Return Stacked® Portfolio Solutions

Return Stacking for Outperformance

Return stacking strives to unlock the potential for benchmark outperformance, helping investors achieve their goals with greater confidence.

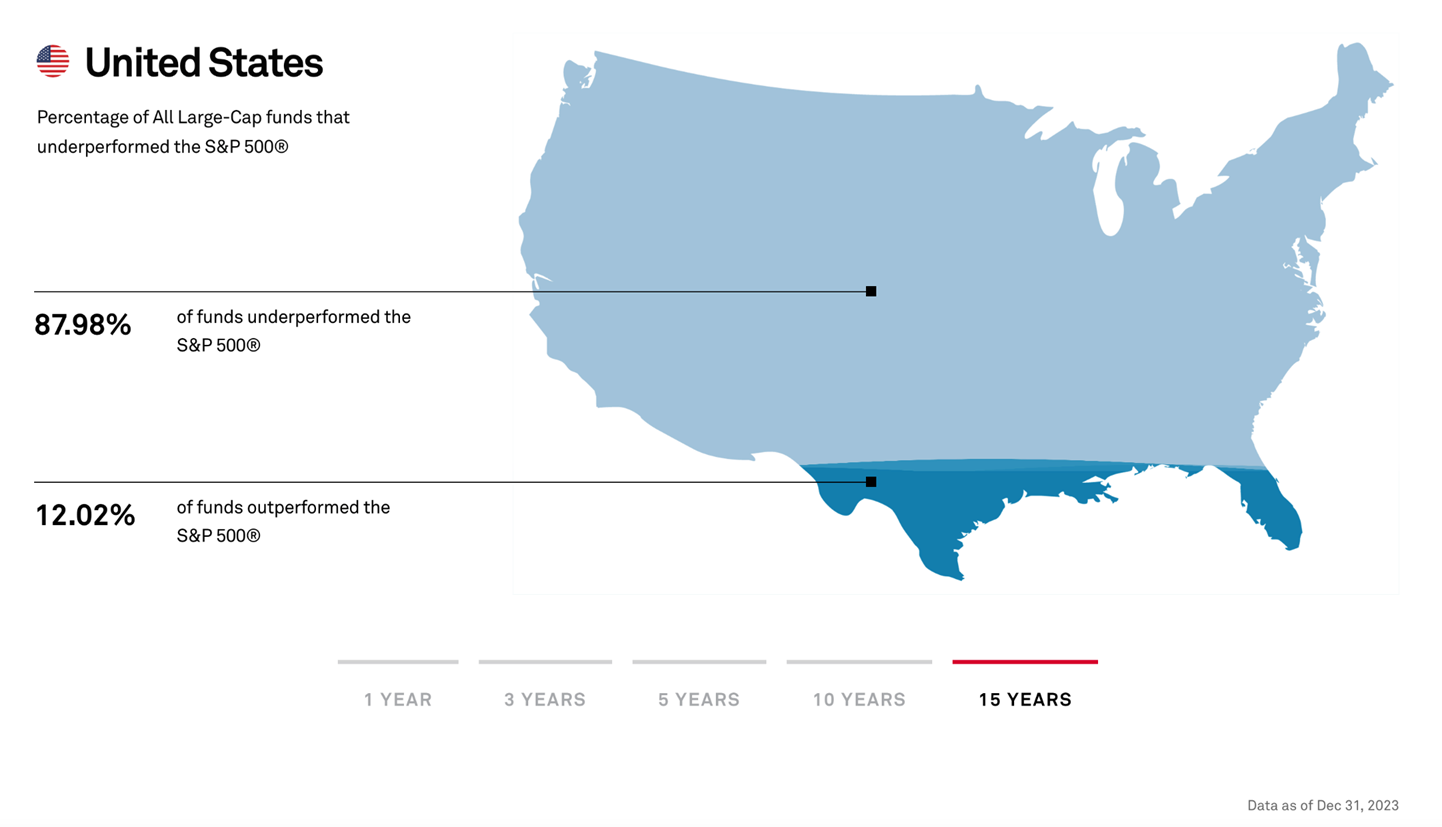

The Data is In: Beating the Market Is Hard

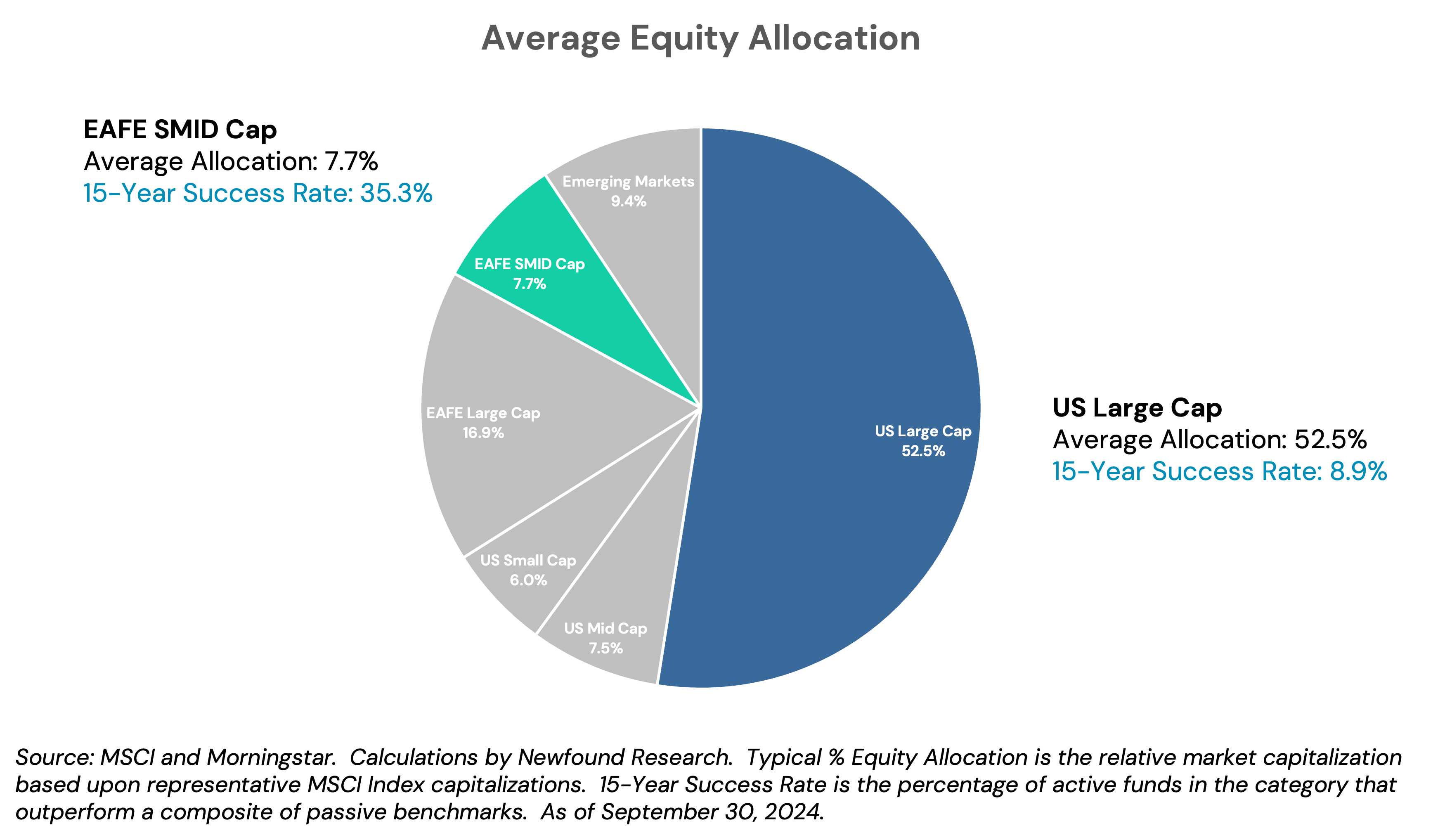

Alpha is Most Elusive Precisely Where Investors Have the Largest Allocations

On average, equity investors have more than 50% of their portfolio in U.S. Large Cap. The success rate – i.e. the percent of managers that beat their passive benchmark after fees – of large-cap US equity managers over the last 15 years is <10%.

Other areas of the market have historically had much higher success rates, but investors have much less capital allocated there. In other words, investors have the majority of their capital tied up in what has historically been the most efficient part of the market.

Why do we keep fishing for alpha in the same overcrowded pond?

Introducing Return Stacking

At its core, return stacking is the idea of layering one investment return on top of another, achieving more than $1.00 of exposure for each $1.00 invested.

By wrapping this concept into professionally managed mutual funds and exchange-traded funds, we seek to provide investors with the building blocks to unlock the benefits of diversification in their own portfolios.

The Question We Have to Ask Ourselves

Which is more likely:

- We can identify – and stick with – a manager who can deliver alpha in traditional markets.

- We can can construct a diversified portfolio of alternative asset classes and strategies that can generate positive excess returns.

In other words, do we think we can pick securities more efficiently than the market, or is it better to own the market and layer other diversifying assets and strategies on top?

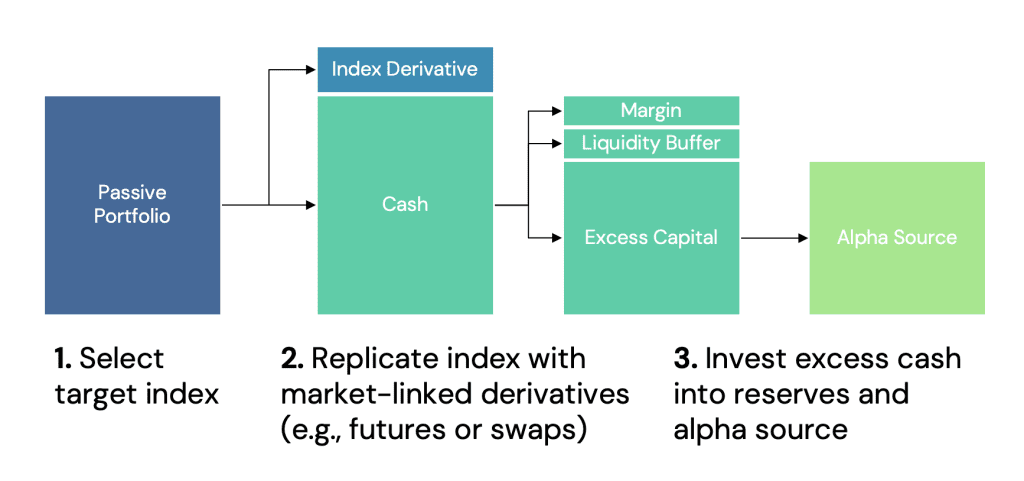

An Old Idea Reborn

In the 1980s, the Pacific Investment Management Company (PIMCO) launched their StocksPLUS series of strategies. The idea was simple, but powerful. Rather than search for alpha in large-cap equities, where competition was fierce, they would buy passive equity exposure and look for alpha in short-term, high quality bonds.

To make this idea work, PIMCO would gain its equity exposure through capital efficient derivatives such as futures and swaps. This meant they only had to outlay a fraction of their capital to achieve the passive equity exposure, leaving the remainder of the capital available for investing in bonds!

Portable Alpha for Everyone

For decades, sophisticated institutional investors have used portable alpha to include diversifying alternative strategies without diluting their core stock and bond allocations. Due to the complexity of managing derivatives, small institutions, financial advisors, and individuals have largely been locked out of this approach.

Today, professionally managed mutual fund and exchange-traded products allow investors to implement this concept.

At Return Stacked® Portfolio Solutions, we are developing the research, product design, and portfolio construction that unlocks this opportunity for everyone.

Over time, investors realized that this design allowed investors to separate beta from alpha. By implementing beta through capital efficient derivatives, valuable capital can be unlocked and reinvested in potentially diversifying alternative return streams.

This concept became known as portable alpha.

Explicitly Stacking Alternatives

Funds implementing return stacking may combine a variety of betas (e.g., stocks and bonds), non-traditional betas (e.g., commodities), and alternative investment strategies in a variety of leverage targets to provide capital efficient exposure for investors.

As an example, consider a fund that seeks to provide $1 of exposure to bonds and $1 of exposure to alternatives for every $1 invested. If you wanted to stack the alternative strategy on top of your existing portfolio, you could simply sell some of your bonds and buy the fund.

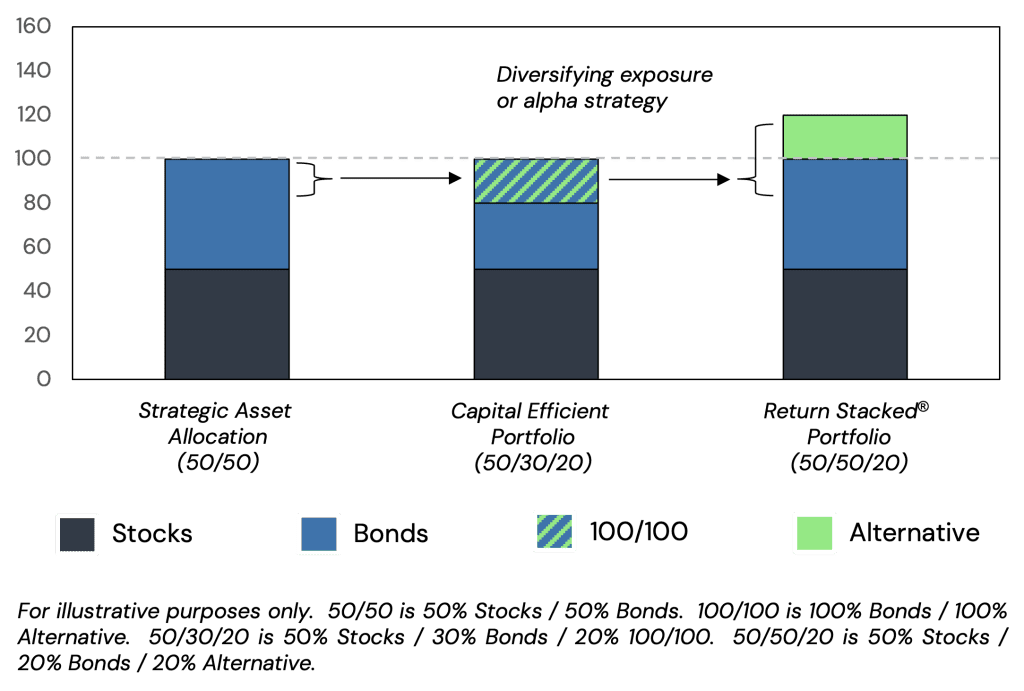

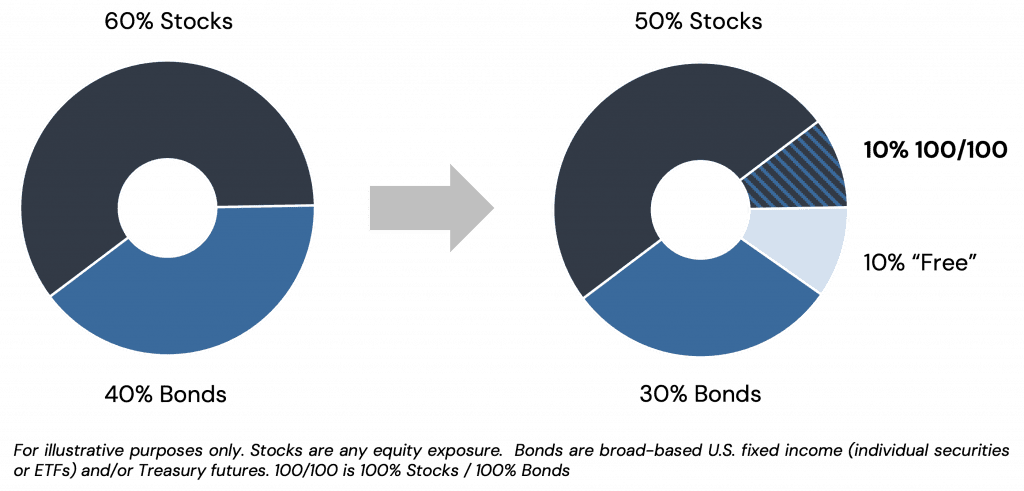

Making Room in a Portfolio

Assume you held a 60% stock / 40% bond portfolio. You could replace some of your holdings with a fund that provides 2x exposure to a 50% stock / 50% bond portfolio (a “100/100” fund). For example, by selling 10% of your stocks and 10% of your bonds and allocating 10% to such a fund, you create a capital efficient implementation that frees up 10% of the portfolio for a variety of potential uses.

For example, it might also be allocated to alternative assets and strategies that have the potential to introduce beneficial diversification to the portfolio. You could also leave it in Treasury Bills (or a money market fund) to help better manage cash-flow needs (e.g. withdrawals or capital calls) without sacrificing core stock and bond exposure.

Why Return Stacking?

For decades, sophisticated institutional investors have thoughtfully applied leverage to include diversifying alternative strategies without diluting their core stock and bond allocations. Due to the complexity of managing derivatives, small institutions, financial advisors, and individuals have largely been locked out of this approach.

Today, professionally managed mutual fund and exchange-traded products allow investors to implement this concept. We are developing the research, product design, and portfolio construction that unlocks this opportunity for everyone.

Pursuing Diversification without Sacrifice

Opportunity for

Enhanced Returns

Potential to

Improve Diversification

Managing Investor (Mis-)Behavior

Alternative investments can be difficult to stick with, particularly when they underperform traditional assets for years on end (often with higher costs, less tax efficiency, and less transparency).

Historically, to make room for alternatives in your portfolio, you would have to sell core stock and bond exposure. The choice to add alternatives is also a choice to subtract stocks and bonds. This has the potential of creating meaningful underperformance during strong bull markets.

With return stacking, you have the potential to maintain your core stock and bond exposure, reducing tracking error to your benchmark.

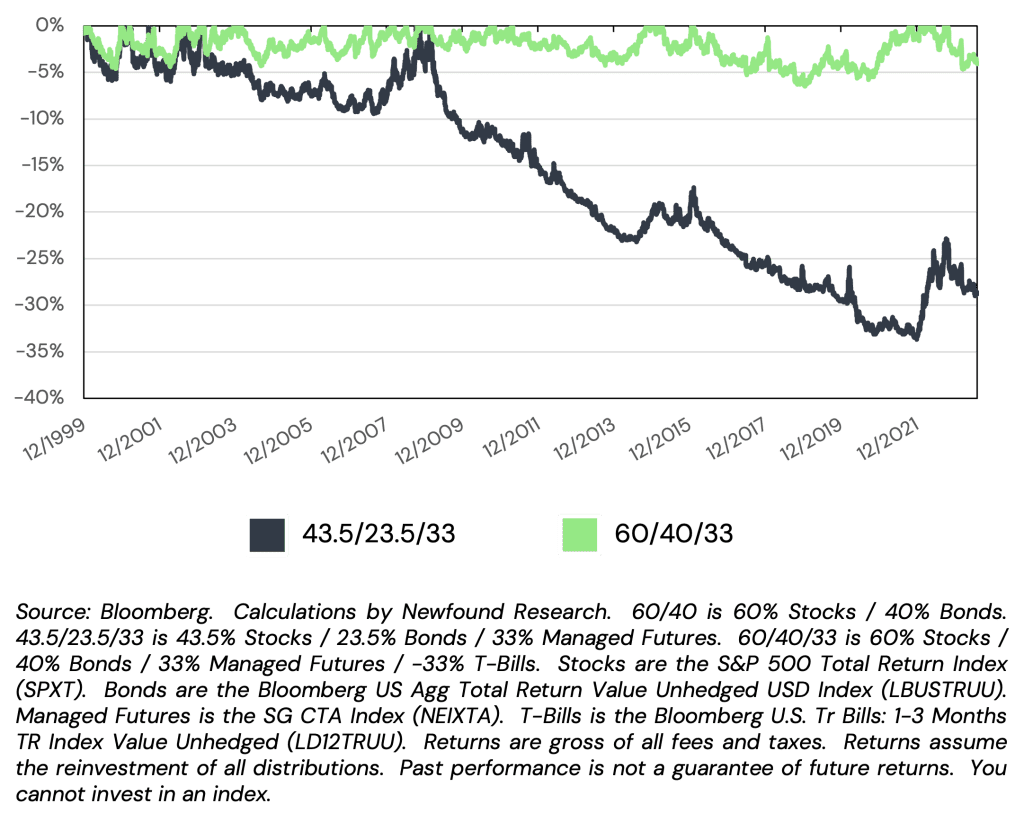

In the figure below, we assume an investor has a 60% S&P 500 / 40% Bloomberg Core US Bond benchmark. In the first case, they allocate 33% of their portfolio to managed futures by selling stocks and bonds equally. In the second case, they stack the returns on top. The figure plots the relative drawdown of these portfolios versus the benchmark, showing the periods when they would have underperformed, how much they would have underperformed by, and for how long.

Relative drawdowns versus a 60/40 of two different methods of including alternatives in a portfolio

GETTING STARTED