For decades, the “4% rule” has stood firm as a guidepost to safe withdrawal rates in traditional stock/bond portfolios. In this note, we explore the impact of introducing managed futures, both as a part of the asset allocation as well as a stacked allocation. Our simulation-based approach suggests that managed futures has the potential to: (1) reduce failure rates for the same withdrawal rate; or (2) allow investors to increase their withdrawal rate for the same failure rate.

Retirement, Safe Withdrawal Rates, Managed Futures

Introduction

In our view, designing a savings and decumulation strategy without giving careful consideration to investment strategy is like designing all of the necessary elements of a car – chassis, gear box, braking system, etc. – except the engine.

– Clare, et al (2017)1

A question that we increasingly receive is whether return stacking concepts can be useful for investors in the retirement phase of their life, or if it is simply a tool for investors in the accumulation stage of life.

Put another way: “have I missed the bus on return stacking?” We believe the answer is a resounding “no.”

In the litany of financial planning literature, a 4% withdrawal rate is the go-to safe withdrawal rate for portfolios during retirement2. This rule, however, is extremely dependent on the sequence of returns. An unlucky return environment that comes at an inopportune time in their lives can knock-out retirees from their financial freedom. If retirees invest too conservatively, however, they risk not having sufficient growth to offset their spending.

In this context, we believe that return stacking can be incorporated for both its offensive as well as its defensive capabilities. By adding additional sources of return to the portfolio, return stacking may help enhance long-term growth rates. By carefully selecting those return sources for their diversification properties, return stacking may help reduce the risk of significant drawdowns that can permanently impair portfolios while still maintaining growth potential.

This article will review traditional portfolio asset allocations and their efficacy throughout the withdrawal phase of an investor’s life. We will then explore how return stacking may augment these prototypical asset allocations, using allocations that are currently implementable.

What Asset Allocation Do I Want?

To begin our analysis, we will start with a few basic assumptions.

Withdrawal Rates

First, our initial withdrawal rate will be governed by a certain percentage of our “initial” portfolio value and will be taken at monthly intervals. The remaining withdrawals during retirement will be indexed by inflation. For example, let’s say our initial withdrawal rate is 4% of our initial portfolio value; with the portfolio value being $1 million. Our first month’s withdrawal amount would be $3,333.33. If inflation increases during the month by .165%, then the next month’s withdrawal amount would be $3,338.83. Conversely, if the portfolio finds itself in a deflationary period, the withdrawal amount will decrease by the commensurate level of inflation. (This is functionally equivalent to assuming a constant dollar withdrawal rate and using real returns for our analysis.)

Simulation-Based Returns

Second, as common history3 limits our ability to address real return sequences, we will utilize simulation techniques to create simulated return realizations that will allow us to assess the risk that any specific asset allocation may fail in our retirement needs. To this end, we will utilize a block bootstrap methodology to simulate 100,000 thirty-year periods comprised of randomly selected 12-month periods from history, simulating the performance of stocks, bonds, cash, managed futures, and CPI, simultaneously4.

Failure Rates

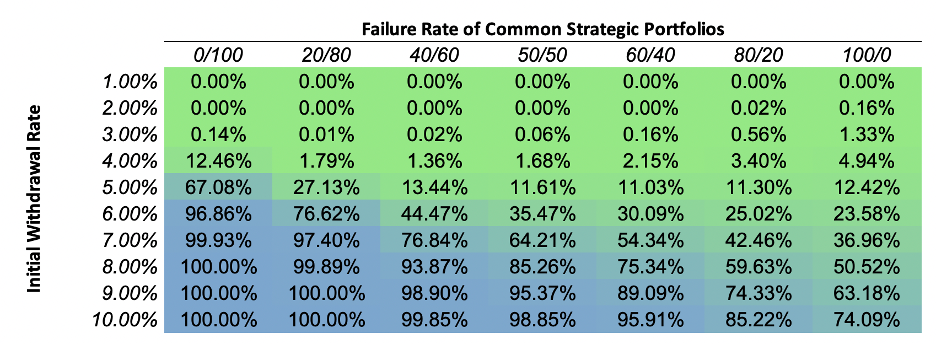

Figure 1 depicts the failure rates of typical strategic portfolios, ranging from an all-bond portfolio to an all-stock portfolio, rebalanced monthly. Here, we define failure rate as the probability of the portfolio not being able to sustain the full thirty years of withdrawals5.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

From the above figure, we can see that the popular 4% withdrawal amount is in-line with the existing literature, comprising a roughly 2-14% failure rate in the provided simulations. Note how the failure rate for a 60/40 jumps from 2.1% to 11.0% when the withdrawal rate goes from 4% to 5%; a seemingly small increase in withdrawal rate has a profound impact on longevity risk.

One comment we would like to emphasize is that withdrawal rates are inherently linked to the risk-taking ability of the investor. As we can see from Figure 1, with an initial withdrawal rate of 4%, an all-bond portfolio carries a roughly 12.5% chance of withdrawal failure throughout retirement while a 100% stock portfolio carries a 5% chance of failure.

A 50/50 portfolio, however, achieves a lower failure rate (roughly 2%) than either an all-stock or all-bond portfolio. From this result we can see that diversification provides a real benefit while a portfolio is being drawn down. Additionally, we can infer that some form of risk-taking is necessary, such that the growth potential of equities can combat the withdrawal rate for as long as possible.

Consider that a 10% annual withdrawal will invariably lead to a portfolio consisting of 100% bonds to completely draw down within 30 years, while a 100% stock portfolio has a higher (though, still low) probability of success. Too little risk ensures that the portfolio does not grow enough to offset withdrawals. Too much risk, however, means that the investor will likely make withdrawals during large drawdowns, permanently impairing the portfolio’s ability to recover.

Our immediate conclusion, thus far, must be that if we would like our portfolio to sustain our lifestyle, it must contain diversifying assets. In addition, the portfolio should be able to assume a commensurate level of risk, such that our portfolio will be able to grow and sustain the withdrawal amounts we require.

One lever we have not yet pulled is whether we can increase our diversification beyond stocks and bonds. As the diversified portfolios from Figure 1 shows, increased diversification may eliminate the need to take more explicit risk.

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Easily backtest & explore different return stacking concepts

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

Let’s Add Some Diversifiers

Managed futures have historically provided a low degree of correlation to both stocks and bonds, making them a prime candidate for consideration6. Another primary (and top-of-mind) reason that we believe managed futures can add value to a traditional portfolio is its relationship with inflation. When comparing the economic regimes in which stocks and bonds perform well or poorly, rising inflation is the proverbial Achilles heel of such a portfolio. To add insult to injury, a retiree’s stock-bond portfolio has an additional exposure to inflation, as an investor will likely desire to increase her portfolio withdrawal amount to keep up with an increasing cost-of-living.

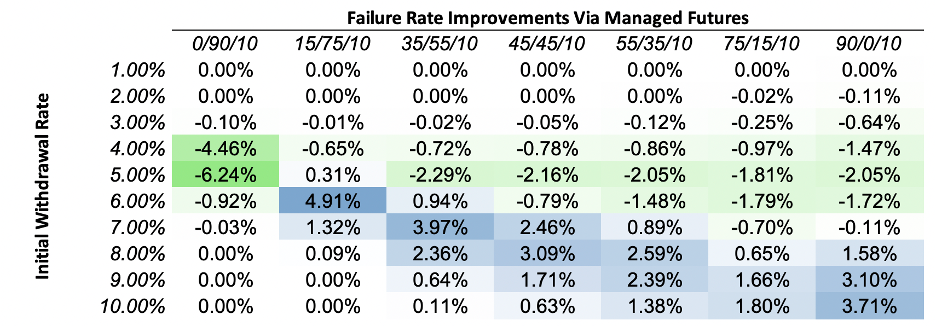

To tease this analysis out further, we will extend Figure 1 by reducing a core stock/bond portfolio by 5% each to include a 10% managed futures exposure. This would mean that a 60/40 stock/bond portfolio will be adjusted to a 55/35/10 stock/bond/managed futures portfolio. In the case of a 100% stock or 100% bond portfolio, we will simply reduce either exposure by 10% to make room.

Figure 2 shows the resulting failure rate improvement7 when compared to the original core portfolios8. A negative number signals a lower failure rate while a positive number signals an increased failure rate.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

As we can see, there are many scenarios in which decreasing stocks or bonds to add an allocation to managed futures is beneficial. These results align with Miller (2017)9, who showed that a 50/40/10 strategic portfolio increased the safe withdrawal rate, while not drastically altering the volatility of the resultant portfolio, when compared to a 50/50 portfolio.

The above figure, has two key takeaways:

- In the 4-5% withdrawal range, we see a marginal failure rate improvement, meaning the new asset allocation has a higher probability of success. An interpretation we can make here is that this added diversification is ideal for counteracting any portfolio drawdowns and allowing the portfolio to recover prior to the loss creating a permanent impairment to the financial plan.

- For scenarios greater than a 5% withdrawal rate, we can draw two simultaneous conclusions. First, being that by reducing our growth asset, we dampen the portfolio’s ability to out-grow larger withdrawals. Second, by withdrawing larger portfolio amounts, we inhibit the long-term benefits of diversification as the portfolio’s life is drastically shortened.

With these results in mind, the question becomes: “How do we take advantage of the diversifying benefits of managed futures while still exposing the portfolio to the necessary growth that equities provide?”

Enter Return Stacking

In previous posts, we have established the potential benefits of introducing managed futures to a retirement account from a return and risk perspective. One glaring problem that we face is how do we make room for them? Do we sell stocks, bonds, or both?

Our answer to that question? None of the above.

Equities provide the primary growth component of a portfolio. Bonds provide diversification and stability. Both are important in the retirement planning playbook. Rather than selling either one to make room, we will explore introducing manage futures on top of our existing asset allocations10.

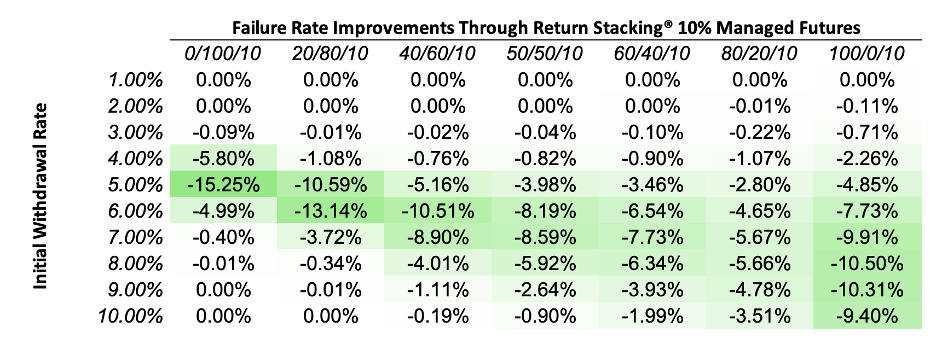

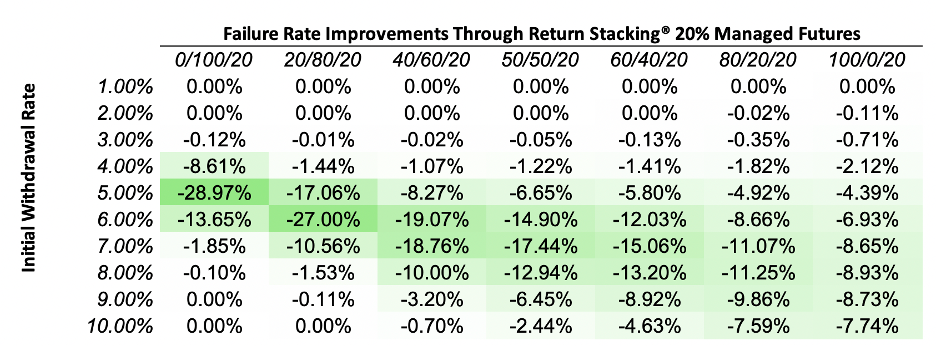

To assess the impact of such an addition, we will run the simulations again. However, this time, we will stack 10% and 20% allocations to managed futures for each of the strategic portfolios. This approach leaves the core portfolio untouched while introducing managed futures as an overlay.

The figure below shows the average failure rate improvements for both the 10% and 20% stacks.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

Recall that the 60/40 core portfolio with 5% initial withdrawal rate exhibited a somewhat dour failure rate of 11%. The addition of the stacked exposure reduced the failure rate by 3.5% and 5.8%, for the 10% and 20% managed futures allocations, respectively.

While it is no large surprise that the failure rate improved in all cases (though some improvements were minimal), the magnitude of these improvements provide some degree of faith that the inclusion of this strategy could mean the difference between a fruitful retirement and renewing the job search.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

The Return Stacking landscape is ever evolving,

go deeper by connecting with a team member.

But What do these Failure Rates ACTUALLY mean for our portfolios?

So far, we have shown that by stacking a diversifying exposure into our portfolio, our failure rates meaningfully improve. This, in and of itself, is a fantastic result. However, so far, we have taken the allocations and withdrawal rates as given; by stacking managed futures in our portfolio, we may now have the ability to adjust our asset allocation and/or our withdrawal rates, without harming an investor’s retirement plan.

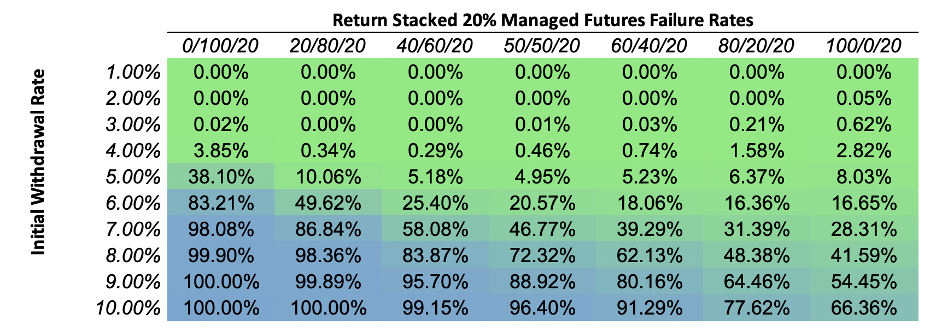

To tease this idea out further, Figure 6 explicitly compares the failure rates of a 60/40 portfolio and a 50/50/20 portfolio.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

In nearly all cases, the 50/50/20 has a lower failure rate than the 60/40. This implies that a portfolio isn’t required to take more equity risk to improve their retirement success. For any investor or client that may be worried about equity valuations or the economy, reducing equity exposure doesn’t need to be paired with discussions about reducing withdrawal rates. We can simply stack on a diversifying asset and the longer-term financial plan can remain largely undisturbed, if not improved.

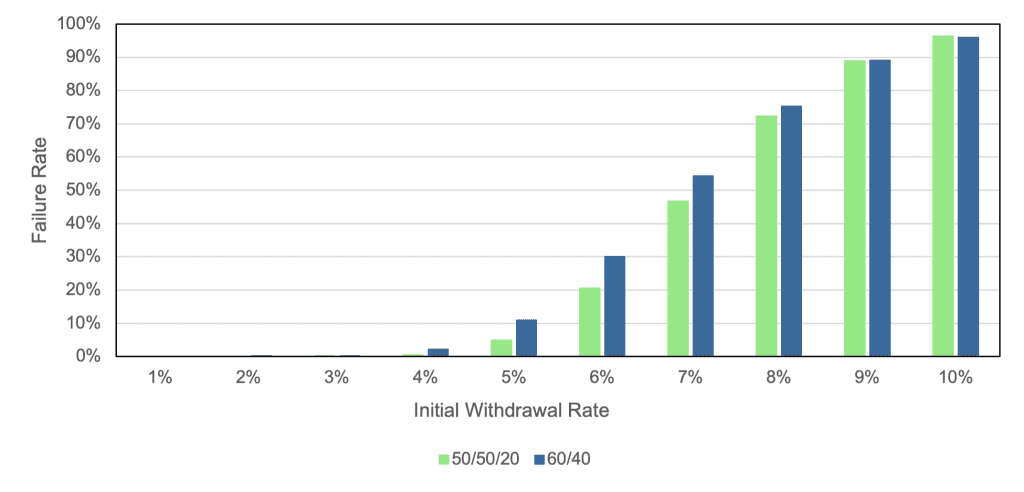

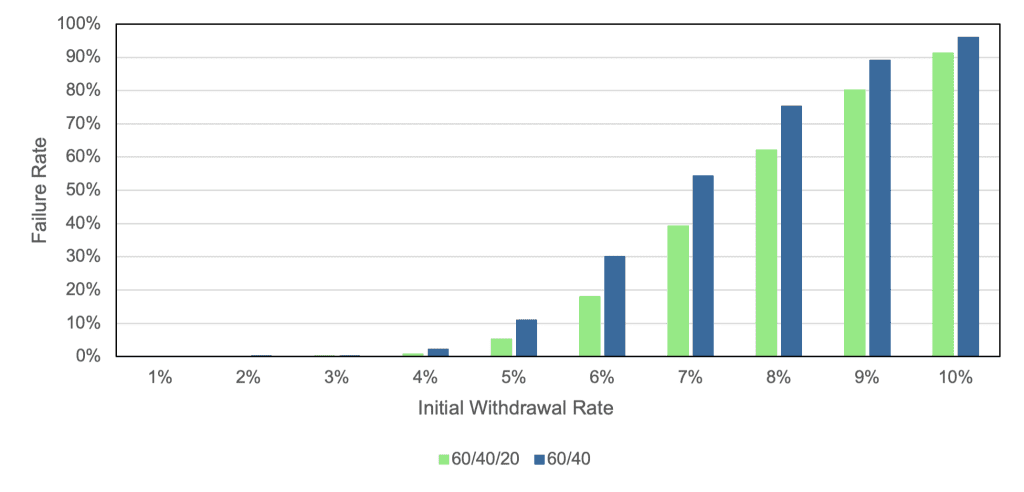

For the initial withdrawal rate, can stacking additional diversification allow us to safely increase our withdrawal rate? Figure 7 shows the failure rates of a 60/40 portfolio with a 60/40/20 portfolio by initial withdrawal rate.

Source: Bloomberg, Kenneth French Data Library, BarclayHedge, St. Louis Fed. Calculations by Newfound Research.

What really grabs our attention is when we compare across withdrawal rates. Specifically, a 5% withdrawal from the 60/40/20 portfolio and a 4% withdrawal rate from the 60/40 portfolio have very similar failure rates. By stacking managed futures on top of our existing allocation, we find that we can comfortably increase our initial withdrawal rate by a full percentage without inflicting a great deal of harm on our probability of retirement success.

This increase in possible withdrawal rate may allow for the investor to live a comfortable life in retirement without drastically affecting the chances of the portfolio being depleted.

Conclusion

When we discuss return stacking, we often speak about it in the framework of an investor in the accumulation phase of their life. Importantly, though, the diversification benefits of return stacking extend to investors in the withdrawal phase of their life, as well.

We utilized simulations to explore the expected failure rates of common strategic portfolios for varying levels of initial withdrawal amounts. By selling down stocks and bonds to make room for a diversifying exposure to managed futures, we found that the failure rate improvements produced mixed results. The success of this strategy largely depends on the level of the initial withdrawal, as well as the existing portfolio.

Finally, we explored the impact of return stacking, which reduced the failure rates in nearly all scenarios. In most cases, we saw that stacking managed futures on top of the core asset allocation can allow an investor to comfortably reduce equity exposure without damaging the success of the portfolio through retirement. In addition, we found that return stacking may allow investors to modestly increase withdrawal rates without materially impacting the success of the retirement portfolio.

Footnotes

1. Reducing Sequence Risk Using Trend Following and the CAPE Ratio, Clare, et al. (2017)

2. William Bengen, the inventor of the 4% withdrawal rule has revisited this number and indicated that it may not be a realistic rule and that more variables need to be considered when making these decisions.

3. The Barclay BTOP50 Index has a monthly history beginning in 1986.

4. See Appendix A for index definitions.

5. From the existing financial planning literature, we will note that many papers incorporate actuarial death probabilities into probability of failure (POF) rates. In most cases, using death probabilities in the analysis will bias the POF rates down, however, for this post, we will maintain the thirty-year definition to allow generality.

6. For a deeper discussion on managed futures and their historical relationships with stocks and bonds, see our post What is Managed Futures.

7. To be clear, in this figure, a positive value would indicate that the managed futures allocation reduced the failure rate by that magnitude.

8. For comparison purposes, this figure compares a 0/90/10 to a 0/100, a 55/35/10 to a 60/40, etc.

9. “Using Trend-Following Managed Futures to Increase Expected Withdrawal Rates”.

10. In all cases, we assume that the managed futures index is excess of the cash return, and such assumes that the financing rate is the risk-free-rate.

APPENDIX A: Index Definitions

Stocks: U.S. total equity market return data from Kenneth French Library. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all dividends.

Bonds: Bonds is the Bloomberg US Aggregate Bond Index (Bloomberg ticker: LBUSTRUU). Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all dividends.

Cash: U.S. Risk-Free Rate return data from Kenneth French Library. Performance is gross of all costs (including, but not limited to, advisor fees, manager fees, taxes, and transaction costs) unless explicitly stated otherwise. Performance assumes the reinvestment of all dividends.

Managed Futures: The BTOP50 Index from BarclayHedge. The BTOP50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50. In each calendar year the selected trading advisors represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe.

CPI: The Consumer Price Index for All Urban Consumers: All Items (FRED Identifier: CPIAUCSL) is a price index of a basket of goods and services paid by urban consumers.