Return Stacked® Portfolio Solutions

Diversification Without Sacrifice

Return stacking strives to unlock the benefits of diversification, helping investors achieve their goals with greater certainty.

The Math is Clear...

It is said that the only free lunch in investing is diversification. By incorporating uncorrelated alternative investments and asset classes, portfolios can generate steadier returns across various economic regimes, reducing vulnerability during periods of market stress and uncertainty.

Why, then, do so many investors forgo diversifying alternative investments within their portfolios?

Source: Bloomberg and Société Générale. Analysis ReSolve Asset Management SEZC (Cayman). Equities is MSCI All Country World Index (“ACWI”), Bonds is ICE U.S. Treasury 20+ Year Bond Index Total Return (ICET20X2), Gold is Gold Index (“XAUUSD”), Commodities is DBIQ Optimum Yield Diversified Commodity Index (DBLCDBCT), Trend Following is the Société Générale Trend Index (“NEIXCTAT”). You cannot invest in an index. Returns are gross of taxes. Past performance is not indicative of future results.

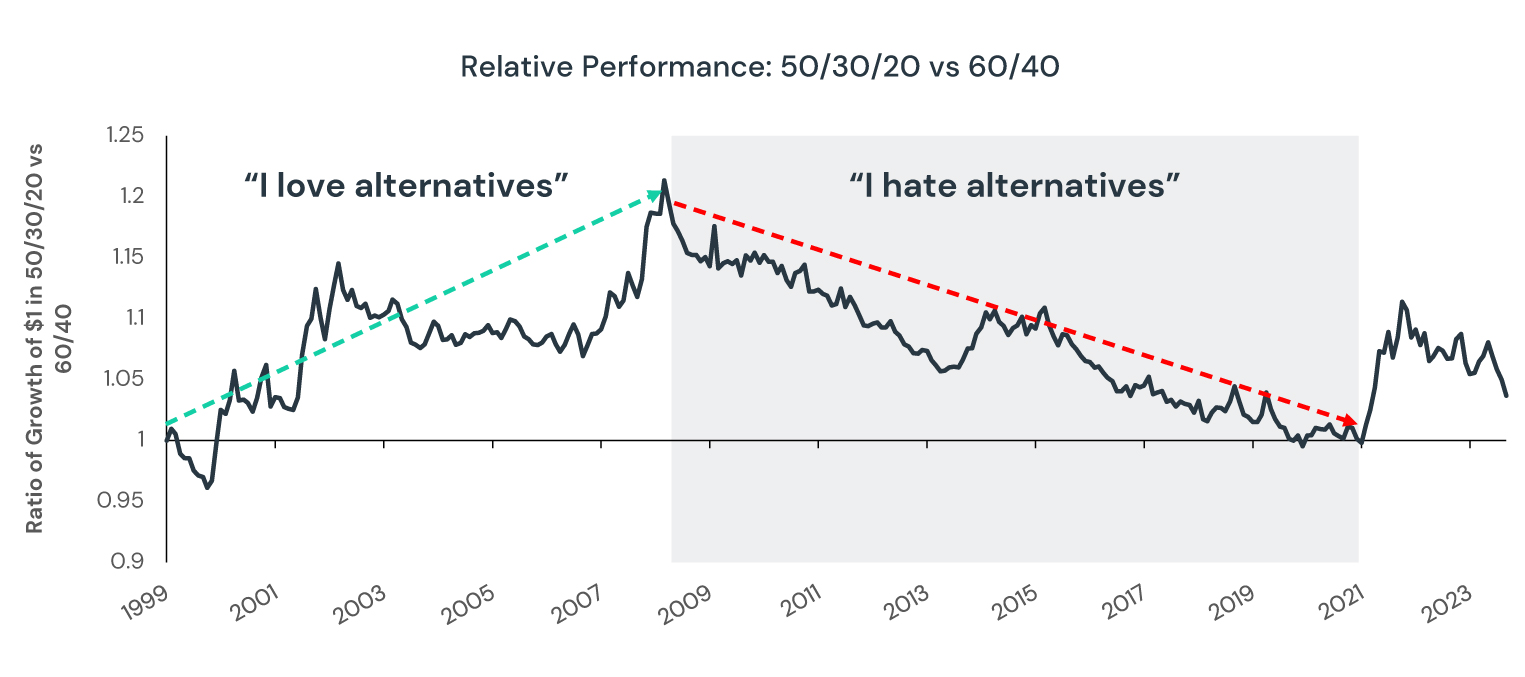

The green line and “I love alternatives” Illustrates a period where a 20% allocation to alternatives is outperforming the rest of the portfolio which could make it easier for investors to hold relative to a 60/40 portfolio. The red line, grayed out area and “I hate alternatives” represent a period where a 20% allocation to alternatives are underperforming the rest of the portfolio and could make it harder to hold from behaviorally. Source: Bloomberg and Société Générale. U.S. Stocks is the S&P 500 Index (“SPX”). U.S. Bonds is the Bloomberg US Aggregate Bond Index (“LBUSTRUU”). Returns for both U.S. Stocks and U.S. Bonds are gross of all fees. CTA Trend is the Société Générale Trend Index (“NEIXCTAT”), an index designed to track the largest trend following commodity trading advisors (“CTAs”) in the managed futures space net of underlying fees. 50/30/20 is 50% U.S. Stocks / 30% U.S. Bonds / 20% CTA Trend rebalanced monthly. 60/40 is 60% U.S. Stocks / 40% U.S. Bonds rebalanced monthly. You cannot invest in an index. Returns are gross of taxes. Returns assume the reinvestment of all distributions. Past performance is not indicative of future results. Period is 12/31/1999 through 8/31/2024. The starting date is chosen based upon the earliest date data is available for the underlying indexes.

"If diversification is so good, why don't all investors add alternatives to their portfolio?"

Ask enough investors and an answer becomes clear: it is not just a question about adding things to a portfolio, but also one of subtracting.

To make room for an alternative investment strategy in their portfolio, you typically have to sell some of your core stocks and bonds. This can lead to a significant performance drag in periods where alternatives underperform these core assets.

But what if you didn’t have to sell core stocks and bonds? What if you could stack the alternative investment on top?

Introducing Return Stacking

By wrapping this concept into professionally managed mutual funds and exchange-traded funds, we seek to provide investors with the building blocks to unlock the benefits of diversification in their own portfolios.

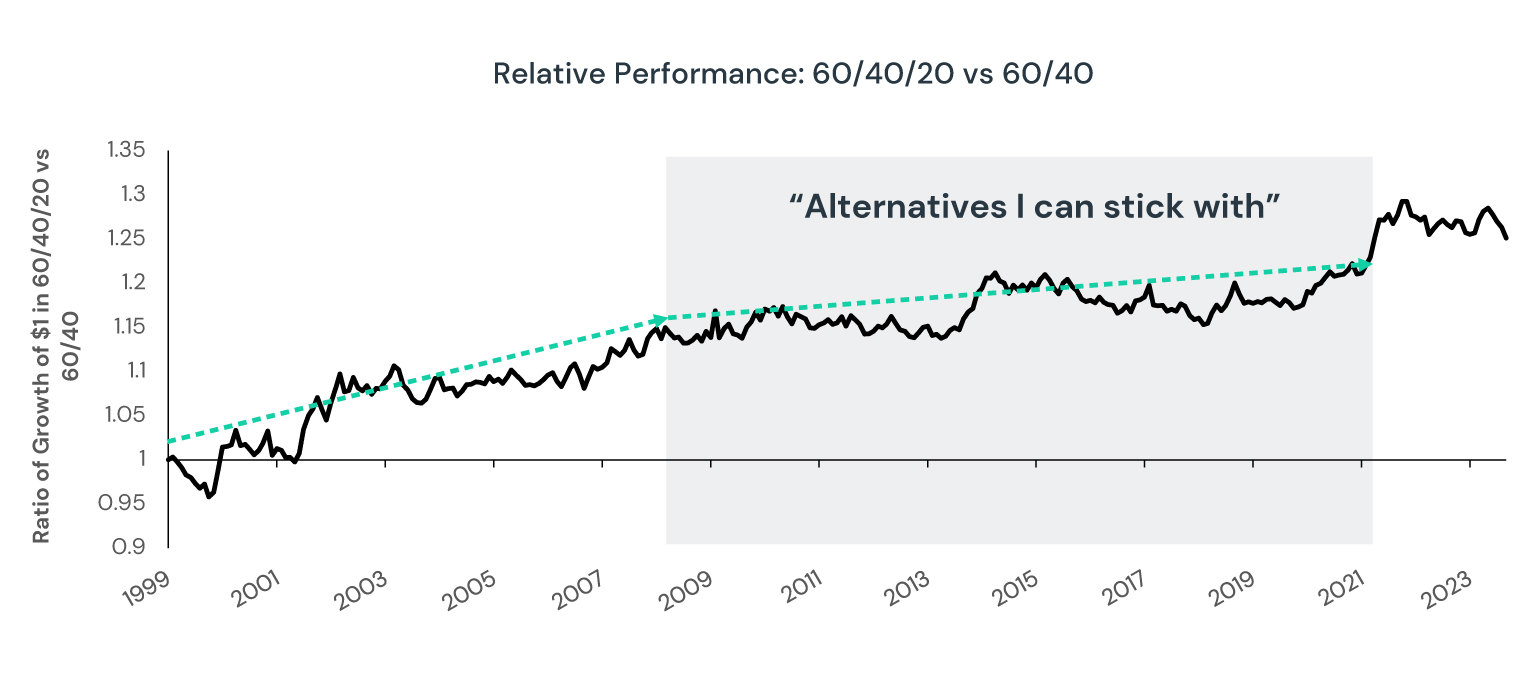

The green line and the phrase “Alternatives I can stick with” help illustrate how stacking 20% to alternatives on top of a 60/40 portfolio exhibited more consistent, upward sloping relative performance even in the decade where managed futures did poorly relative to a 60/40 portfolio (the gray area) and hence could make it easier to hold from a behavioral perspective. Source: Bloomberg and Société Générale. U.S. Stocks is the S&P 500 Index (“SPX”). U.S. Bonds is the Bloomberg US Aggregate Bond Index (“LBUSTRUU”). Returns for both U.S. Stocks and U.S. Bonds are gross of all fees. CTA Trend is the Société Générale Trend Index (“NEIXCTAT”), an index designed to track the largest trend following commodity trading advisors (“CTAs”) in the managed futures space net of underlying fees. 60/40 is 60% S&P 500 Index and 40% Bloomberg U.S. Aggregate Bond Index rebalanced monthly. 60/40/20 is the 60/40 portfolio plus 20% in the Société Générale Trend Index minus 20% in the Bloomberg Short Treasury US Total Return Index (“LD12TRUUU”). You cannot invest in an index. Returns are gross of taxes. Returns assume the reinvestment of all distributions. Past performance is not indicative of future results. Period is 12/31/1999 through 8/31/2024. The starting date is chosen based upon the earliest date data is available for the underlying indexes.

Making Diversification Sustainable

Return stacking allows you to maintain your core portfolio assets and introduce a strategic allocation to alternatives for the inevitable periods when the core assets struggle.

An Old Idea Reborn

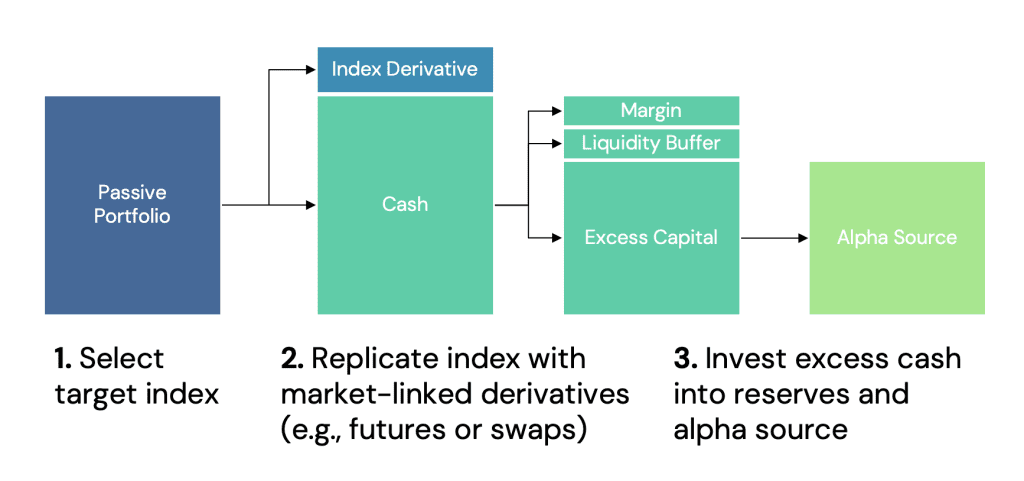

In the 1980s, the Pacific Investment Management Company (PIMCO) launched their StocksPLUS series of strategies. The idea was simple, but powerful. Rather than search for alpha in large-cap equities, where competition was fierce, they would buy passive equity exposure and look for alpha in short-term, high quality bonds.

To make this idea work, PIMCO would gain its equity exposure through capital efficient derivatives such as futures and swaps. This meant they only had to outlay a fraction of their capital to achieve the passive equity exposure, leaving the remainder of the capital available for investing in bonds!

Over time, investors realized that this design allowed investors to separate beta from alpha. By implementing beta through capital efficient derivatives, valuable capital can be unlocked and reinvested in potentially diversifying alternative return streams.

This concept became known as portable alpha.

Portable Alpha for Everyone

For decades, sophisticated institutional investors have used portable alpha to include diversifying alternative strategies without diluting their core stock and bond allocations. Due to the complexity of managing derivatives, small institutions, financial advisors, and individuals have largely been locked out of this approach.

Today, professionally managed mutual fund and exchange-traded products allow investors to implement this concept.

At Return Stacked® Portfolio Solutions, we are developing the research, product design, and portfolio construction that unlocks this opportunity for everyone.

Explicitly Stacking Alternatives

Funds implementing return stacking may combine a variety of betas (e.g., stocks and bonds), non-traditional betas (e.g., commodities), and alternative investment strategies in a variety of leverage targets to provide capital efficient exposure for investors.

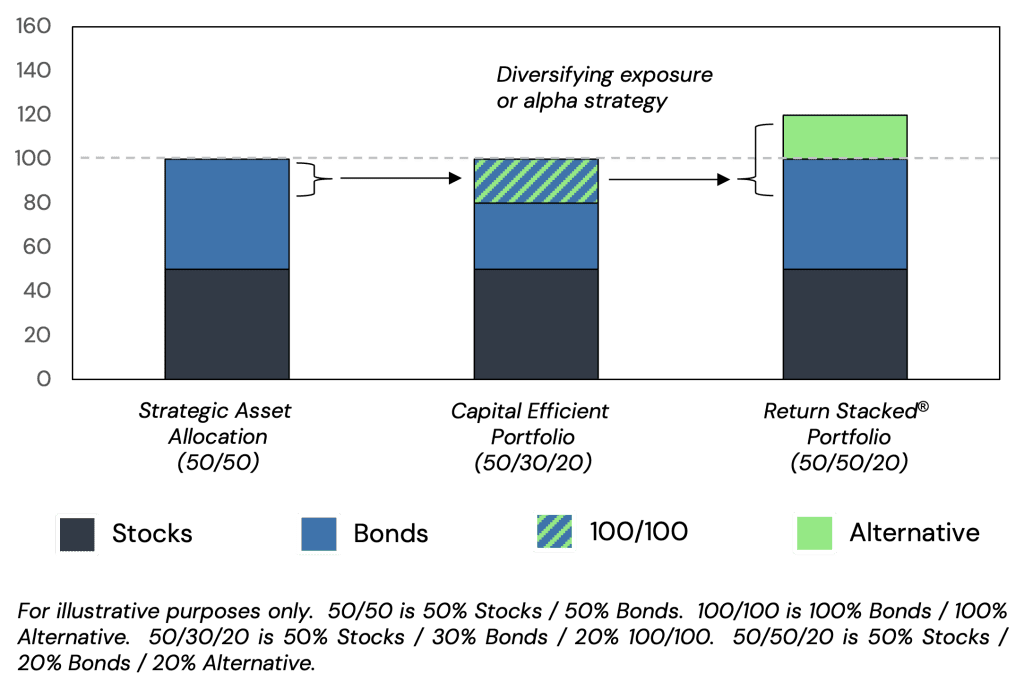

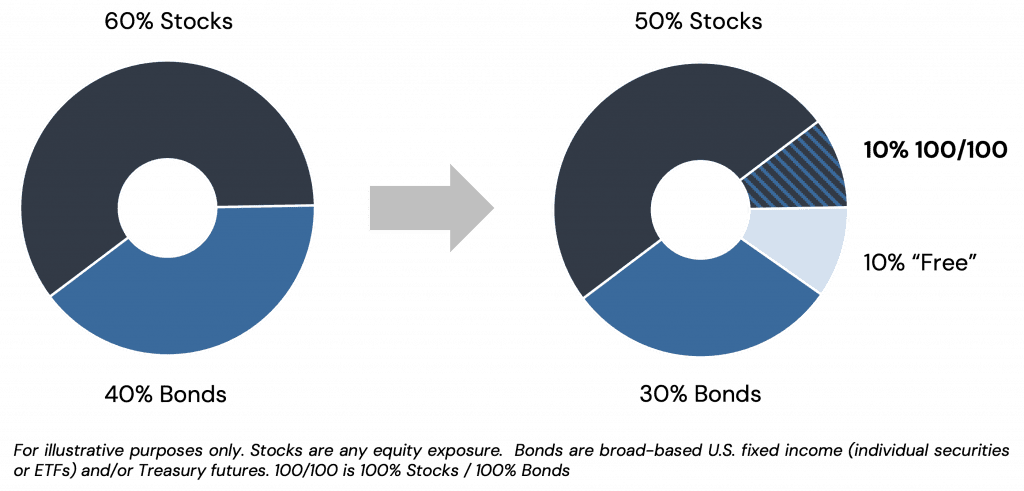

As an example, consider a fund that seeks to provide $1 of exposure to bonds and $1 of exposure to alternatives for every $1 invested. If you wanted to stack the alternative strategy on top of your existing portfolio, you could simply sell some of your bonds and buy the fund.

Making Room in a Portfolio

For example, it might also be allocated to alternative assets and strategies that have the potential to introduce beneficial diversification to the portfolio. You could also leave it in Treasury Bills (or a money market fund) to help better manage cash-flow needs (e.g. withdrawals or capital calls) without sacrificing core stock and bond exposure.

Why Return Stacking?

Today, professionally managed mutual fund and exchange-traded products allow investors to implement this concept. We are developing the research, product design, and portfolio construction that unlocks this opportunity for everyone.

Pursuing Diversification without Sacrifice

Investors can introduce diversifying assets and strategies without sacrificing exposure to their traditional asset allocation.

Opportunity for

Enhanced Returns

By introducing additional sources of return, Return Stacking creates the potential for outperformance, which may be particularly attractive in an environment where expected returns for traditional assets may be muted.

Potential to

Improve Diversification

By thoughtfully introducing differentiated return streams, investors may gain a diversification advantage with the potential to reduce portfolio volatility and drawdowns.

Managing Investor (Mis-)Behavior

Alternative investments can be difficult to stick with, particularly when they underperform traditional assets for years on end (often with higher costs, less tax efficiency, and less transparency).

Historically, to make room for alternatives in your portfolio, you would have to sell core stock and bond exposure. The choice to add alternatives is also a choice to subtract stocks and bonds. This has the potential of creating meaningful underperformance during strong bull markets.

With return stacking, you have the potential to maintain your core stock and bond exposure, reducing tracking error to your benchmark.

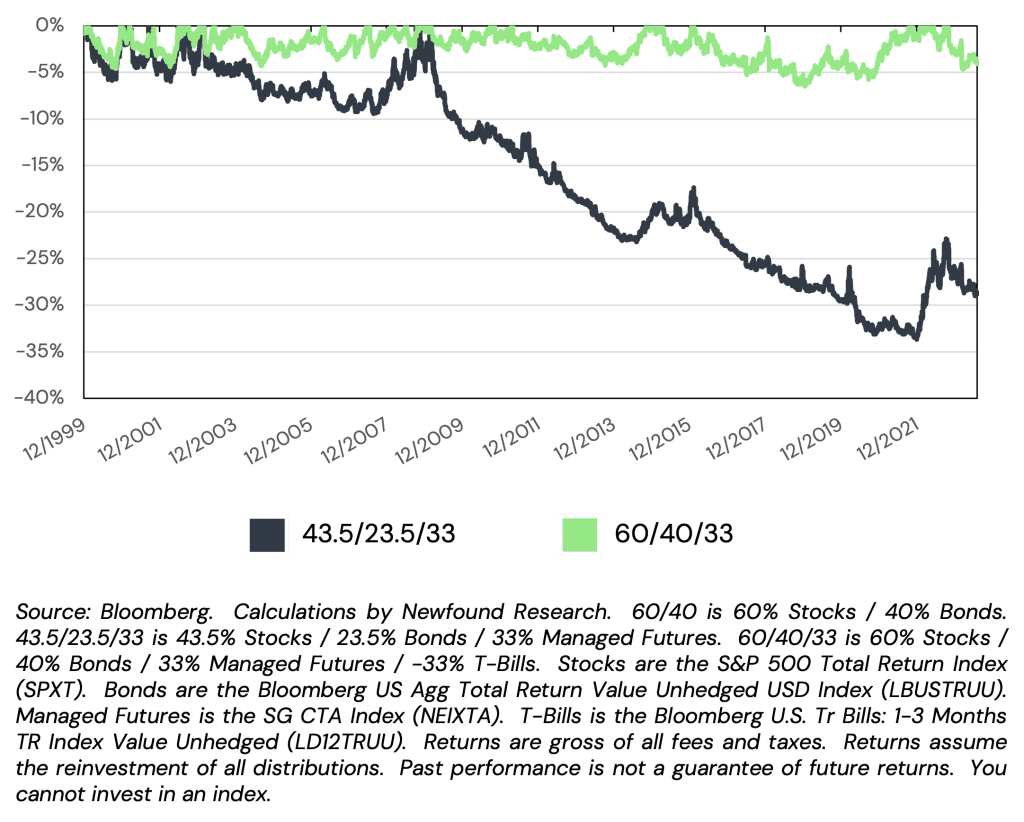

In the figure below, we assume an investor has a 60% S&P 500 / 40% Bloomberg Core US Bond benchmark. In the first case, they allocate 33% of their portfolio to managed futures by selling stocks and bonds equally. In the second case, they stack the returns on top. The figure plots the relative drawdown of these portfolios versus the benchmark, showing the periods when they would have underperformed, how much they would have underperformed by, and for how long.

Relative drawdowns versus a 60/40 of two different methods of including alternatives in a portfolio

GETTING STARTED

New to Return Stacking?

If you’re new to the idea of Return Stacking, you’re in the right place. The best way to learn about the philosophy, start to understand how you can optimize your clients’ portfolios, and stay up to date with the latest research is to subscribe to our newsletter.