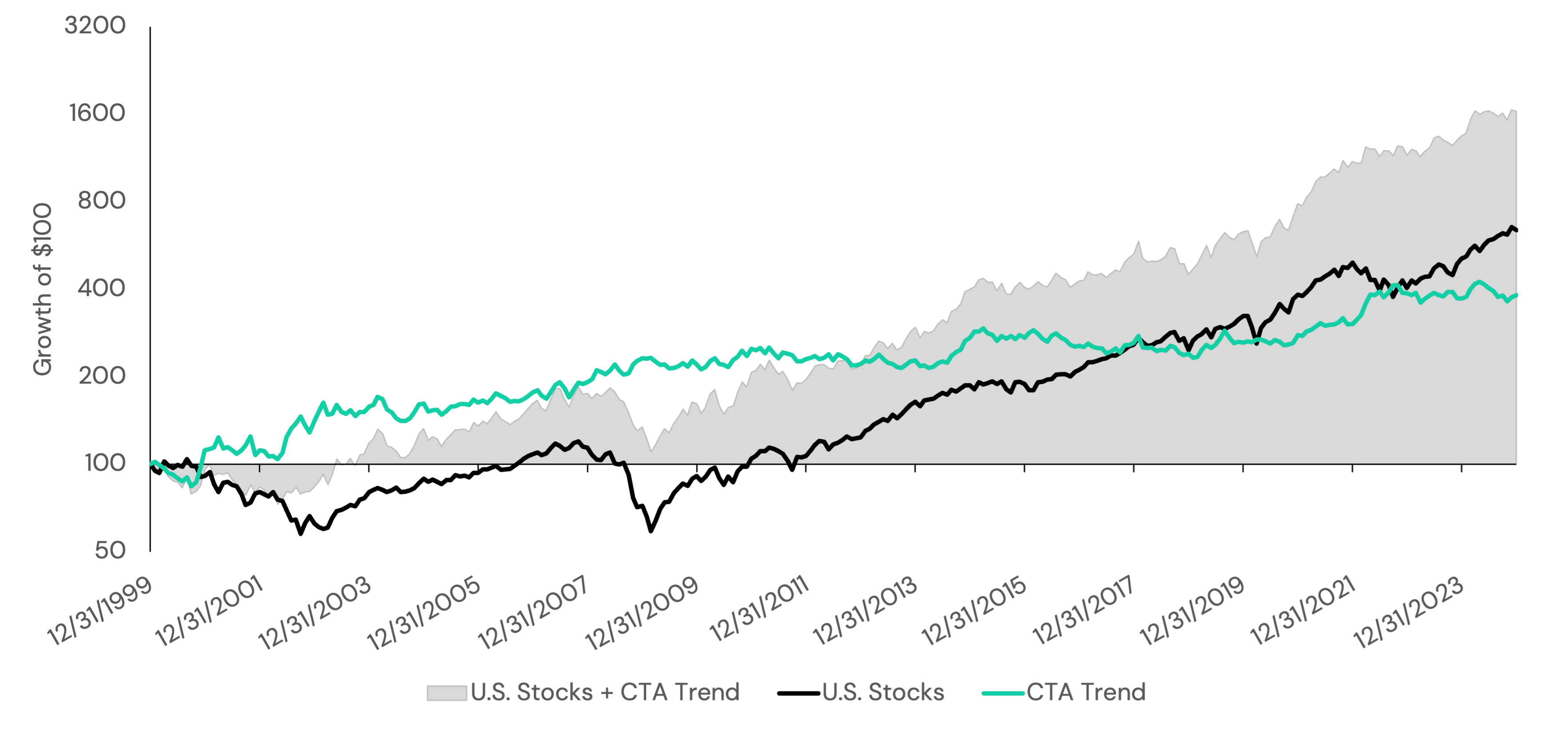

Figure 3: The Divergent Performance of Core and Alternative Strategies in Different Environments

| U.S. T-Bills | Managed Futures | Balanced Allocation | Return Stacked® Portfolio | |

| 12/2014 – 12/2019 | 1.02% | -0.76% | 7.51% | 6.00% |

| 12/2019 – 12/2022 | 0.70% | 13.91% | 2.79% | 16.83% |

| 12/2022 – 12/2024 | 5.23% | -0.79% | 14.09% | 7.98% |

Figure 4: Equities, Managed Futures, and a Hypothetical 100% Equity + 100% Managed Futures Strategy

Source: Bloomberg. U.S. Stocks is the S&P 500 Index (“SPX”). Returns for U.S. Stocks is gross of all fees. CTA Trend is the Société Générale Trend Index (“NEIXCTAT”), an index designed to track the largest trend following commodity trading advisors (“CTAs”) in the managed futures space net of underlying fees. U.S. Stocks + CTA Trend is 100% U.S. Stocks / 100% CTA Trend / -100% Bloomberg Short Treasury US Total Return Index (“LD12TRUUU”). You cannot invest in an index. Please see glossary at the end of this presentation for index definitions. Returns are gross of taxes. Returns assume the reinvestment of all distributions. Past performance is not indicative of future results. Period is 12/31/1999 through 12/31/2024. The starting date is chosen based upon the earliest date data is available for the underlying indexes.

The word “leverage” can understandably make advisors and clients nervous. But in this context, it’s important to distinguish between leveraging a single asset class and combining multiple uncorrelated exposures using capital efficiency.

The leverage in a return stacked strategy isn’t designed to magnify the volatility of equities or managed futures individually. It’s designed to combine them thoughtfully in the same dollar of capital—without sacrificing one to fund the other. That’s a fundamentally different use case.

In fact, many institutional investors—pensions, endowments, and even insurance companies—have been building portable alpha strategies on this principle for decades. They use efficient instruments (like futures or swaps) to gain exposure to diversifying strategies on top of their core allocations. The objective is not more risk, but enhanced returns and better balance.

Some advisors may reasonably ask whether this structure introduces new operational risks—especially around liquidity or capacity.

It’s a fair concern, and it underscores the importance of implementation. Futures markets are deep and liquid, particularly in core asset classes like equities, Treasuries, and currencies. But capacity is not infinite. Skilled managers will often impose internal limits to ensure the strategy scales responsibly.

Similarly, collateral management is a real consideration. A well-designed return stacked strategy must carefully monitor margin requirements, volatility shocks, and position sizing to ensure that both layers of exposure remain supported under stress. This isn’t a “set it and forget it” system—it requires active oversight and thoughtful risk controls.

Advisors should perform due diligence as they would with any other strategy, ensuring that the fund or vehicle being used has robust infrastructure to manage liquidity, derivative exposure, and portfolio rebalancing.

Managed futures and long/short strategies are already derivatives-based approaches that hold significant amounts of collateral in cash or cash-like instruments. By replacing that capital with thoughtfully chosen beta exposure—whether equities, bonds, or a blend—advisors can help clients achieve better capital efficiency and improved diversification, without increasing their funding requirements.

For advisors seeking to simplify their portfolios, improve behavioral adherence, and potentially enhance long-term risk-adjusted returns, return stacking offers a compelling framework. Not as a silver bullet, but as an evolution of what smart portfolio construction has always aimed to do: make every dollar work a little harder.