The Return Stacking Checklist

Overview

We believe return stacking is a portfolio concept that can revolutionize the way you think about building portfolios. There are a number of things to consider, however, when building a return stacked portfolio. Which is why we built this checklist: to help get you started on your return stacking journey.

Key Topics

Diversification, Risk, Fees, Taxes

1. Figure out what you want to stack

First and foremost, we need to choose what we want to stack on our portfolio. In theory, we can stack just about anything. In practice, however, we want to consider at least two important points.

First, how similar is what we’re stacking to what we already own? Ideally, stacking allows us to introduce new, diversifying sources of return. Here we want to consider not just how the exposures behave on average, but in the tails as well.

Second, we want to think about liquidity. Stacking highly illiquid assets (or even just funds with a higher probability of gating redemptions in a stressed market environment) can prevent you from rebalancing during periods of market stress, potentially causing significant misalignments with intended risk profiles.

2. Measure your hurdle rate

When stacking, it’s important to remember that we’re implicitly borrowing money, which means there is a financing rate. Fortunately, the embedded financing rate in derivatives like equity and bond futures is usually quite low; historically, they have been in the range of 1-3 month T-Bills and/or the SOFR rate. Other derivatives that can enable stacking, like swaps, may have different embedded costs. We also need to consider the fees of any fund wrapper as well as the potential tax implications of how we’re implementing return stacking (see checklist item #8).

Taken together – financing rate, fees, and taxes – we create an embedded hurdle rate that our stacked exposure has to overcome before it can add any excess returns to our portfolio. Understanding this hurdle rate is critical for setting expectations as to the potential value a given exposure can contribute.

3. Determine how big a stack you want

The size of the stack is a critical component in defining the potential portfolio impact, including both the contribution to return and risk. As a simple rule, the size of the stack times the exposure’s volatility will tell you, in the worst case scenario, how much more volatility and tracking error you’re adding to your portfolio.

For example, if you want to stack a 10% exposure to a managed futures program with a volatility of 15%, you’d multiply 10% by 15% and find that you’d be adding 1.5% to portfolio volatility and tracking error. On the other hand, if you’re looking to stack short-term, high-quality corporate bonds that have a volatility of 3%, a 10% position would just add up to 0.3% to the risk and tracking error profile.

As we can see, what you’re stacking can heavily influence the appropriate size of the stack. Stacking equity on top of an equity heavy portfolio will just add risk. Stacking an uncorrelated asset or strategy might actually reduce risk. For example, stacking managed futures on a 60% stock/ 40% bond portfolio has historically reduced drawdowns.

You can explore how different assets and stack sizes have historically impacted returns and risk with our return stacking visualizer tool.

Register for our Advisor Center

Tools Center:

Easily backtest & explore different return stacking concepts

Model Portfolios:

Return stacked allocations, commentary and guidance designed

for a range of client risk profiles and goals

Future Thinking:

Receive up-to-date insights into the world of return stacking theory and practice

4. Determine if the exposure you want exists in a stacked fund

Once you have figured out what you want to stack and the size of the stack, you need to figure out how you’re going to implement the stack. In some cases, the exposure may already exist pre-stacked in a fund.

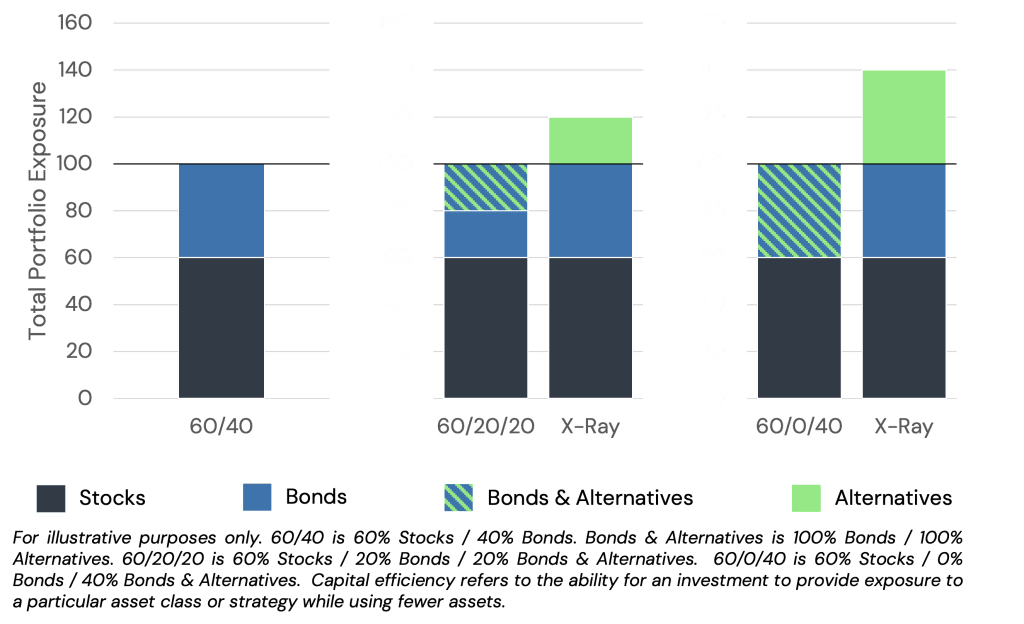

For example, if you want to stack an alternative strategy, funds may already exist that simultaneously provide that alternative strategy and either stock or bond exposure. This can make implementation much easier, as you simply need to replace the appropriate amount of stocks (or bonds) with the pre-stacked fund. In the figure below, we show an example of how a 100% Bond / 100% Alternatives fund could be used to stack either 20% or 40% alternatives exposure on top of a 60% stock / 40% bond portfolio.

Figure 1: An illustrative example where return stacking is achieved through the use of a fund that internally implements return stacking

However, not all exposures exist in stacked formats. Or, perhaps, a strategy does exist in a stacked format, but you have a preferred manager for that strategy and they do not offer a stacked version. In this case, you need to figure out how to free up room in your portfolio other ways.

5. If the exposure does not exist as a stacked fund, figure out how you’re going to free up room in your portfolio

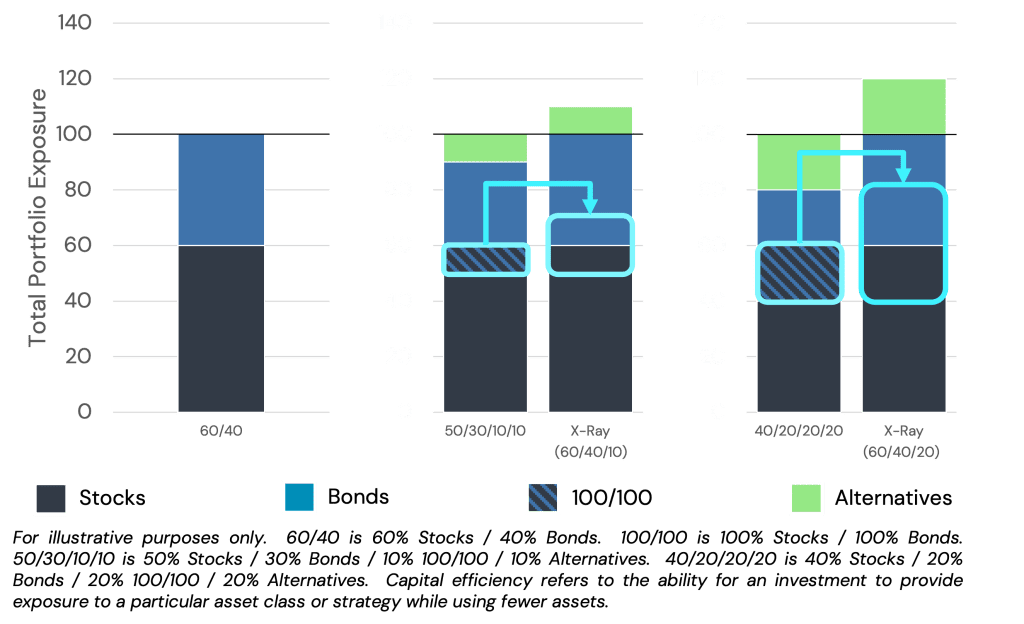

If a pre-stacked fund does not exist for the exposure you’d like to stack, you’ll likely have to sell some combination of stocks and bonds and buy a capital-efficient stock/bond fund to make room in your portfolio.

For example, if we want to stack a 10% allocation to an alternative fund, we could sell 10% stocks / 10% bonds and buy 10% of a 100% stock /100% bond fund. We can then invest the newly available 10% in the alternative fund. In the figure below, we show an example how a 100% stock /100% bond fund can be used to stack either 10% or 20% of an alternative of top of a 60% stock / 40% bond portfolio.

Figure 2: An illustrative example where return stacking is achieved by making room in a portfolio through a capital efficient stock/bond fund

6. Make sure your betas match

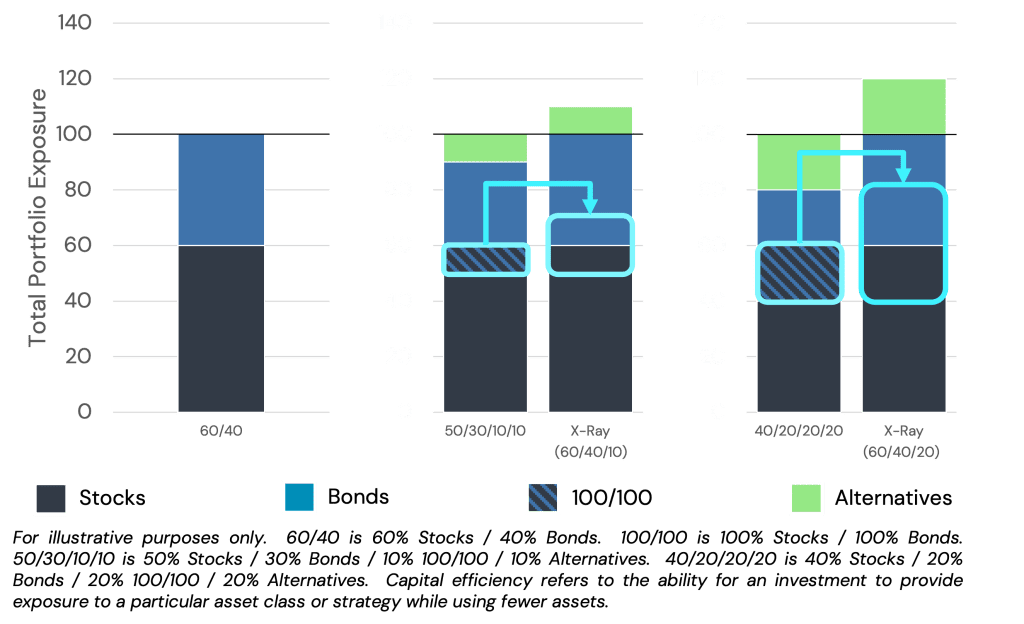

Whether you’re using a pre-stacked fund or selling stocks and bonds to make room via a capital efficient stock/bond fund, you want to make sure your betas match.

For example, if you’re planning on buying a 100% Bond / 100% Alternatives fund to stack alternatives on top of your portfolio, you want to make sure the bonds (or bond funds) you sell in your portfolio are of the same nature of the bonds in the stacked fund.

Similarly, if you’re selling both stocks and bonds to buy a capital efficient stock/bond fund, you want to make sure the stocks and bonds are of the same nature.

As an example, you probably wouldn’t want to sell foreign developed stocks and short-term U.S. Treasuries to buy a 100% stock / 100% bond fund that gives exposure to the S&P 500 and broad U.S. Treasuries. Doing so would create a significant mismatch in your pre- and post-stacked portfolio profile.

Figure 2: An illustrative example where return stacking is achieved by making room in a portfolio through a capital efficient stock/bond fund

The Return Stacking landscape is ever evolving, go deeper by connecting with a team member.

7. Estimate the worst-case scenario of your new stacked portfolio

While we advocate for trying to stack assets that will zig when our underlying portfolio zags, the phrase “return stacking” reminds us that we’re just adding returns together. And if both of those returns are negative, we’re going to be worse off then if we didn’t stack.

Understanding the historical and expected return profiles for what we already own and what we’re trying to stack is important for choosing the right stack size.

8. Consider the tax implications and asset location

Some forms of stacking can be more tax efficient than others. Consider the example of a 100/100 stock/bond fund. One way of creating this fund is by purchasing stocks and Treasury futures. Wrapped in an ETF, this may be highly tax efficient, especially since Treasury futures can be more tax efficient than Treasuries!

On the other hand, if the fund is implemented by buying bonds and S&P 500 futures, it will likely be very tax inefficient, regardless of whether it’s in a mutual fund or ETF, especially since S&P 500 futures receive substantially worse tax treatment then passive S&P 500 exposure usually would.

When in doubt, you probably want to stack in qualified accounts. However, if you are looking to stack with taxable money, you’ll want to consider the tax implications of how the stack is created.

9. Consider line-item risk

If you are managing money on behalf of others, line-item risk is a behavioral bias to thoughtfully consider. Not only does the individual need to be able to stick with the portfolio as a whole, but they need to be able to tolerate the volatility and relative performance of individual line items. This can change how you might consider implementing a given return stacking strategy.

As an example, let’s say you want to stack a 10% allocation to managed futures, there are at least three ways you can do it. First, you could sell 10% of your bonds and buy a 100% Bond / 100% Managed Futures stacked fund. Second, you could sell 10% of your stocks and buy a 100% Stocks / 100% Managed Futures fund. Finally, you could sell 10% of your stocks and 10% of your bonds, buying 10% in a 100% stock / 100% bond fund and 10% in a managed futures fund.

All three approaches are, effectively, the same. But the performance of the line items in your portfolio will differ.

For example, the short-term performance of the 100% Bond / 100% Managed Futures fund will likely be dominated by the Managed Futures performance, as it is much more volatile than the bonds. The 100% Stock / 100% Managed Futures fund will be a significantly more volatile fund, and may have much more significant performance swings when stocks and managed futures are moving in the same direction. Similarly, the 100% Stock / 100% Bond fund might stand out in years like 2022 while the isolated managed futures fund might stand out in periods like 2010-2020 when managed futures largely went sideways.

While all of these approaches are identical at the aggregate portfolio level, understanding your – or your clients’ – tolerance for different forms of line-item risk is important.